Trade Alert Service Posts Two Year 90% Profit

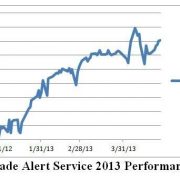

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 90.6% profit since the inception of the service 30 months ago. That compares to a modest 21% return for the Dow average during the same period. This raises the average annualized return for the service to 36.2%, elevating it to the absolute apex of hedge fund ranks.

My bet that the stock markets would continue to grind up to new all time highs in the face of complete disbelief and multiple international shocks paid off big time, as I continued to initiate new long positions in the S&P. After steering readers away from gold (GLD) all year, I then caught the bottom and rode a $74 rally on the way back up. Every short position in the yen has been a money maker. I even managed to cover a brief short in the Treasury bond market for a small profit.

Trade Alerts that I wrote up, but never sent, worked. That?s because I have been 100% invested for the entire year in long stock/short positions. However, followers of my biweekly strategy webinars caught my drift and benefited from the thinking, and many did these trades on their own. These included shorts in the Treasury bond market, (TLT), the Euro (FXE), (EUO), and the British pound (FXB).

Sometimes the best trades are the ones you don?t do. I have been able to dodge the bullets that have been killing off other hedge funds, including those in (USO) and commodities (CORN), (CU). The average hedge fund is up only 4% in 2013, as their short positions in the lowest quality companies have easily outpaced their longs on the upside.

All told, the last 35 of the 42 trade alerts issued by the Trade Alert Service in 2013 were profitable, a success rate of 83%. The year-to-date profit stands at a stunning 35.5%.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.