The Thinking Behind Ray Dalio

Every time I watch an interview with the Bridgewater hedge fund manager Ray Dalio, what he doesn’t say really paints the picture of who he really is.

Yes, it’s undeniable that he is incredibly wealthy, successful, and has returned shareholder profits continuously, but his support for the Chinese communist party has to be called out.

Dalio necessarily isn’t anti-American, but he loves to trot out propaganda that America is a “weakening” power confronting a “rising” power.

I would argue this isn’t true and that China is just a paper Tiger with infinite more problems than the U.S. and has been hit infinite times harder economically because of this pandemic.

China is hoping to solve the issue from going from the world’s growth engine to 250 million unemployed Chinese on the streets, thanks to the city of Wuhan.

His response is almost automatic at this point in regard to China as he skirts around specifics and issues general statements to avoid criticizing the land of Chairman Xi Jinping.

Why does Ray Dalio give a free pass to China?

The easiest way to understand is to look where he deploys his money.

It’s well known that criticizing the Chinese government is a red line for the communist party and they will sabotage, swindle, destroy anyone that steps over this line, and even more so for a foreigner.

Ray Dalio doesn’t want his capital nicked in China where he would have zero chance of navigating through the corrupt judicial system successfully in a land that has zero rule of law.

As long as Dalio has meaningful investments in Chinese tech companies, he will never say anything bad about China. He is part of the problem that has spread through the U.S. system of self-censored Americans who have a financial interest in China.

What does he own?

Tencent Music Entertainment (TME).

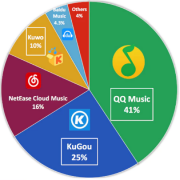

Offering one-stop music services and solutions designed to create a complete music entertainment ecosystem, Tencent Music Entertainment has solidified its status as the biggest online music company in China by monthly active users (MAUs).

Dalio has upped his holdings by a staggering 858% in TME, Bridgewater has pulled the trigger on 620,000 shares in Q2. At 692,262 shares, the total position is valued at $9,318,000.

TME added 4.4 million subscribers in the quarter versus 2.8 million in Q1, and subscriber average revenue per user also grew 8% year-over-year.

What about the direction of the company?

The company renewed the Universal Music Group (UMG) licensing deal.

Additionally, it organized nine TME Live performances in Q2 and long-form audio licensed titles increased 300% year-over-year, with penetration of 9.4% compared to 4.6% last year.

What other Chinese investments does Dalio own? You would think an American billionaire would help the U.S. health industry find solutions against a global health crisis, but no, Dalio is investing in Chinese health companies.

What does he own?

Zai Lab Ltd. (ZLAB)

Zai Lab offers transformative medicines for cancer, autoimmune, and infectious diseases to patients in China.

Dalio's Bridgewater made a splash with a new position buying 63,837 shares. The value of this holding? It lands at $5,243,000.

The firm has performed well driven by Zejula's second-line ovarian cancer (OC) launch in China. Total sales from China, Hong Kong, and Macau reached $13.8 million.

The Chinese government is already requesting applications for the National Drug Reimbursement List (NDRL) for this year. ZLAB is expected to apply for Zejula's second line OC indication, with the results potentially coming in November 2020 and driving upside.

As for its other launch, Optune became commercially available at the end of June. Optune is priced like a premium therapeutic and would be with a list price of $19,000 and a net price around $11,000. This is at a modest discount price of that of the U.S. list price of around $20,000. Most patients in China are self-paying for this innovative device.

Why invest in Chinese tech firms when the U.S. has a perfectly operating tech industry that has seized even more market share from the broader economy?

Growth.

Watching Dalio’s interview, it’s clear to me that he is a numbers guy. The genesis of his logic originates from the debt cycle and how investments and payments function derive from this concept.

It’s hard for Wall Streetists to ignore the growth numbers in China and Chinese tech firms have the best growth numbers in any industry in an otherwise faltering Chinese economy.

Chinese tech firms have the best growth numbers out of any tech industry in the world, that is, if you believe them.

Dalio has put his money where his mouth is and clearly believes in Chinese tech and makes sure his toes are set squarely behind the Chinese communist line.

I just would remind Ray Dalio that he is one investigative report away from losing his money because industry experts agree that no number out of China is even close to accurate.

I again strongly urge readers to never deploy capital in any mainland Chinese tech firm, simply because there are too many great tech firms in the U.S., and also from the risk control perspective.

Do not follow Dalio down this path where you need to drink the same Kool Aid as him.

We are entering into the golden age of U.S. tech and there will be vast amounts of opportunity moving forward.

We are just scratching the surface here as technology will become a bigger part of our lives, it’s up to you if you want to be a participant or not.