The Market Outlook for the Week Ahead, or What's Next?

This is not the rose garden we were promised.

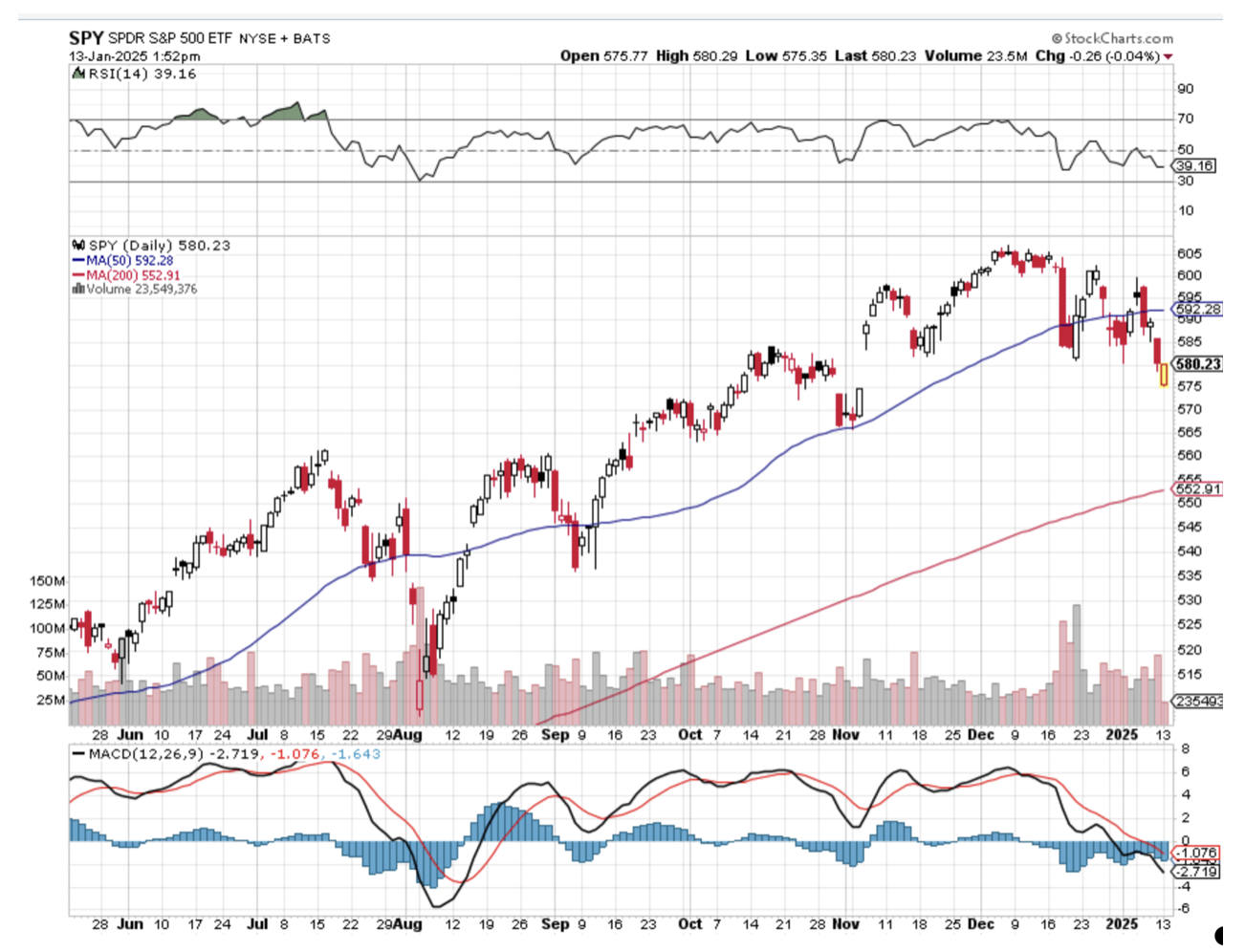

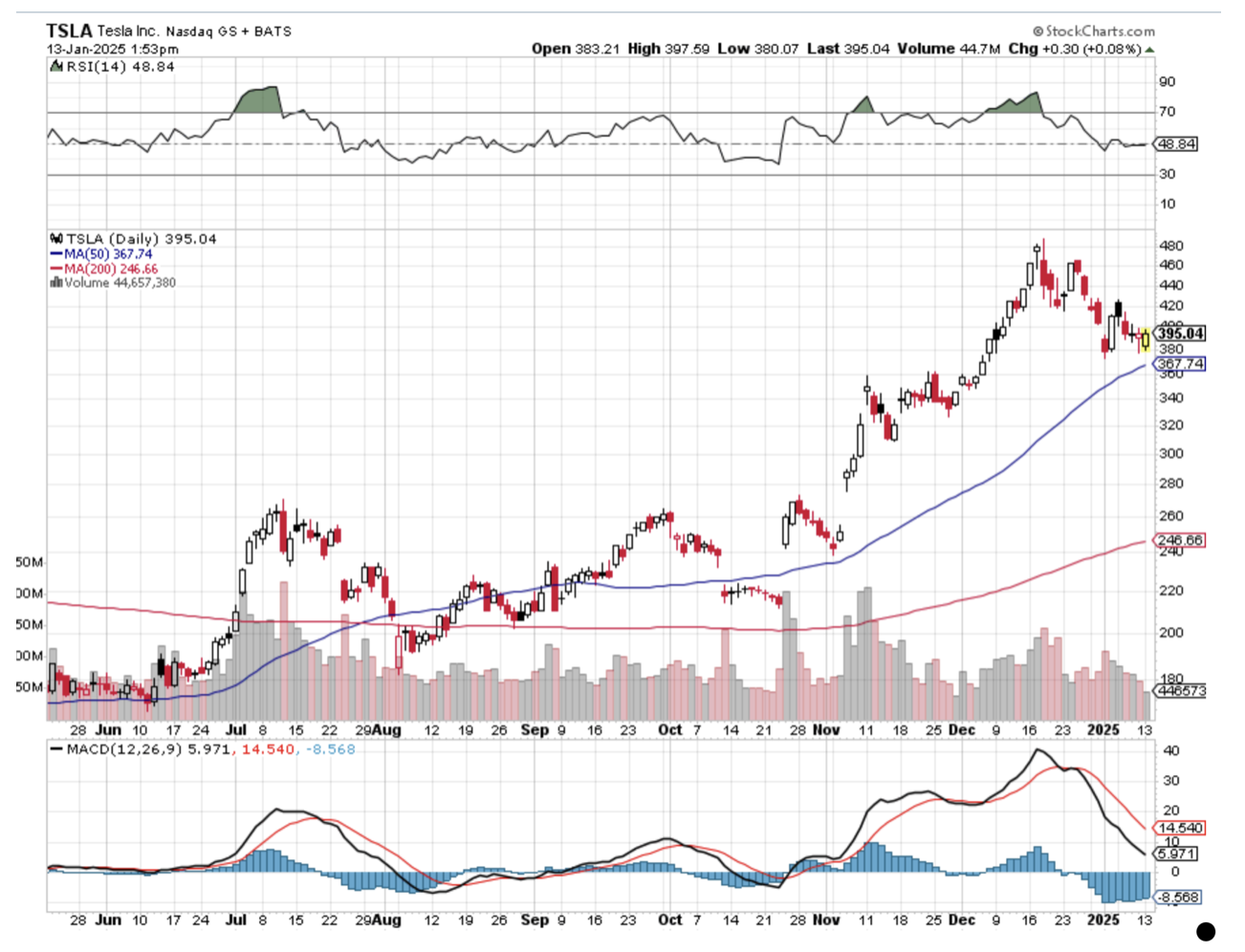

Down three of six trading days so far in 2025, with the S&P 500 off 2.2%. Worse yet, there is an almost perfect head and shoulders topsetting up on the charts portending lower lows. Lead names like Tesla (TSLA) have taken it on the nose, down 25%.

Tax-deferred selling has definitely been the dead weight hanging on the market since January 1. High-net-worth individuals would have shot the financial advisors off if they had saddled them with big tax bills during the last weeks of 2024. After two 20% back-to-back years, many of these positions had doubles and triples in them. How long it will be anyone’s guess.

Once the selling does end, the market will go into “show me” mode, waiting for the new administration to deliver the promised action. This could be a long wait. The earliest Congress can vote on a new economy-changing bill in May. Until then, the market could be entering a tedious trading range until action is delivered.

The good news? There were many times in my life when I never thought I’d live until 2025. Also, we get two extra holidays in January, Jimmy Carter’s funeral and Martin Luther King Day on the 23rd.

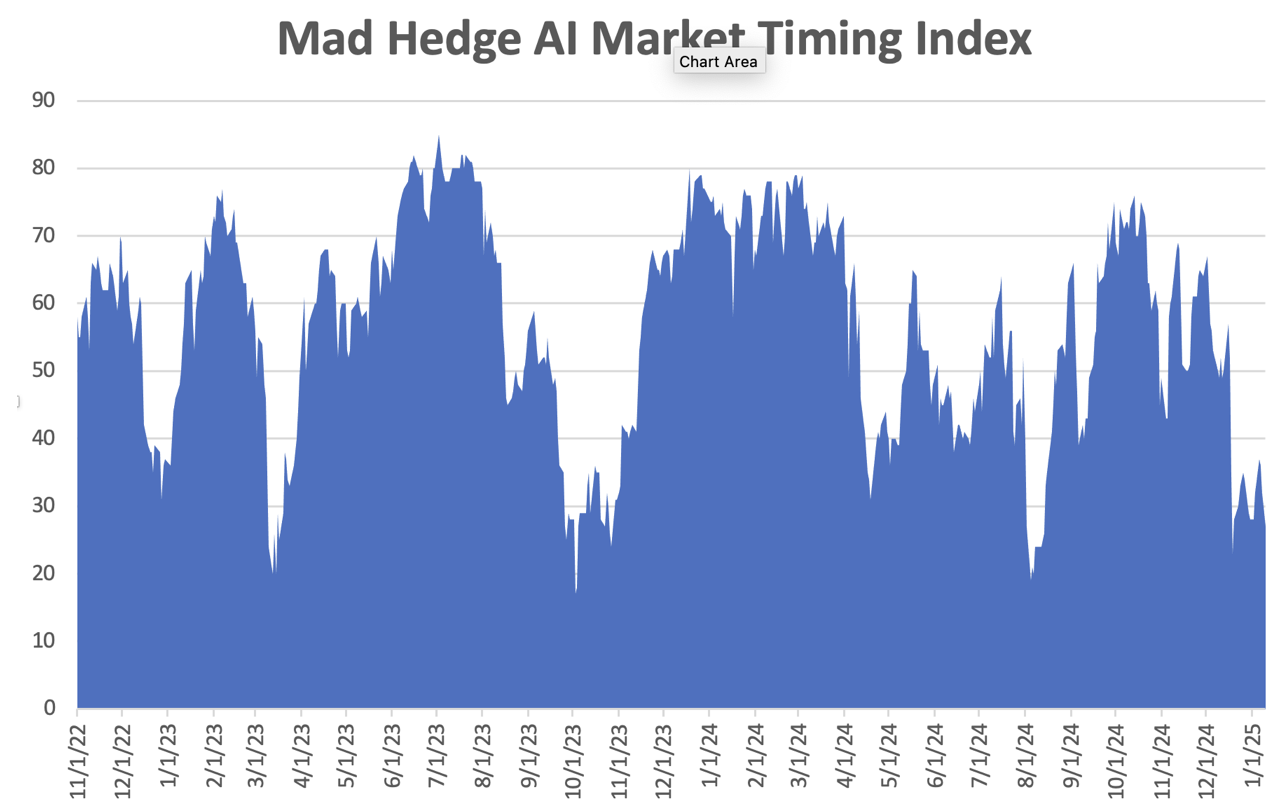

So, what’s a trader to do in these suddenly benighted times? 90-day US Treasury bill looks fantastic right now with a 4.21% yield. Nothing is better than getting paid to wait. Big tech is entering a long-range trade from which it will eventually escape to the upside. A lot of the AI trade needs to be digested and earnings spun off before a major new upleg can begin.

One of the great things about a 16-day cruise from Los Angeles to Fort Lauderdale, Florida is the many fascinating people you meet. It turned out that I missed the start of the Great Los Angeles fires by a week.

I attended a wine tasting and learned that the entire event had been bought out by the preeminent aviation family of Alaska. The 93-year-old grandmother treated her extended 25-member family to a free cruise, great-grandchildren and all, at a cost of only $250,000. Apparently, aviation in Alaska pays well.

The subject of airplanes inevitably came up. They mentioned that they still had their original aircraft, a 1928 Travelaire D4D, which Grandpa bought second-hand and brought up to Alaska during WWII. They couldn’t get any of their current pilots to fly it, which they deemed too dangerous to fly.

I mentioned that I happened to be one of ten living pilots rated to fly the plane and showed them videos of me flying my kids over the Malibu coast (click here for the link).

I believe an invitation is pending.

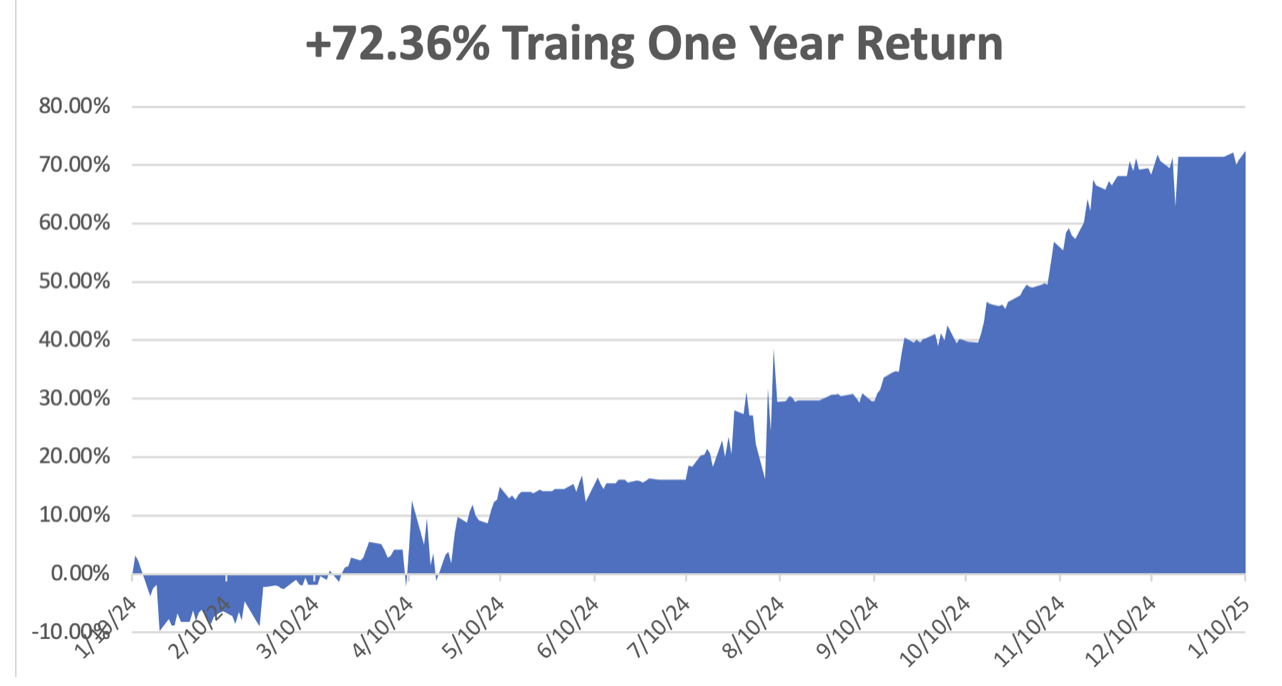

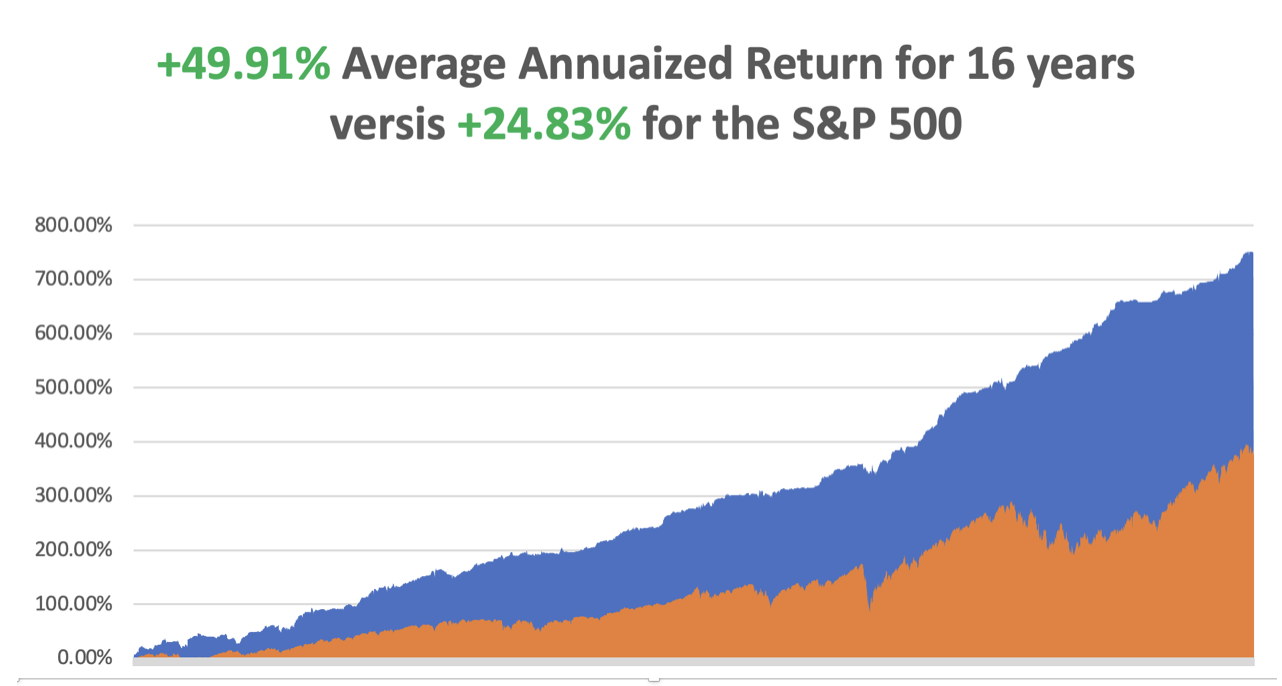

We closed out December at +3.26%. Some 11 out of 12 months were profitable in 2024. The final number for 2024 came in at a sky-high +75.26%. I went all cash on the December 20 options expiration, expecting the current trouble that we are in. I would be thrilled if we even came close to these numbers in 2025.

I started out the New Year with 80% cash and two small hedged positions. I went long 10% (TLT) and long 10% (TSLA). These expire in four days on the January 17 option expiration, when we flip back to a 100% cash position.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

When have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, January 13 at 11:00 AM EST, the Consumer Inflation Expectations are released.

On Tuesday, January 14 at 8:30 AM, the Producer Price Index

is published.

On Wednesday, January 15 at 8:30 AM, the Inflation Rate is printed.

On Thursday, January 16 at 8:30 AM, the Retail Sales are announced.

On Friday, January 17 at 8:30 AM EST, Housing Starts and Building Permits are published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I was recently in Los Angeles visiting old friends, and I am reminded of one of the weirdest chapters of my life.

There were not a lot of jobs in the summer of 1971, but Thomas Noguchi, the LA County Coroner, was hiring. The famed USC student jobs board had delivered! Better, yet, the job included hours at night and free housing at the coroner's department.

I got the graveyard shift, from midnight to 8:00 AM. All I had to do was buy a black suit from Robert Halls, for $25.

Noguchi was known as the “coroner to the stars” having famously done the autopsies on Marilyn Monroe and Jane Mansfield. He did not disappoint.

For three months, whenever there was a death from unnatural causes, I was there to pick up the bodies. If there was a suicide, gangland shooting, or horrific car accident, I was your man.

Charles Manson had recently been arrested and I was tasked with digging up the victims. One, cowboy stuntman Shorty Shay, had his head cut off and neatly placed in between his ankles.

The first time I ever saw a full set of women’s underclothing, a girdle, and pantyhose, was when I excavated a desert roadside grave that the coyotes had dug up. She was pretty far gone.

Once, me and another driver were sent to pick up a teenage boy who had committed suicide in Beverly Hills. The father came out and asked us to take the mattress as well. I regretted that we were not allowed to do favors on city time. He then said, “Can you take it for $200”, then an astronomical sum.

A few minutes later, I found a hearse driving down the Santa Monica Freeway on the way to the dump with a double mattress expertly tied on the roof with Boy Scout knots with a giant blood spot in the middle.

Once, I was sent to a cheap motel where a drug deal gone wrong had produced several shootings. I found $10,000 in a brown paper bag under the bed. The other driver found another ten grand and a bag of drugs and kept them. He went to jail. I didn’t.

The worst pick-up of the summer was also the most disgusting and even made the old veterans sick. A 300-pound man had died of a heart attack and was not discovered for a month. We decided to each grab an arm or leg and all tug on the count of three. One, two, three, and all four limbs came off!

Eventually, I figured out that handling dead bodies could be hazardous to your health, so I asked for rubber gloves. I was fired.

Still, I ended up with some of the best summer job stories ever.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader