The New Tech Darling Meta

Meta (META) is no joke.

They put any sense of concern to bed with its brilliant performance this past quarter.

They are the new poster child of tech as they blew away every meaningful metric that so-called analysts grade tech on.

They are even the newest dividend stock which might be the most absurd part of their performance.

Growth is their new forte and the $200 billion rise in market valuation in one day is the stuff of legends.

How did they make this happen?

Revenue jumped 25% in the quarter from $32.2 billion a year earlier, as the online ad market continued to rebound.

Meanwhile, the company’s expenses decreased 8% year over year to $23.73 billion, and its operating margin more than doubled to 41%, a clear sign that cost-cutting measures are bolstering profitability.

Net income more than tripled to $14 billion, or $5.33 per share, from $4.65 billion, or $1.76 per share, a year earlier.

Meta said it will pay investors a dividend of 50 cents a share on March 26. That comes after cash and equivalents swelled to $65.4 billion at the end of 2023 from $40.7 billion a year earlier. The company also announced a $50 billion share buyback.

Sales in Meta’s Reality Labs unit passed $1 billion in the quarter, though the virtual reality unit recorded $4.65 billion in losses.

I found it highly positive that Meta took getting lean very seriously as they really gutted staff numbers to the delight of the balance sheet.

Talking to many people in the know, META has been overstaffed for quite some time so much so that many at Meta had nothing to do all day.

The 22% year-over-year decrease in staff levels is a sign of things to come and this is just the start.

In the next few years, I do believe that Meta will shave down staff levels to what would amount to 85% less than COVID levels.

Part of Meta’s financial recovery over the past year was driven by Chinese retailers, which have increased spending to reach users across the globe.

Management said advances in artificial intelligence have helped reinvigorate the ad business, which is growing faster than rival Google’s. In Alphabet

’s earnings report Tuesday, the company said Google ad revenue increased 11% from a year earlier, a slower expansion than analysts were expecting.

Meta will continue to invest in AI and in building up its computing infrastructure.

This is the new META and they finally got all their ducks in a row.

Emphasizing what matters is what the stock wanted and they delivered in droves.

They get a green check mark for cutting costs, reducing headcount, spiking operating leverage, tripling profits, improving ad business, moving along the AI business, and delivering a new dividend.

That was just one quarter and if they can keep hammering away on these selective items, then META stock will be one of the best buy-the-dip stocks in the entire equity market.

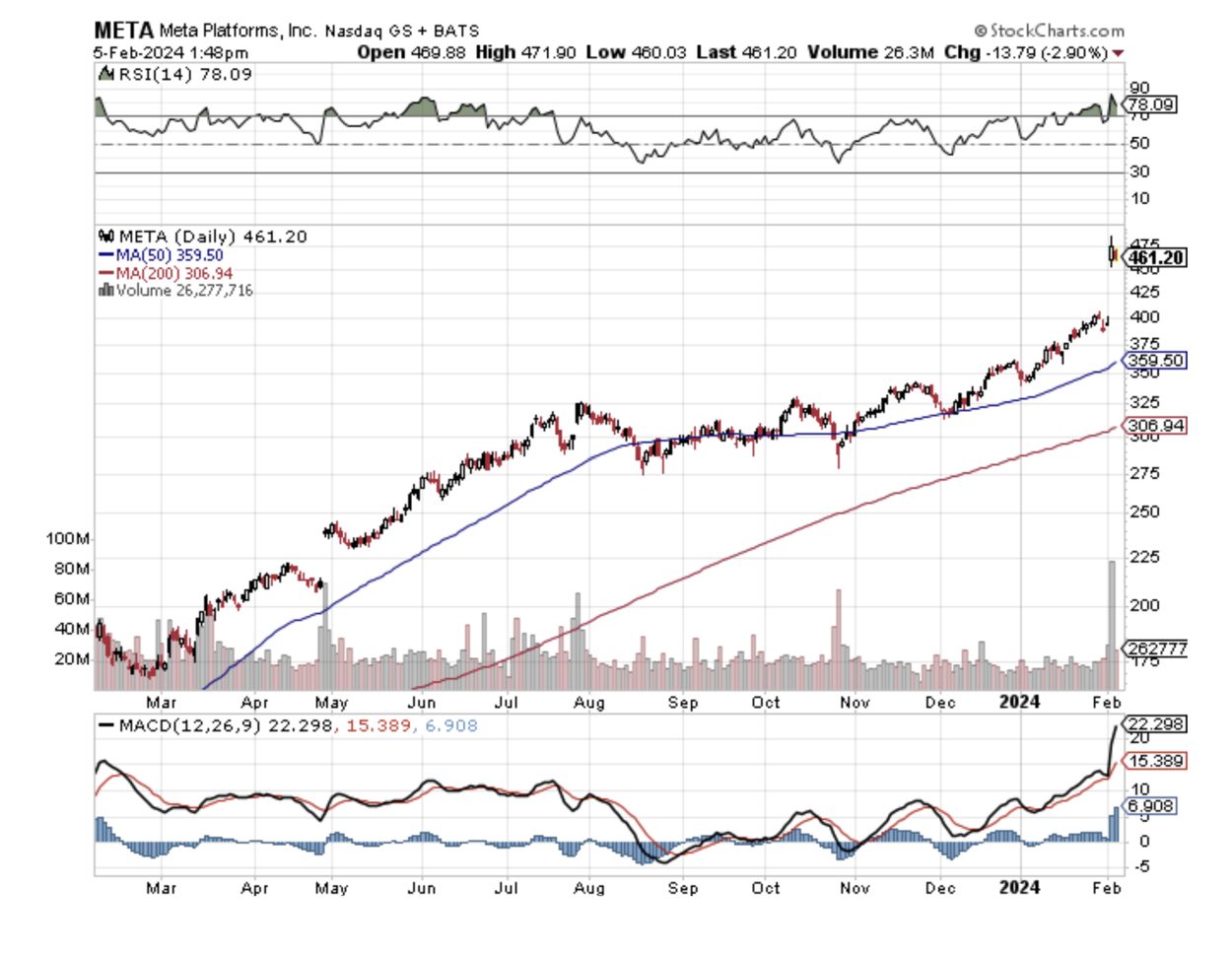

Meta has been a stock I have wanted to get into for a while and entry points are few and far between.

The individual performance suggests that tech is stronger than first believed and might I say even cheap with all this untapped growth on the horizon.