The Ride Sharing King of Tech

It’s hard to believe that Uber (UBER), the ride-sharing company, is where it’s at now and by that, I mean delivering profits.

It was just only a few years ago when burning money was something they were known for and beginning the next lender to fund them was a common request.

That was the era of cheap money where 0% interest rates created companies like Uber and this capital was the oxygen they needed to keep trying until they could make it work.

Much of the early years were characterized by a fierce competition with competitor Lyft (LYFT) offering subsidies to drivers.

Fast forward to today and they also have a sparkling food delivery business and are projected to continue to grow in the first quarter of 2024.

The company carved out a profit of $1.43 billion in the final three months of 2023, which included a $1 billion benefit from its equity investments as well as income from its operations.

The company has turned an annual profit once before, in 2018 on the back of its investments, but it wasn’t earning money from its operations until now.

The company’s performance in the last three months of 2023 suggests that demand for its ride-sharing and food-delivery services remains robust.

From 2016 through the first quarter of 2023, Uber bled cash close to $30 billion in operating losses.

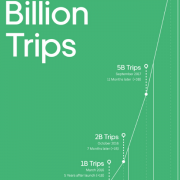

The company posted its first quarterly operating profit in the second quarter of 2023. The company was founded in 2009.

It was also better than Lyft at responding to a sudden driver shortage after the economy reopened from lockdowns. That helped Uber gain market share.

Lyft is still twisting in the wind of mediocrity and has yet to post its first operating profit.

Uber expanded advertising on its app over the past year. It says it has continued to become more disciplined about spending on discounts to consumers and incentives to drivers. It says it has also become better at combining deliveries and reducing errors, which has improved its operational efficiency.

In the last three months of 2023, the company’s mobility revenue grew 34% and its delivery revenue expanded 6%, while its revenue from freight declined 17%.

After bottoming around $19 per share in the middle of 2022, the stock has been on a rampage and now sits nicely at over $81 per share.

No doubt the stock benefited from last year's slew of capital betting on the Fed to drop interest rates.

I even anointed Uber as my number 1 stock of 2023 and their performance delivered in spades.

What we are witnessing is the maturity of the company and I am not saying they are going to deliver profit back to the shareholder like a FANG, but the conversation will start and that should carry momentum.

The US economy is still going strong growing a few percentage points per quarter and that means US consumers are still spending and that is good for ride-sharing and food delivery.

Uber is sitting nicely as they are a monopoly in this area of technology services.

I am bullish Uber.