The Next Wave of Lithium Battery Demand is Here

The theme of consumer price inflation is here to stay as the largest increase in inflation since 1982 has been fueled by major price spikes.

Energy and mobility are high up on the list of inflationary items and in 2022, when you combine these two, the result is electric vehicles.

2022 is the year of the EV and that means the world needs to produce more lithium batteries.

Inflation has penetrated deep into the consumer psyche and consumers have started to mentally adjust to the realities that we must pay higher prices permanently.

In phone interviews with a random sample of more than 800 Americans, energy prices were one of the leading items of discontent because of the reliance on gas-guzzling cars.

High oil prices along with global government policy is promising to be a boon for EV makers.

We sit here on the precipice of a massive transformation into advanced mobility.

I believe that lithium stocks are poised for higher highs in 2022’s as the demand for EV soars.

To satisfy the industry's insatiable appetite for lithium, global supply will have to quadruple to 2 million metric tons by 2030.

Current and expected projects should be able to meet demand until 2025, but after that, the world will need to explore more supply.

Over the longer term, high prices will fix themselves by spurring miners to increase production. Higher prices will also encourage more lithium recycling, further boosting supply. Meanwhile, companies that buy lithium will look for cheaper alternatives.

Lithium companies that need to be looked at:

- Lithium Americas (LAC)

- Albemarle Corporation (ALB)

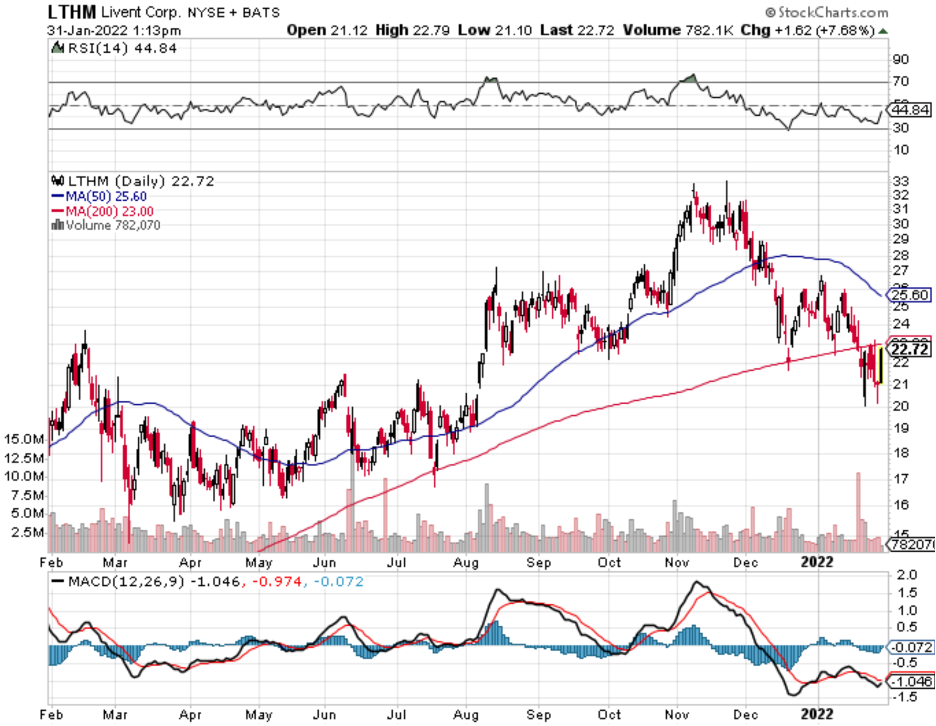

- Livent Corporation (LTHM)

There are more native plays involved in more of the lithium supply chain than simply mining. Livent Corp. (LTHM), which is on track with its own near-term lithium expansion plans and has a decent cash-to-debt ratio, adds value to the lithium it mines by turning it into compounds for the electric vehicle market and other industries.

ALB stock is also among the best lithium stocks to consider for the medium to long term.

For Q3 2021, the company reported lithium sales of $354 million, which was higher by 33% year over year.

Remember that some of these companies have never extracted any lithium and are trading on the prospect of mining lithium so it’s important to differentiate who actually has meaningful sales.

Overall, ALB’s lithium, bromine and catalyst business segments reported $863 million for the third quarter. The key point to note is that Albemarle expects earnings to increase three-fold by 2026. A large part of this growth is likely to come from lithium expansion.

Lithium Americas (LAC) got a boost right as 2021 kicked off when its Thacker Pass project in Nevada, which had been delayed for years because of the inability to receive a federal permit.

Thacker Pass is said to have the largest lithium resource in the U.S. and holds the key to the company's growth.

Finally obtaining the Thacker Pass permit was a big deal, but the $400 million in issued debt means it will cost a pretty penny to extract.

Lithium Americas continue to make inroads on its other project, the Cauchari-Olaroz mine in Argentina, which it owns alongside China's Ganfeng Lithium.

The two companies announced second-stage expansion to add additional annual capacity of at least 20,000 tons of battery-grade lithium carbonate equivalent (LCE) by 2025.

Investors also have the choice to reduce risk by buying into a Lithium ETF.

The Global X Lithium & Battery Tech ETF (LIT) and Amplify Lithium & Battery Technology ETF (BATT) are some that readers should look at.