The Means to a Frightening End

Death of websites.

I love doing presentations to small businesses on my free time, partly to stay in touch with the pulse of the Davids who have the unenviable task of fighting uphill against the Goliaths.

It’s bad enough that the tech giants have scaled locally turning one’s local playground into a disadvantage.

The presentation is aptly titled "Content is King... But Only Through One’s Ownership" where the same parallels are explored and unpacked for my audience.

Proprietary Content – must be yours and you must own it on your own turf - your blog, your vlog, your app, and so on, it goes for everything.

Repurposing content on other platforms as a supplement to your own is one thing, but the moment you adopt an enemy platform as your main platform, that’s your coup de grâce.

SMEs (small businesses enterprise) believe it’s plausible to work with the higher ups, but don’t forget they have every incentive to cut you off from the fountain of youth.

One could say the best skill big tech has today is undermining their competition.

Facebook doesn’t allow posting content that criticizes Facebook, have you ever wondered why?

Website innovation has grinded to a halt because of the PageRank algorithm from Google, everybody is making websites the same, a top nav, descriptive text, a smattering of images and a handful of other elements arranged similarly.

Google’s algorithms and the self-regulating nature of their ecosystem have perverted the chance to have a unique online experience.

Most internet users have probably discovered that most websites don’t work well and the execution of them is lousy.

Many companies are not contributing enough resources to build out their site properly, or just don’t have the cash to fund it or a mix of the two.

About 95% of customer service calls originate from the company’s webpage because of payment problems, disfunction, misleading content, or simply because the website is down.

Ask any small business and they will tell you they deal with their domain being down for hours at a time because of some unknown server problem.

Not only is capitalism only working for a small group of Americans, but so are websites, such as massive companies like Amazon.com who have worked wonders with its e-commerce site.

Because the internet and namely websites are the key to building businesses, Silicon Valley is now using the concept of websites and their position as de-facto moderators to prevent others from developing proper websites, killing off the competition.

Alphabet is notorious for ranking their own products at the top of page one of any Google search.

Amazon has followed the same practice by sticking their in-house brands at the top of any Amazon search on Amazon.com.

And remember that none of this can be called “antitrust” because these borderline tactics offer consumers lower prices but that is only because consumers are brainwashed to believe Amazon offers the lowest price.

What if the same products are available for half of Amazon’s in-house brands, would Amazon volunteer to post their in-house brands on the second page, the graveyard of search results?

I would guess no.

Websites used to give businesses a chance, remember in the mid-90s when a website of any ilk was impressive as if someone was walking on water.

What can we expect next?

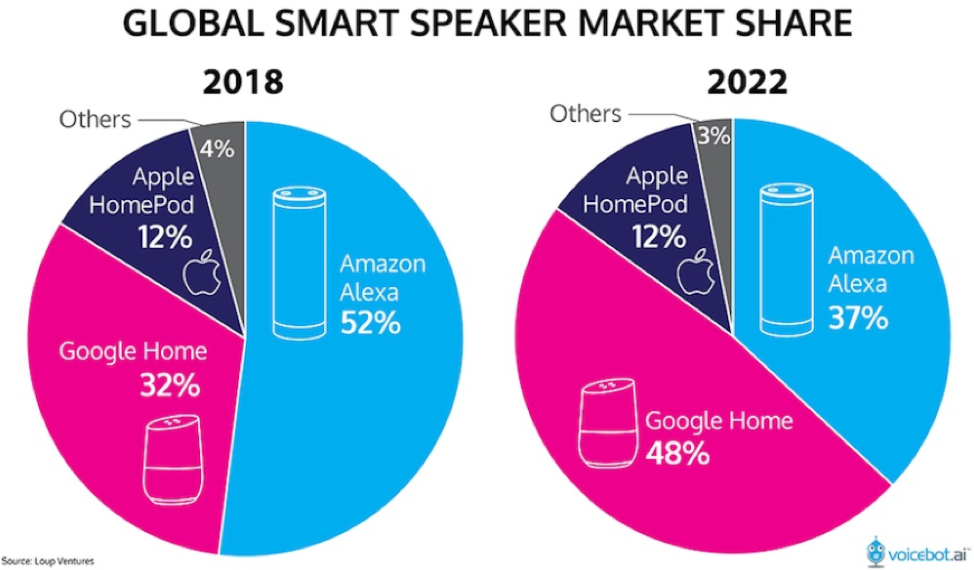

Amazon, Google, and Apple are taking their shows to artificial intelligence voice platforms.

SMEs could at least throw hail marys on standard internet searches with visual screens, but once content migrates over to voice platforms owned by Silicon Valley, then its game, set, and match.

For instance, a local business such as Joe’s Furniture Moving Business who, with the internet and visual screens, is searchable through search engines and can be even located on Google Maps with a concrete address.

Once we migrate the lions share of content to voice platforms over the next 15 years, Google Home, Apple HomePod, or Amazon Alexa could easily choose to remove Joe’s Furniture Moving Business information because they make more money offering you information of a moving service they own or have a stake in.

The advent of 5G will refine the voice technology and enhance the machine learning techniques needed to complete the migration of content.

Once the world crosses an inflection point where the technology and volume of content on smart speakers outweigh the hassle to use a keyboard or mobile screen, this effectively makes these smart speaker manufacture Gods of the World because they will own the voice-based internet.

They will be the gatekeepers of all global information, business, and development in the world and we will need to satisfy their algorithms to get our own content uploaded on their voice platforms.

And because of the nature of voice, users cannot see what else is out there, users will only hear what these companies tell us offering an outsized opportunity to manipulate the user experience generating more dollars for these powerful platforms.

By the end of 2019, 74 million Americans will be using smart speakers, giving these smart speaker firms adequate data to fine tune their products.

Eventually, all Americans will be forced to use it or will not be able to function, similar to the effects of a laptop, email, and smartphone combination now.

Once these voice platforms become ubiquitous, websites will be deemed irrelevant – consumers will simply have a choice of Google Home, Amazon Alexa, and Apple HomePod and blindly trust what they tell you is in your best interests.

Pick your poison.

That’s right, users won’t control content in about 15 years, a scary thought, and now you understand why these companies will even give their voice A.I. platforms for free if they have to and probably will in the future.