The Trade War Moves Down Market

To understand the consequences of the global trade war, just take a look at the second-tier software companies.

There has been softness in the latest earnings reports and guidance signaling a lukewarm upcoming summer.

The best-case scenario is the likes of DocuSign (DOCU) and Zuora (ZUO) rallying into the end of the year.

That is hardly a given considering the global turmoil has shifted supply chains in every which way as well as denting overall demand.

Cloud-based companies have seen meaningful weakness this earnings season, even some of them absorbing heavy losses in the wake of their quarterly results, but analysts aren’t ready to write off this industry yet.

Referencing the latest industry survey, 20 software companies reported results in the last month, and of those, only six saw a positive response in their stock prices.

DocuSign and Pure Storage (PSTG) were among names that got clobbered, along with cloud-computing plays like Cloudera Inc., Nutanix Inc., Box Inc., and Pivotal Software Inc.

The current malaise in software is due to higher valuations and macroeconomic issues which subsequently elevates uncertainty.

There is no reason to go hysterical over this, and in no way, shape, or form, does this signal an imminent implosion of cloud companies, any incremental caution may be reversible if macro indicators and sentiment rebound.

And this rebound can be swift once all the stars align together.

Adding to the comfort is that some of the sharp drawdowns were company-specific reasons.

MongoDB Inc. or Zscaler Inc., were coming off strong year-to-date advances in their shares and it was time to take profits before the next upward explosion.

Cybersecurity company Zscaler, is appropriately accounting for outperformance and have already been crushing higher than normal expectations.

DocuSign eclipsed expectations on some metrics but disappointed on others, such as billings growth.

This disappointing miss punished the company with a drop of 15% in the pre-market session, as DocuSign grew sales by 27%, a lower rate than in previous quarters.

Management blamed the poor performance to an elongated sales cycle.

Bulls were hoping for a beat-and-raise quarter and instead got in-line numbers with some soft spots around the periphery.

Investors aren’t in a charitable mood and the sensitive mood around geopolitics has made investors more agitated with a shorter leash.

There was a tone of a broader deceleration in software demand prompting stronger names to get comingled together, but the bulk of this negative price action has been overdone.

Even further down the pecking order, results from smaller cloud firms have pointed to more fundamental issues, and these stocks have emerged as a particularly weak sub-sector.

A number of these companies reigned in their forecasts, a trend that has buttressed analyst caution over the group.

Considering that many companies have labored and there exist clear narrative similarities, it’s hard not to surmise that some real systemic pains in infrastructure exist.

Many in the industry are acutely aware of the growing chorus of companies blaming competition or poor sales execution.

Lower growth rates are effectively the predominant reason for lower stock prices in this group of cloud companies.

On the flipside of this weaker cloud growth are the heavy hitters who are throwing around their weight getting through largely unscathed.

If any of these bigger cloud companies can fuse together a business model with no China exposure, then shares are likely stable to upward trending.

A company like Adobe (ADBE) is a perfect company to look at with an unpretentious yet steady growth rate and wildly successful products.

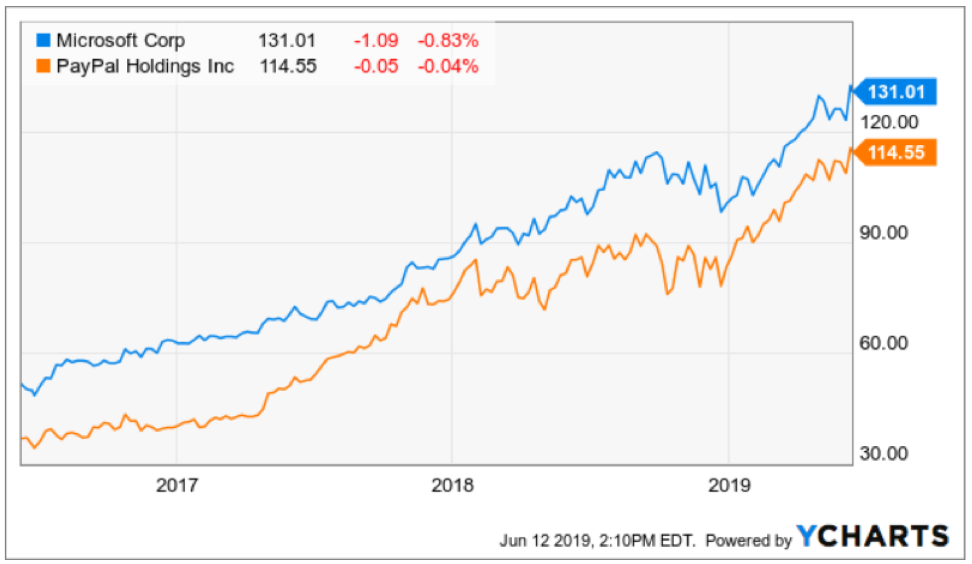

If we were to look at more growth-based companies with larger scale, then PayPal (PYPL) and Microsoft (MSFT) epitomize the type of cloud companies that are thriving in this environment and if geopolitics subsides, take on another 10% in sales.

Not only is the weather hot in the summer, but the anti-trust regulators are turning up the heat on certain tech companies on anti-trust concerns.

This could be a time to wait out those stocks and there could be another move to the upside if regulation is weaker than expected.