The Nationalization of the Bond Market

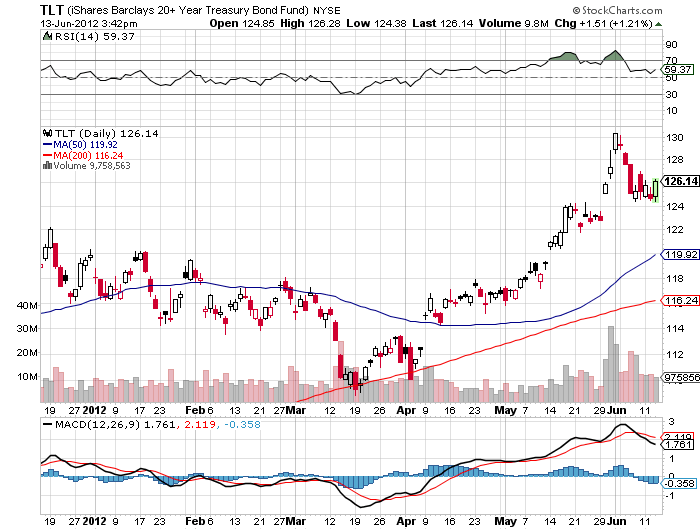

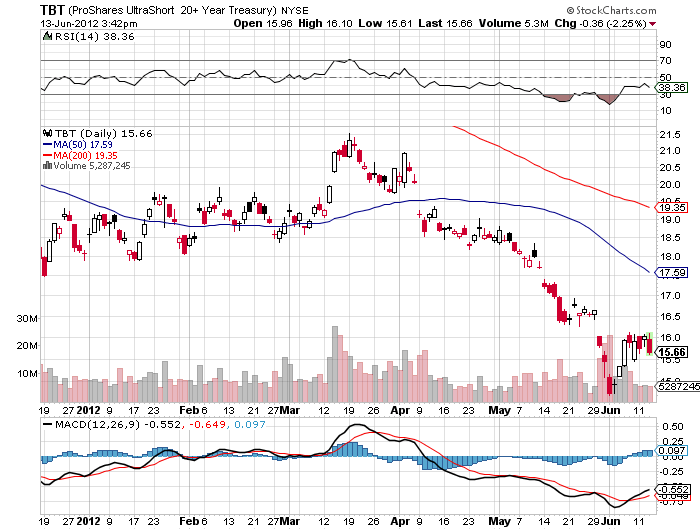

I was as stunned as anyone when the yield on the ten year Treasury bond (TLT), (TBT) plummeted to 1.42% two weeks ago. Predictions that long dated government paper would reach subterranean Japanese levels, considered loony as recently as a few months ago, are now donning the mantle of respectability, and even plausibility. Where will this end? With yields at 1.25%, 1%? 0.50%?

As with any ground breaking, epoch making, even cataclysmic change in the fundamental structure in the global financial markets, I searched for the reasons why I didn?t see this coming. How could I be so wrong? What did I miss? I haven?t been this far off base since the term ?blue dress? entered the political lexicon.

Then I looked at the recent ownership of the Treasury bond market and the answer was so obvious that it practically lifted me up by the lapels of my Brioni jacket and shook me until the gold inlays fell out of my teeth. The implications for international finance are huge, and are even bigger for your own net worth.

It turns out that governments have been steadily taking over the global bond market, not just Uncle Sam, but all major countries that have been pursuing quantitative easing. As a result, private ownership of Treasury bonds has shrunk from 55% thirty years ago, to only 23% today. Foreign holders, primarily central banks, have increased their portfolios from 13% to 34% during the same period. The Federal Reserve?s ownership of the Treasury market has soared from 5% to 11% since 2012, thanks to QE1, QE2, and the twist policy.

Therein lays the problem. Governments aren?t like you and I. They are the ultimate ?dumb money?. Once they buy a bond, they don?t care what the price is. They just carry it on their books at face value. They don?t need to mark to market. When debt matures, they just roll it over into similar issues. If you or I tried this, we would go to jail, and possibly even share the same cell.

The bottom line on all of this is that governments are uneconomic, irrational, and even price insensitive buyers. If the price goes up they don?t care. They also don?t do what the rest of us do when prices spike, as they have done, and that is sell. That?s because they don?t have clients like we do. This has created an unnatural market where the demand for government paper is nearly limitless, and the supply is inadequate.

Using this analysis, the big surprise is not that ten year yields hit 1.42%, but that they took so long to get there. This also suggests that bond interest rates will stay unbelievably low far longer than anyone realizes, possibly for years more.

There is another angle to this, which the pols on Capitol Hill failed to recognize. As a result of the new Dodd-Frank financial regulation bill, many derivatives contracts will become marginable for the first time. With the aggregate amount of such contracts estimated at $700 trillion, even just a minimal 1% collateral requirement would automatically create $7 trillion in potential Treasury paper buying.

That is little less than half the current $15 trillion national debt. In fact, it was massive government mandated bond buying in Japan just like this that kept interest rates so low there for so long. I know because I have written three books on this topic.

Much of the current political debate revolves around the belief that the US government is borrowing too much money. But the markets are screaming at us that the complete opposite is true. It is not borrowing enough. There is in fact a global savings glut and bond shortage that looks to get worse before it gets better. As for the monstrous, untamable inflation that such high levels of borrowing created in the past, like the Loch Ness Monster, the Yeti, and Bigfoot, and I?ll believe it when I see it.

Look, There Goes Inflation