Updating the Mad Hedge Long Term Model Portfolio

I rarely make changes to the Mad Hedge Long Term Model Investment Portfolio.

This is my shot at recommending portfolios of assets and individual stocks that investors never have to touch. You just put your money in, and don’t cash in until you hit your retirement age of 65 or 70.

After all, changes in the drivers of our $22 trillion economy rarely occur. Trends usually last for decades.

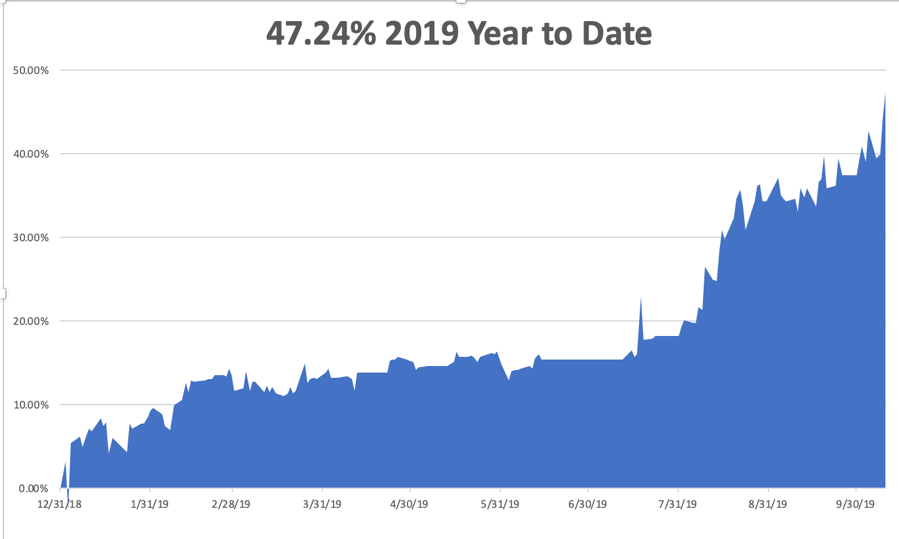

However, this year is completely different. The rate of change in the drivers of our economy is changing so fast that the whole idea of “long term” is becoming a distant relic. Not to update my portfolio would have been irresponsible.

So please find the new Mad Hedge Long Term Model Portfolio by clicking here. You must be logged into your account to gain access. There you can download an Excel spreadsheet containing the entire portfolio.

Here are my comments on the changes.

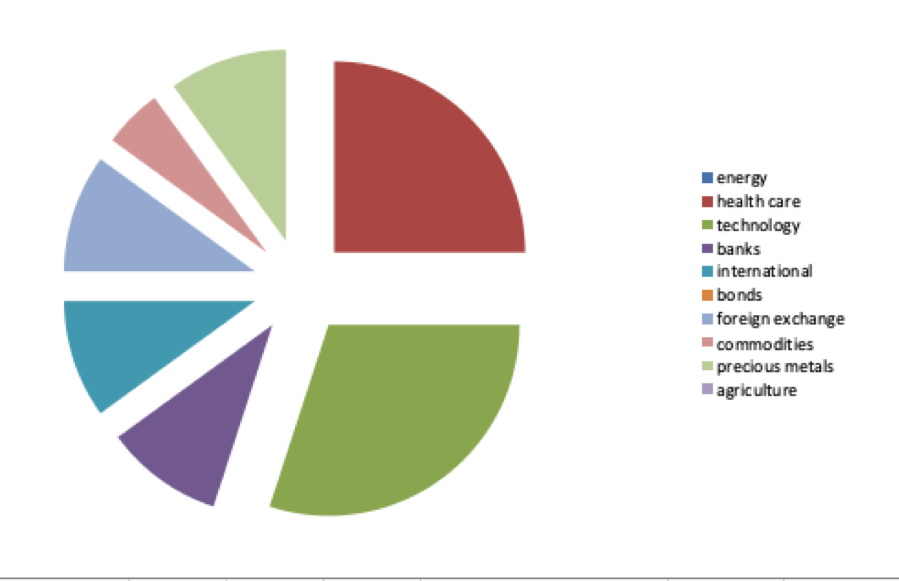

I have taken my energy weighting (USO) from 10% to zero. With falling demand and rising supply from fracking and alternatives, it is hard to see that any investment in the area will do well. When Saudi Arabia wants to get out of the oil business, as it was with its ARAMCO IPO, so do you. Eventually energy prices will approach near zero.

I am increasing my allocation to biotech healthcare (XLV) from 20% to 25%, which I believe will become one of the two dominant sectors of the 2020s. Scientific advancement is accelerating on all front, creating enormous profit opportunities. This is why I launched the Mad Hedge Biotech and Healthcare letter.

I am also increasing my weighting in technology from 25% to 30% as their share of the global economy expands significantly. I am changing the mix here, taking our holding in legacy IBM (IBM) and adding PayPal (PYPL) and Square (SQ), betting on the future of fintech.

I am maintaining my share of banks at 10%, betting on an eventual resurgence in interest rates and the growth of the US economy. JP Morgan Chase (JPM) and Bank of America (BAC) are looking good and are selling below book value.

I am keeping my international exposure at a low 10%. But I am doing a substitution, dumping Europe and adding the iShares MSCI Emerging Markets ETF. (EEM) has been down for so long that it has essentially already discounted the next recession.

As for bonds, I am cutting my allocation from 10% to zero. With a ten-year US Treasury bond yield at 1.72%, the risk/reward for this entire asset class on a long-term basis is terrible. Adding $1.5 trillion in new debt every year will come back to haunt this market.

I am cutting my short position into the foreign exchange market from 20% and flipping to a long of 10%. As long as the US has the world’s highest major currency interest rates, the downside will be limited. However, the end of the Brexit saga will also be hugely Euro positive.

Regarding commodities, I am keeping my 5% holding in Freeport McMoRan (FCX), which has already fully discounted the next recession. You need to have some cash in areas that will explode coming out the other side of the next short recession, and this is one of them.

I am also reentering the gold market on the long side with a 10% weighting. Gold (GLD) is a hedge against the next recession and is also a play on China moving a major portion of its reserves out of US Treasuries and into precious metals.

Staying out of agriculture completely has been one of the smartest things I have done in recent years. I have even stopped covering it in my newsletters. It has been a major trade war victim as I expected. But it is also suffering from hyper-accelerating technology, which is delivering ever large amounts of crops at very lower prices. Here zero stays zero.

So, that’s it. Make your reallocations and go back to sleep. I’ll wake you up at the end of 2020.

Energy - 0%

Healthcare - 25%

Technology - 30%

Banks - 10%

International - 10%

Bonds - 0%

Foreign Exchange - 10%

Commodities - 5%

Precious Metals - 10%

Agriculture - 0%

Total - 100%