Is it Time to Get Back Into Uber?

I dig it that Uber has larger data sets than anyone else in a world where bigger is better in terms of data.

What they have is ultimately uber valuable in the modern day of data being the new oil.

This advantage is precisely why Uber is able to train an in-house algorithm better than the next guy.

Global reference points are what every company these days lust for.

Matching and routing an incentives marketing engine that is highly personalized is an existential issue for ride-sharing giant Uber.

When you parlay their data edge with possessing op teams on the ground in every single market and understanding of the regulatory marketplace as well, it means per unit, Uber’s overheads are way lighter than competitors.

It all translates into cost of customer acquisition being lower and a higher lifetime value because of the higher frequency accounts that they have with customers.

You could almost say that in this particular industry, it’s a game of who can outdo one another in customer acquisition unit cost.

Beating on cost is a must because Uber has all these unprofitable businesses and when it comes down to it, they are a glorified delivery driving service.

They must acquire to scale out because that’s the only hope they have to become profitable by wielding the economies of scale advantage.

Uber’s Grocery division is off to a great start internationally and at home in the U.S., Instacart is a strong competitor.

So I do believe they face a steep uphill climb to get anywhere near Instacart who has had skin in the game forever.

But when we get into the weeds, Uber’s short-term direction will clearly be driven by the supply of drivers or the lack of them for a reasonable price.

In July, new driver additions on Uber in the U.S. grew 30% month-over-month. That's right, 30% month-over-month even as they pulled back on incentives and improved margins. As investments taper, Uber expect mobility to show strong leverage in the back half.

Management tried to gloss up results but Uber had spent a massive $250m in driver incentive investment in the second quarter, which increased losses at its ride-hail business.

I mentioned at the top that Uber’s model is about low-quality tech married with scale, thus, there’s no way to justify spending $250m in one quarter to find drivers.

The dearth of drivers came about because of incremental government stimulus, lack of child care services, unemployment subsidies, even preventative virus concerns, or simply some drivers just died of corona.

Not only is data the oil for Uber, but in that oil, one massively important input is the cost of acquiring drivers.

For management to be so behind the curve on this one shows a degree of unpreparedness.

Granted, it’s been quite difficult for any tech management to get a hold of the new tech trends post-pandemic, but that’s what they are paid to do.

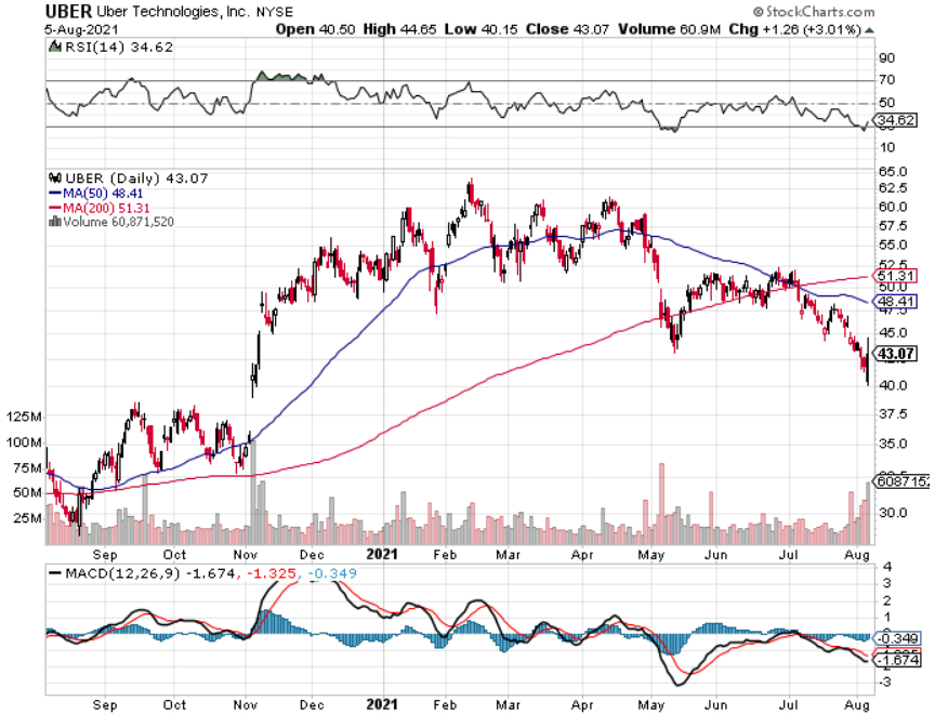

Shares of Uber have tanked around 30% since mid-February this year speaking volumes to management lack of execution in supplying the volume of drivers.

I know it’s not a simple one-day smash and grab to get drivers.

We are talking about marketing, onboard costs, background checks, vaccinations, promotions, registration process and education.

This isn’t all free.

I would hope that as we approach 2022, those costs become less of a burden.

But it does go to show that for Uber, the honeymoon period is long gone and even the low-hanging fruit area doesn’t exist anymore.

We seem to have entered a phase of chronic underperformance met with a finite period of overperformance the only to shift backwards again and repeat the same cycle over again.

As we look at the rest of 2021, the driver acquisition marketplace is unhealthy and wait times are up big causing surge pricing to make Uber a pricy service.

I don’t see that moving significantly down by end of 2021, but this specific headwind will moderate which is good for the stock.

A little bit more regionally, a bunch of cities, southern cities are actually back to normal and it’s about putting dollars in front of drivers and the top 20 cities, drivers for mobility are making over $40 an active hour, including just earnings and tips as well.

I will tell you - this company has no chance to become profitable if they are doling out a median wage of $40 per hour.

It’s a fool’s game.

Even if you want to get “leaner”, I don’t see where the cost savings will come from unless they want to gut the corporate staff or cut back on the technology.

That’s not to say they will even be able to retain drivers who might get better offers in different industries and never consider driving an Uber again.

I mean honestly, being an Uber driver isn’t exactly a desirable job for most people unless you have no skills or no better options.

Everyone wants to work at home from a desk and computer where they can brew their own coffee and not commute. Being a driver is a job where you are in perpetual commute!

And if less skilled workers are being paid to stay home with an eviction moratorium so they don’t have to pay rent or a mortgage forbearance, so they don’t need to leave home, then it’s gotten so bad that Uber is paying $40 per hour to move the needle.

Regional cities have recovered but driver supply problem is acute in major cities like New York, San Francisco and L.A. with demand continuing to outplay supply and prices and wait times remain above comfort levels.

When this happens, customers stop using your service and for a company that relies on high volume, it couldn’t be more than terrible.

It means Uber doesn’t get paid when people are clamoring for their service.

I just don’t see Uber going into other markets and burning more cash to stay relevant because they are too mature of a company.

They are running out of gunpowder in 2021 and will expect to pump out the profits soon.

To profit means outperformance and Uber hasn’t delivered more than the dead cat bounce of the economy reopening which is a little pitiful.

I made a bullish call earlier this year which was correct at the time but then Uber hit a wall at $65 and has come back down with vengeance.

I can say that at $43 today, the stock will rise if Uber’s management can trim the $40 per hour they are paying drivers today while increasing driver headcount by 30% quarter over quarter.

I believe Uber’s management will be successful at bringing down driver costs.

It’s easy to see how they go down from here, and I do believe that the bad news is priced into Uber shares, and that many of these headwinds were transitory and the outlook will improve moving into 2022.

Even though I forecast the stock going up in the short to midterm, I still believe at some point, the company will need to come to terms with having no cutting-edge technology and no moat around its business model.

That issue has been lying dormant but that doesn’t mean it has gone away.

Just think about it, if Amazon or Google wanted to do what Uber does, they could figure it out in months, but they don’t see any value in this profit model.

Uber is definitely on the clock and that’s not a good thing for their management.