The Portfolio That Will Double in Three Years

Below, I have listed a portfolio of ten stocks that will almost certainly double in three years. If I am wrong, it will gain 100% in only two years.

But there is a catch. This basket of stocks may have to drop 20%-30% first. It is a cardinal rule of investment that if you want to earn higher returns, you must accept higher volatility as well.

It doesn?t require a rocket scientist to figure out that this is an energy-based portfolio.

Crude almost certainly hit it's trough in the current quarter at $26 a barrel. But this python has a couple of pigs that it has to digest first.

As an old oilman, I can tell you that the oil majors have never been able to forecast the price of oil, and that is with all the resources in the world to accomplish this.

This is why they hedge out all their production in the futures market, or with long-term contracts with customers. The oil companies that thought they could predict the price of oil all went out of business a long time ago.

And as a mathematician, I can also tell you that this is an impossible task. There are just too many variables involved. So, don?t even try.

The bottom line is that absolutely no one can pinpoint when and where oil will hit bottom.

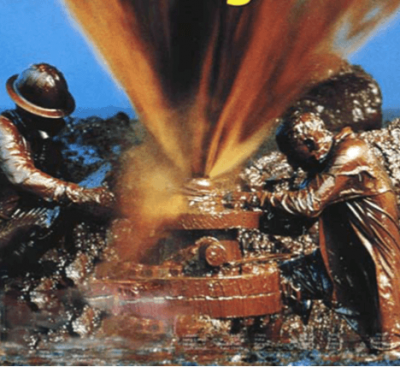

Let?s start with the supply side. Thanks to the avalanche of cash that poured into fracking plays at the top of the market last year, US oil production peaked at 9.6 million barrels a day in the spring of last year. It has since fallen to 9 million barrels a day.

This is occurring because once money enters the production pipeline, it stays there forever. Drillers would rather complete a half finished well and sell its output at a loss for a couple of years, rather than shut down construction and lose everything.

However, new projects have fallen precipitously. You see this in the collapse of the number of drilling rigs in use, from a peak of 2,000 five years ago to only 352 last week, according to the Baker-Hughes reports.

Then there is the storage issue. Much of this new oil is going straight into storage. As a result, the facilities at Cushing, Oklahoma, are full. Virtually every tanker in the world has already been chartered and is also loaded to the gunnels with Texas tea.

Once all the storage in the world was full to capacity, there was not alternative but to cap wells, or dump new production on the spot market. This led to the price Armageddon that so many investors worried about.

The peace deal with Iran won?t be a huge factor. The country?s oil infrastructure is in such a miserable state that it will be years before it impacts the market in a major way.

And, by the way, Iran is also thought to be storing oil it couldn?t sell in a fleet of tankers offshore.

Now, lets look at the demand side. We only need two letters for this one: QE.

We are a mere year into what is probably a 5-6 year program of quantitative easing in Europe. The Bank of Japan continues to dump massive amounts of cash into its own economy. Even China is easing.

In the meantime, the United States is still basking in the glow of its own just ended hyper aggressive $4 trillion QE strategy. It?s now looking like all of America?s 2016 economic growth will be concentrated in the final three quarters of the year.

This all adds of to a global synchronized economic recovery and much higher oil prices. Personally, I think oil could recover to $70 a barrel in 2017, and to $100 by 2018.

This is why large, long term institutional investors are happy to look across any potential $30 valley that may occur over the next few months and are loading the boat with energy stocks now.

Maybe you should do the same.

|

Mad Hedge Fund Trader Model Energy Portfolio |

? | |||

| ? | ? | ? | ? | ? |

|

Majors |

Symbol |

Price |

Yield |

Weighting |

| ? | ? | ? | ? | ? |

|

Exxon Mobil |

(XOM) |

$84 |

3.85% |

10% |

|

Chevron |

(CVX) |

$95 |

4.28% |

10% |

|

Occidental Petroleum |

(OXY) |

$69 |

4.41% |

10% |

|

Conoco Philips |

(COP) |

$40 |

2.52% |

10% |

| ? | ? | ? | ? | ? |

|

Exploration and Production |

? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

EOG Resources |

(EOG) |

$73 |

0.90% |

10% |

| ? | ? | ? | ? | ? |

|

Offshore Drilling |

? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

Transocean |

(RIG) |

$9 |

0.00% |

10% |

| ? | ? | ? | ? | ? |

|

Gas Liquifaction |

? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

Cheniere Energy |

(LNG) |

$34 |

0.00% |

10% |

| ? | ? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

Solar |

? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

First Solar |

(FSLR) |

$57 |

0.00% |

10% |

|

SunPower |

(SPWR) |

$22 |

0.00% |

10% |

| ? | ? | ? | ? | ? |

|

Master Limited Partnerships |

? | ? | ? | ? |

| ? | ? | ? | ? | ? |

|

Alerian |

(AMLP) |

$11 |

11.8% |

10% |

| ? | ? | ? | ? | ? |

|

Total |

? | ? | ? |

100% |