The Slippery Slope for Oil

If volatility and lack of direction in the equity market are driving you nuts these days, thank your lucky stars you?re not in the oil market. Only last night, a Japanese supertanker plowed into a US Navy destroyer, causing prices to spike. That?s assuming that you had time to notice while sifting through numerous, contradictory leaks from Israeli intelligence about whether they will, or will not, imminently attack Iran. Oh, and don?t forget, demand from Europe is disappearing up its own tailpipe.

My take is that the administration is pursuing the correct policy on Iran. With Europe joining the embargo on June 30, and its major means of trade financed with the dispatch of Standard Chartered, Iran?s economy is now caught in a vice. With minimal domestic refining capacity, the country is drowning in its own oil, but facing several gasoline shortages. Some essential foodstuffs have doubled in price. These are key ingredients needed for the Arab Spring to spill into Iran. Then the country falls into our lap like an overripe piece of fruit, without a shot fired.

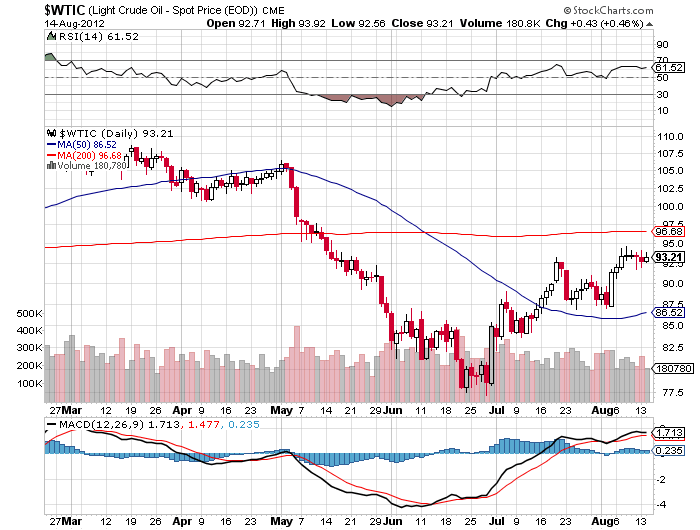

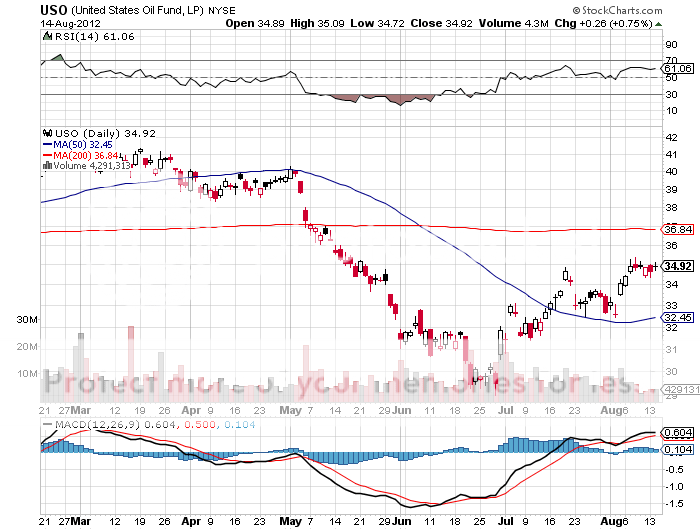

It could well be that none of this makes any difference to the price of crude. Like every other asset class, it has become hostage to the likelihood of another round of quantitative easing from the Federal Reserve. West Texas Intermediate has moved an impressive $18 off of its $77 low on the prospect of QE3 alone. All that is left is for Ben Bernanke to pull the trigger.

Our first chance at a hint will be at the Jackson Hole confab of central bankers on August 26. After that, we have to wait until the September 18-19 Open Market Committee Meeting for relief. It is safe to say that if Ben delivers, oil could be trading at triple digits very quickly. If he doesn?t, then we could be plumbing new lows shortly.

That put us in the same risk/reward dilemma for oil as with the equity markets. Note the imbalance. If we get QE3, then we can entertain $6 of upside. If we don?t, you are looking at $25 of downside. Hint: strapping on risk/reward trades like this is not how hedge fund managers get rich.

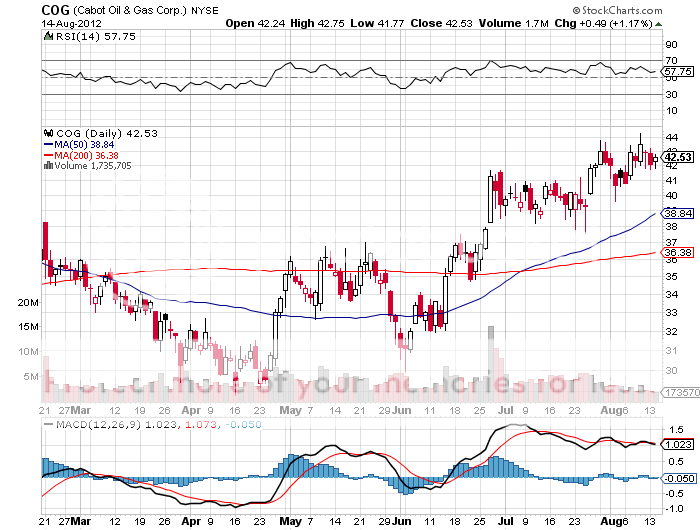

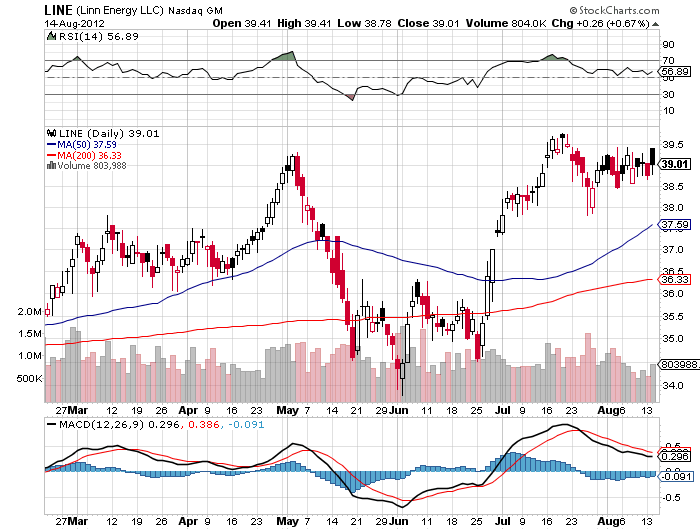

That makes me a happier buyer on the next big dip than a chaser up here. Names to focus on? ExxonMobile (XOM), Occidental Petroleum (OXY), and Cabot Oil & Gas (COG), as well as the master limited partnerships like Kinder Morgan (KMP), Enbridge Energy Partners (EEP), Trans Montaigne Partners (TLP), Linn Energy (LINE).

That?s all for today. It is hard to write brilliant, seamless prose when you?re brain dead and mindless from nine hours of jet lag. Besides, the whales are still on vacation at Southampton and the South of France, so my traditional sources of hot tips will remain dry for another week or so. Damn! I should have taken an extra week off to investigate economic conditions in the Greek Islands. With a Depression on, I hear that hotels that normally go for $2,000 a day can be had for $2,000 a week.