Trade Alert - (OXY) – BUY

Trade Alert - (OXY) – BUY

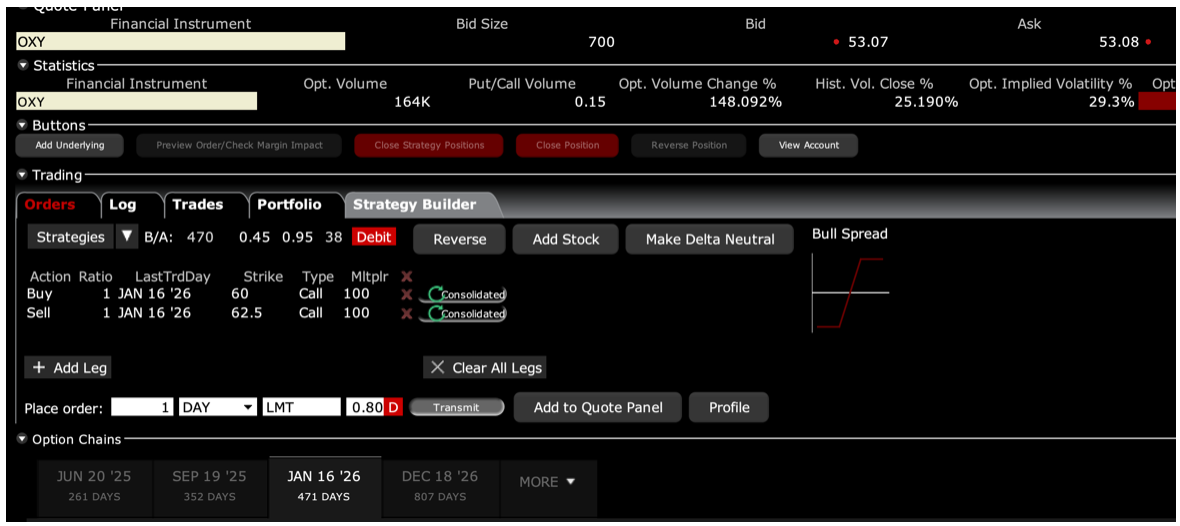

BUY the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $0.80 or best

Opening Trade

10-8-2024

expiration date: January 16, 2026

Number of Contracts = 1 contract

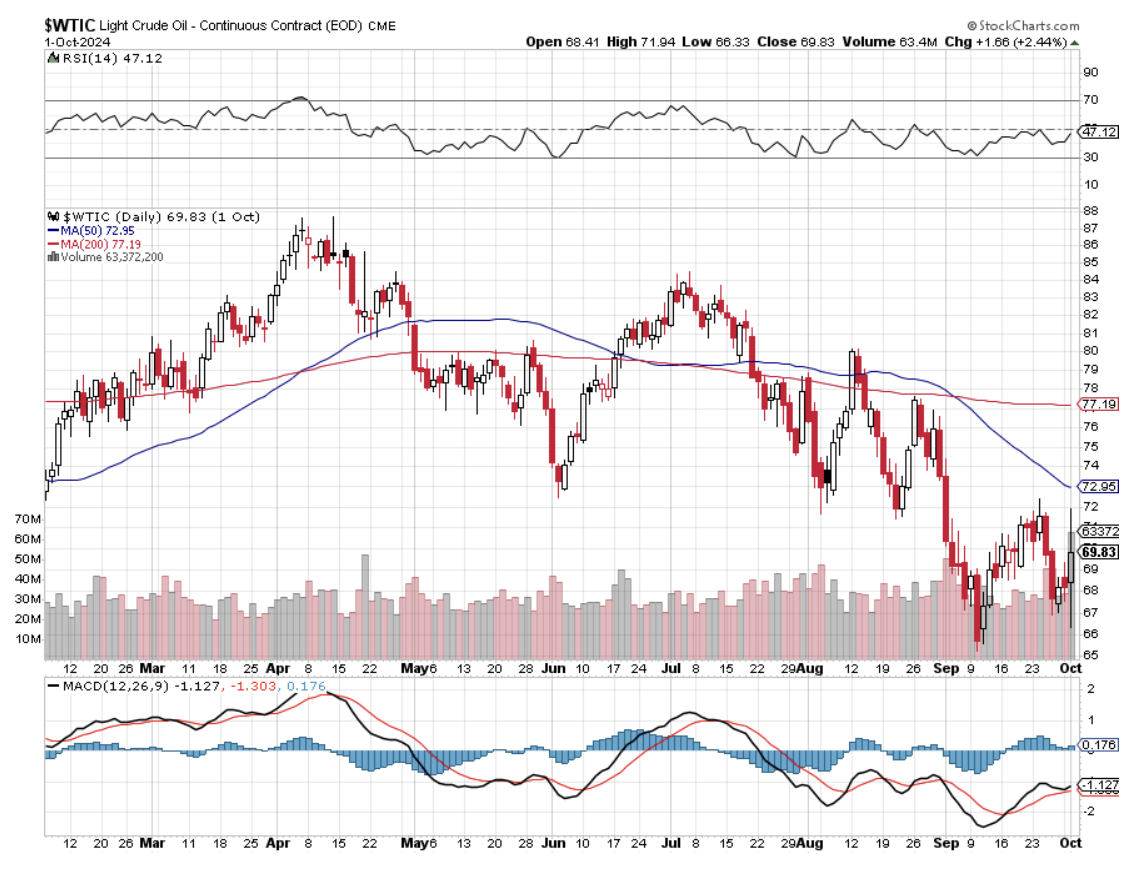

China certainly brought out a big bazooka with its massive stimulus package last week. If this one proves inadequate, they can bring out many more. China is no longer the poor country I knew 50 years ago. For a start, they own $869 billion worth of US Treasury bonds.

And what is the best leverage China plays out there?

Oil.

It just so happens that energy is virtually the only cheap sector in the stock market and the worst stock market performer of 2024.

Oil consumption in China amounted to 16.6 million barrels per day in 2023, up from 15 million barrels daily in the prior year. That is 17.2% of the 96.4 million barrels in global oil production last year. Between 1990 and 2023, figures increased by more than 14 million barrels per day, up from 1 million barrels a day.

It has been China’s lagging economy that has dragged down the price of West Texas Intermediate Crude by 31%, from $94 a barrel to $65. China has published GDP growth figures this year of 5%, but most who know China well believe the real figure is close to zero. Get China back in business, and we could revisit $94 in no time.

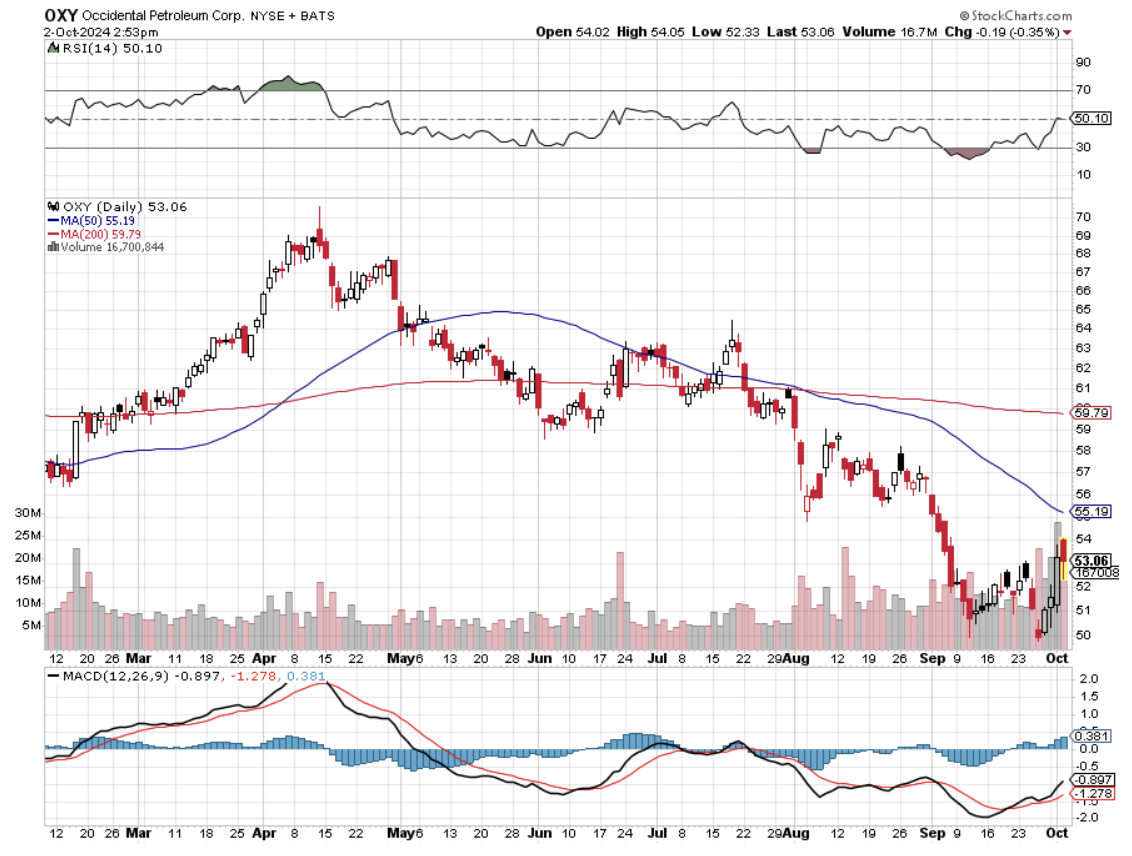

We have just seen a healthy 32% correction in the shares of California-based oil major Occidental Petroleum (OXY), and I am starting to salivate. Finally, I can put to work my 50-year relationship with the company (see research piece below).

If you don’t do options, buy the stock. My target for (OXY) in 2025 is $74, up 37%.

I am therefore buying the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $0.80 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

This is a bet that Occidental Petroleum (OXY) will not fall below $62.50 by the January 16, 2026, option expiration in 15 months.

To learn more about the company, please visit their website at https://www.oxy.com

Don’t pay more than $1.20 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50. Enter an order for one contract at $0.50, another for $0.60, another for $0.70 and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then, enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10% since the time value is so great and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month, just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that a 15.74% rise in (OXY) shares will generate a 212% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 13.46:1. Across the $60-$62.50 space. LEAPS stands for Long-Term Equity Anticipation Securities.

(OXY) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $62.50, where it traded in July.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Here are the specific trades you need to execute this position:

Buy 1 January 2026 (OXY) $60 calls at………….…....……$5.25

Sell short 1 January 2026 (OXY) $62.50 calls at…………$4.45

Net Cost:………………………….………..………….…...............$0.80

Potential Profit: $2.50 - $0.80 = $1.70

(1 X 100 X $1.70) = $170 or 212% in 15 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Take a Look at Occidental Petroleum (OXY)

There are a lot of belles at the ball, but you can’t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics course, which required me to pick a country, analyze its economy, and make recommendations for its economic development.

I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, crawling out of the desert starved, lice-ridden, and half-dead.

I concluded that the North African country should immediately nationalize the oil industry and raise oil prices from $3/barrel to $10. I knew that Los Angeles-based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review.

They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger-than-life figure who owned a spectacular impressionist art collection and who confidently displayed a priceless Fabergé egg on his desk. He said he was impressed with my paper and then spent two hours grilling me.

Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians? I told him everything I knew, including the two weeks in an Algiers jail for taking pictures in the wrong places.

His parting advice was to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

When I went back to UCLA, I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon.

Shocked, I kicked myself for going into an interview so ill-prepared and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 50 years later, while trolling the markets for great buying opportunities set up by the recent China bazooka, I stumbled across (OXY) once more (click here for their site at http://www.oxy.com /). (OXY) has a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America.

OXY’s horizontal multistage fracturing technology will enable it to dominate California shale. The company offers a respectable dividend of 1.65% and has a submarket earnings multiple of only 13.7 times. Need I say more?

Oh, and I got an A+ on the paper, and the following year, Algeria raised the price of oil to $12.

Lenin and Hammer

A Faberge Egg