The Path to the Holy Grail

The pieces are starting to fall together.

This is what Lyft and Uber were hellbent on and they will finally get their cake and eat it too.

At least one of them will.

The holy grail of Lyft and Uber is eliminating the human element to the business.

Phoenix, Arizona is the first site for Lyft’s app collaborating with Waymo’s technology to offer autonomous rides via Lyft’s platform.

This could be the beginning of the end for Uber if Lyft meaningfully pulls ahead.

Why is the human element a roadblock?

Humans complain, get sick, file lawsuits for a lack of benefits, and humans post exposes on companies running amok.

Doing away with that will not only rid Lyft and Uber of high-risk liabilities, but it will boost profitability to the point where these companies will be healthily in the green.

Uber riders were only on the hook for 41% of the actual cost of transportation in 2016, the rest was comprised of generous subsidies making up part of the payments to the driver on top of the driver’s wage.

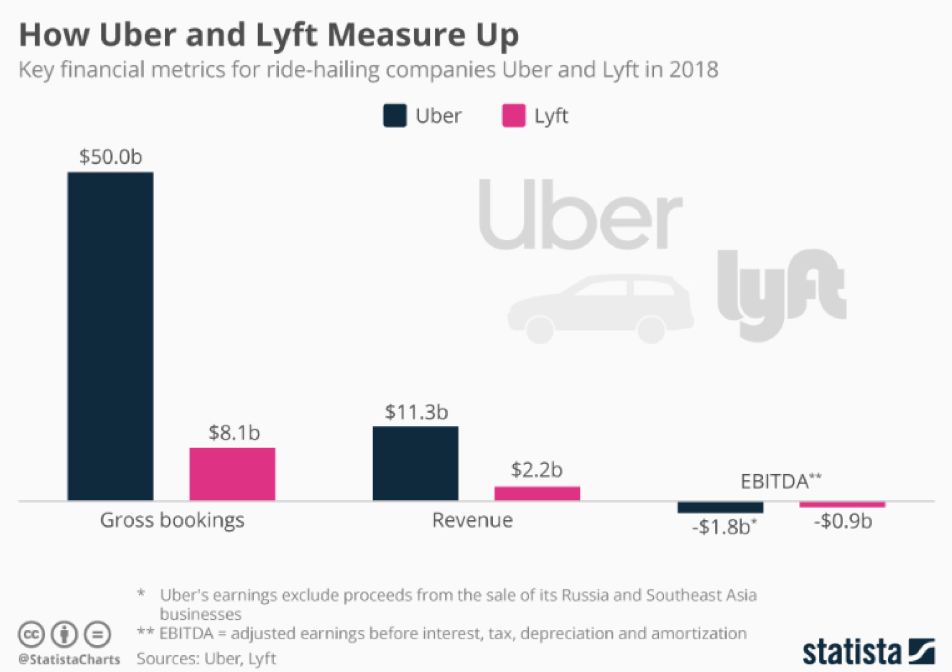

Let me put this in perspective. Lyft made $2.2 billion in revenue last year according to the filing for their IPO, and they lost $900 million from servicing this revenue.

Everybody knows that the gig economy is just a stop-gap measure until tech companies can go full on autonomous and direct operations with one click of a button buttressed by an all-terrain algorithm.

If you thought Uber was a tad better, then you were wrong. Operating losses of $3 billion on $11.8 billion in revenue and a total debt on $8 billion is tough to stomach.

If Lyft were finally able to remove the subsidies because of cost associated with human drivers and then kick the driver to the curb, margins would explode by around 50%.

Being a public company now, the competition will rise to a fever pitch.

The first to remove the driver is effectively an existential dilemma for both companies and I believe Lyft partnering with best in class Waymo will give them the upper hand.

Giving the keys to a vaunted FANG to supercharge your business isn’t a bad idea.

And remember, if you short Lyft, you are betting against Alphabet engineers who have made Waymo into the best in show.

You could do a lot worse.

And it could so happen that Lyft might even tap more Alphabet expertise to hypercharge its business.

It’s definitely not in the realm of fantasy and I already know that Lyft is receiving substantial help from Google ad.

Pre-IPO days were all about jockeying for market share to see who could grab the most volume and now the battle stands with Lyft holding 34% of the market with Uber pocketing with the rest.

Uber has relinquished much of their dominance after bleeding users stemming from bad management decisions.

Now the pendulum is swinging towards the big question of how soon will these companies be profitable?

Luckily for Uber and Lyft, future trends are quite favorable, with data showing that by 2040, 33 million of the vehicles sold annually will be fully autonomous.

Nearly every automaker is developing self-driving systems right now, and semi-autonomous features such as automatic braking, lane-keep assist, adaptive cruise control already are complementary in new vehicles.

Now the game is to continue the subsidies in order to tighten market share but integrate autonomous cars into the business model as fast as possible.

This is all about execution and the management behind the reigns.

By doing this, Lyft and Uber will reduce its expenses and finally become profitable, it would almost be akin to if Spotify stopped paying for music royalties.

Lyft has set the first cone on the floor and I found it interesting that it was Lyft and not Uber.

When we peel back the layers, investors must understand that Alphabet made bets on both Uber and Lyft.

Six years after making what at the time was its largest venture investment ever, Google's $258 million bet on Uber has multiplied by about 20-fold to be worth more than $5 billion.

But it’s not about the appreciating assets that matter the most.

Alphabet knows that one of these platforms will dominate in the end and want to benefit from it either way.

CapitalG, the late stage investing arm of Alphabet, has almost tripled the value of its investment in Lyft at today’s prices after investing $500 million in Lyft in October 2017.

Alphabet has its fingerprints all over Uber and Lyft at this point with not only supplying the map that is displayed on these platforms through Google maps but also leading the marketing operation infusing its best of breed ad tech into these platforms.

It’s obvious that Alphabet has covered its bases with the autonomous transport services and whether its Lyft or Uber that wins out, Waymo taking the initiative to partner with these platforms will make Alphabet the clear winner.

Lyft has all its eggs in one basket with a domestic transportation app while Uber has different interests which could be dragging them away from the autonomous driving opportunity.

Uber did have major setbacks after their technology was the fault of several fatalities.

The first-mover advantage is the key to seizing the bulk of the market.

I am interested to see when Uber will partner with autonomous technology, but for the moment they aren’t because they are developing their own self-driving tech.

This is a risky strategy because Lyft has understood its shortcomings and paid heed to the more sophisticated technology being Waymo and is now actively partnering with them.

They probably understood that they would never be able to beat Waymo.

This unit started off shrouded in secrecy in 2008, a full 5-years before anyone moved a finger of autonomous driving.

Uber is developing its own autonomous fleet which in theory could become a larger business than Waymo and Lyft, but they are battling a company who had a 7-year start and the result of that is Uber trying to shortcut to the top resulting in its technology getting sidelined.

Uber’s self-driving unit is in the bad graces of safety regulators and I would only give Uber a 15% chance of usurping the leader Waymo.

To this point, I believe Lyft will be the main transport app for Waymo in the future, and Waymo having the highest chance to be rolled out nationally.

This is incredibly bullish for Lyft and Alphabet.

Uber still isn’t on the radar with its self-driving technology and being a frenemy in this sense with Alphabet will hurt Uber.

If Alphabet cashes out on its Uber shares, not only could they earn a hefty profit, but it would signal that Lyft will be their main transport app for autonomous driving and Uber has lost out on self-driving technology.

I am now bullish on Lyft and neutral on Uber but waiting on how Uber responds to this massive leg up by Lyft.