Uber Gets Another Mulligan

Great news for tech investors – Uber (UBER) is getting a pass on its almost historic loss-making 2020!

A highly bullish indicator is the broader tech market able to absorb an almost $7 billion annual loss with ease.

This all bodes well for the health of the tech market in 2021 – we should finish this year clearly higher than we are now today albeit with no black swans.

The tech market is iron clad right now with multiple external forces pushing up multiples to historic levels.

Imagine there are copious amounts of better tech companies out there that are actually turning a profit and are even at the vanguard of all the latest tech trends, and Uber definitely isn’t one of them.

Yet, I believe Uber shares will roar higher!

A Nasdaq index brimming with liquidity is the one way to explain this phenomenon because the bar has been set so low for tech companies to jump over that unless there is a bankruptcy or systemic risk, shares will rip higher.

Remove the liquidity subsidy and Uber shares would be headed into the gutter in a flinch.

But here we sit with tech shares going parabolic after a robust breakout.

If this carries on, we will see more abnormal side-effects and I believe the GameStop phenomenon was precisely the precursor to much weirder activity that is about to happen.

I must divulge that part of the narrative driving firms like Uber is the re-opening theme of increased consumer behavior if the population is theoretically inoculated driving a surge in economic activity.

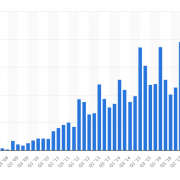

The boom in outdoor consumerism would catapult Uber’s loss-making ride share division which performed poorly grossing only $6.79 billion, down 50% from a year ago.

As many might have guessed, Uber’s pitiful performance in ridesharing in a pandemic was met conversely by heightened food delivery gross volume of $10.05 billion, up 130% from a year ago.

What does this mean?

Uber is turning into a loss-making food deliverer from a loss-making ridesharing company and are still losing vast sums of money.

Their strategy of acquiring other food deliverers like alcohol delivery app Drizly for a deal valued at $1.1 billion in stock and cash combined will scale well and offer cost savings but is no panacea.

They also sealed a deal for a $2.65 billion acquisition of delivery service competitor Postmates in December to help build out its delivery capabilities.

However, where is the light at the end of the tunnel?

Where is that iPhone or YouTube – that game-changing asset?

There is no growth asset here and I still see no proprietary technology other than an app that matches drivers to passengers and a food delivery app that gets a car to its hungry customers.

To Uber’s credit, they revealed 20% improvement in net losses amounting to $6.77 billion, from a jaw-dropping $8.51 billion loss in 2019, and I will agree there is headway to make with such lousy numbers.

As long as Uber is afforded such a long leash and incentivized to perform badly, they can incrementally reign in the net losses and still claim victory.

But I scratch my head thinking how they will finally overcome that “last mile” problem of making this company a true tech giant and not one just brandishing below-average intellectual property and partying for losses that aren’t as bad as expected type of model.

At the end of the day, we can only trade the market we have, and not the one we want.

The broader tech market has given its implicit nod to Uber and this company remains an attractive buy on the dip tech growth company even though I listed a myriad of risks and concerns about its underlying model.