The Next Tech Bubble Top Has Started

Don't go chasing rainbows.

That is what the current tech IPO environment is hinting.

Even though market conditions are frothy, that doesn't mean I'm calling a market top today, hardly so.

I predicted that Lyft (LYFT) would storm out of the gate like a bull on ecstasy, and I was vindicated when the stock flirted intraday with the $87 mark.

The scarcity value of these gig economy companies is hard to quantify.

Examples Uber unduly promise ambition and innovation leading to hopes of a possible air transport service and sharing network that I would need to see to believe.

The built-up expectations smell of over-promising and under-delivering, the majority won’t be able to deliver merely half of what their manifestos promulgate

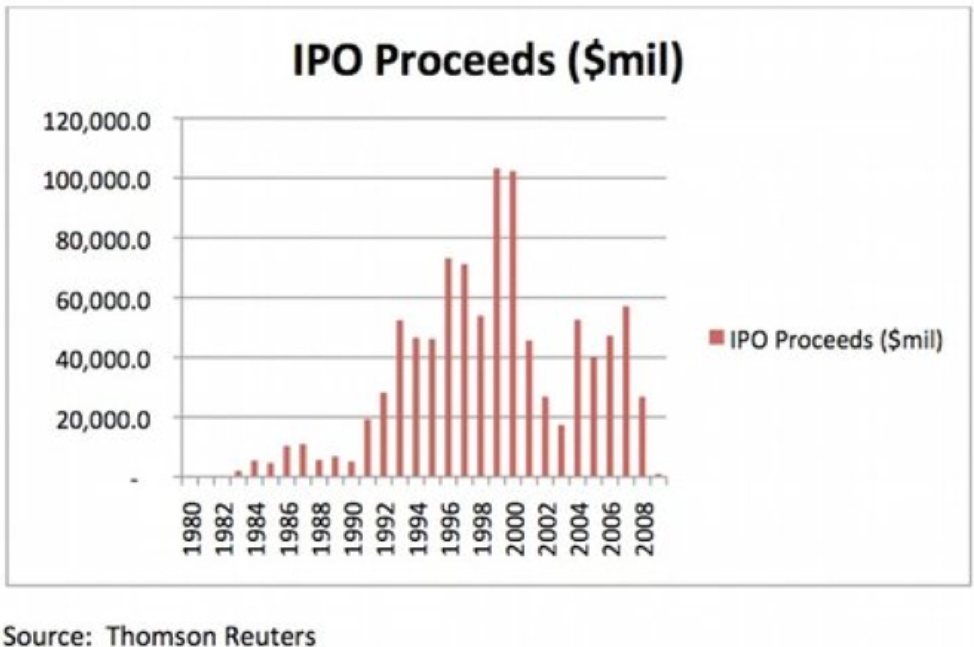

As I put my analyst hat on, the 2019 IPO frenzy coming online has some of the same fingerprints of the infamous dot com bust of 2001.

The two main trends symbolic of the last time the tech industry disentangled were overly generous valuation, pricing in revenue expansion of 80% for the next five years when the leader of the pack Microsoft (MSFT) only grew at 50%.

A tantalizing clue was the utterly deficient cash flow generated back then.

The underlying premise revolved around putting the network effect on a pedestal irrespective of understanding that the network effect should have caused cash flow to accelerate which was conspicuously absent.

Losing money and losing a lot of it does lead to paralysis, examples were rife, for instance, priceline.com losing $30 on each air ticket sold.

Even more hard to fathom was that Priceline was stretching itself to the limits on the open market filling ticket orders because of a dearth of inventory steepening losses.

Priceline gushed about a unique business model of collecting excess ticket inventory that airlines couldn't sell at low cost and reskinning them to a digital audience hoping to take advantage of this price dispersion.

But in reality, this wasn’t always the case.

Priceline was on a suicide mission and expanding from 50 employees to 300 employees based upon misleading growth was madness.

In a nutshell, investors bypassed pragmatic arithmetic and were lifted by the fumes of exuberance that had manifested around the euphoria of the tech bubble.

Lyft is not revolutionary, they are a broker which occupy a low position in the spectrum of tech intellectual property.

Exploiting drivers, compensating them per hour, and letting them figure out their own cost structures for car insurance, fuel costs, and opportunity cost while offering zero benefits is a court battle waiting to happen in California.

And if your response was the way they craft value is by way of a proprietary app, well, Google, Apple, or even Netflix can produce the same type of app and quality of app in a few weeks with their legendary phalanx of top-tier engineering talent.

To Lyft’s credit, they have at least collected the treasure trove of data the app has compiled which is extraordinarily valuable.

The top of the tech bubble means that big tech is overreaching into any revenue they can get their hands on like a heroin addict yearning for the next syringe.

The environment has transformed into an eerily zero-sum game, such as Apple (AAPL) cooperating with JPMorgan Chase (JPM) to create Apple pay, and then instantly flipping around to compete with JPMorgan Chase in the credit card space with Apple Pay being an accomplice.

Big tech has sown the seeds of discord by quietly attempting to trample on any analog business they can get near.

Leveraging the network effect of billions of users in a proprietary walled garden to extract the incremental dollar for a new service is impossible to compete with for analog companies without a similar embedded on-demand audience.

Lyft co-founder and CEO Logan Green mentioned in an interview that in the next five year, he plans to deploy a subscription service coined as transportation-as-a-service like a software-as-a-service option which cloud platforms sell.

A fight to the bottom with Uber will cause major disruption in the pricing mechanisms of the subscription service and could force Lyft to earn less revenue per ride than the current pricing system.

Investors need to remember that Uber is bigger than Lyft and possessed more ammunition.

At the end of the day, the race to the bottom is never good for profitability or sustainability, and Lyft has yet to provide any substantial clues on how they will navigate through this quagmire.

My guess is that Lyft will have to do a deal with the devil of sorts to slang its branded broker app onto the cresting wave of Waymo as Waymo motors ahead and starts to materially monetize its self-driving program.

Remember that Alphabet already has a small stake in Lyft and these two could partner up with Alphabet dictating terms.

Lyft cannot compete with the holy grail of tech - self-driving technology – they are way down the tech value chain.

If we look at the bigger picture, the broader market has been riding the coattails of Federal Reserve Chairman Jerome Powell’s 180-degree turn from winter’s statement that interest rate tightening was on “autopilot.”

Now, there is only a 27% chance given by the market that the Fed will raise rates at all in 2019.

The market responded with strength begetting strength allowing the bull run to continue and even whispers of a possible rate cut later this year.

Sentiment will not change until we get to the point when earnings can’t surpass the expectation which have been lowered substantially.

I bet this won’t happen until late this year or next year.

This is inning 8 or 9 of the bull crusade, the closer is warming up in the bullpen.

Lyft’s opening day gallop is just one of the side effects from a market that is toppy.