Walmart Is The New Tech Unicorn

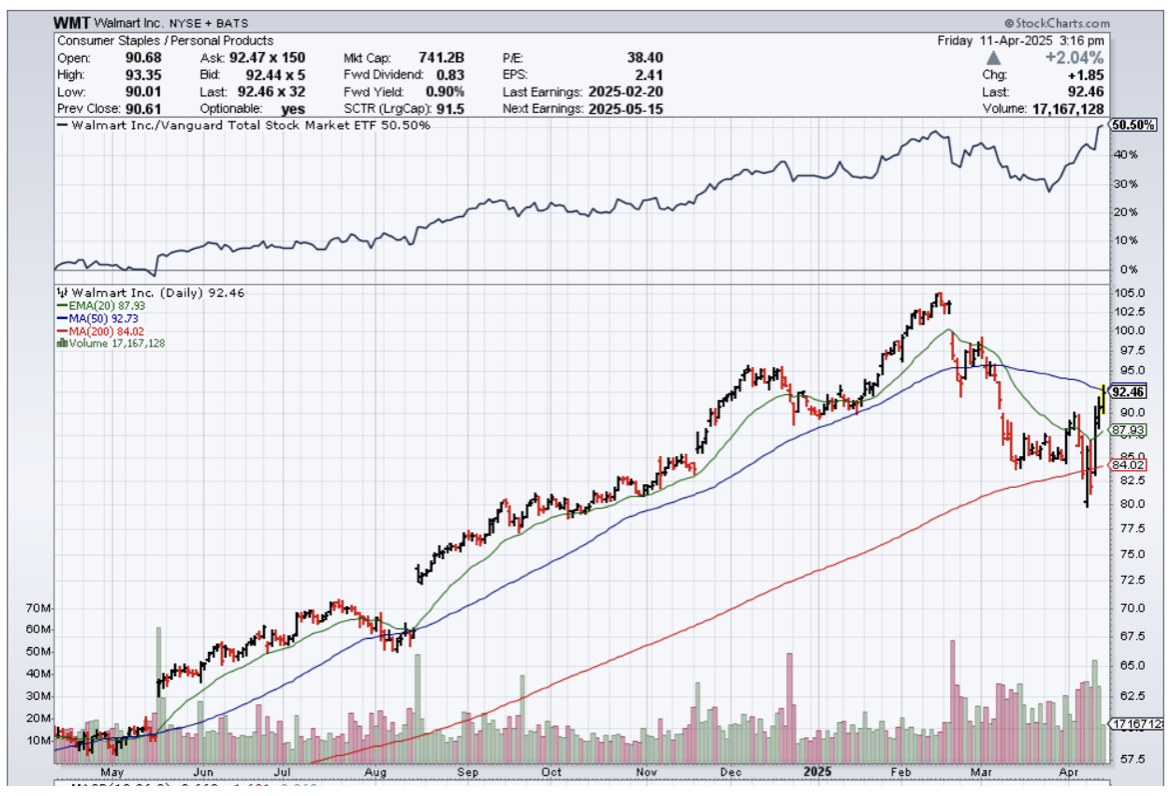

Walmart’s (WMT) shares are up year to date and that is quite an achievement in the stock trading environment we are in.

This company is pretty much an e-commerce company in 2025, and its future is bright.

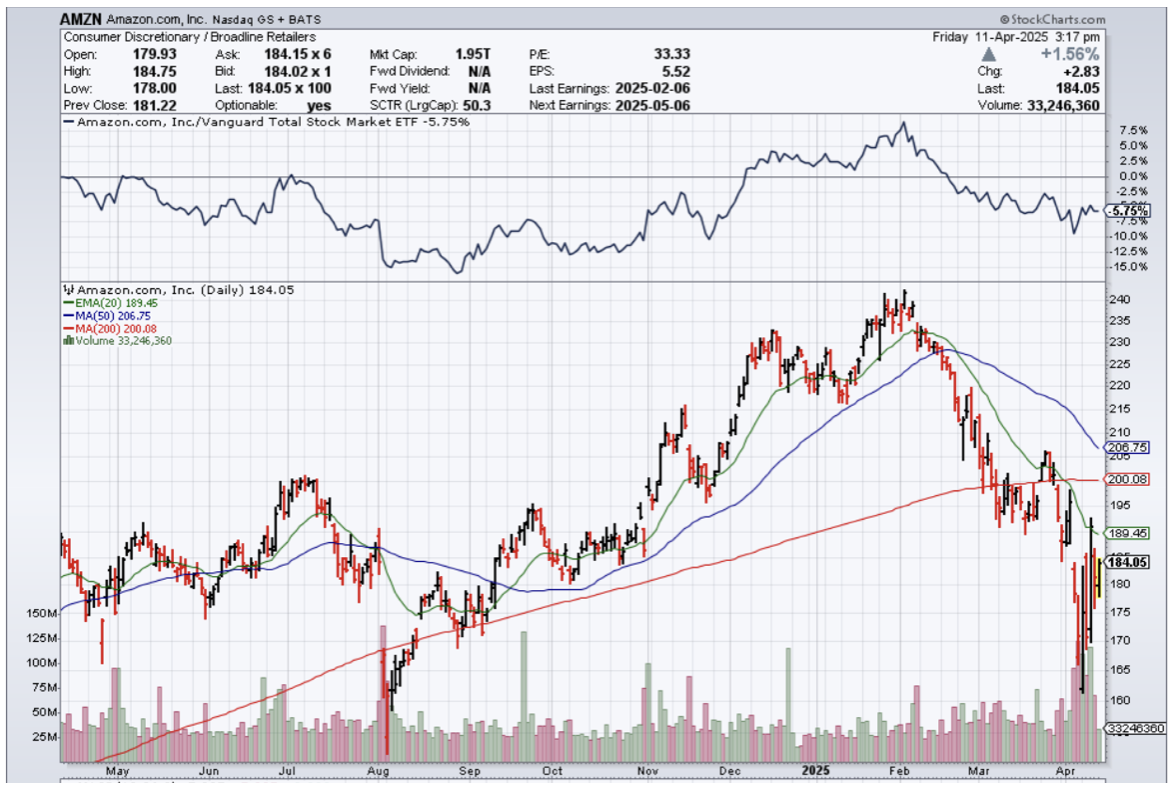

Walmart isn’t a traditional tech company, but it is turning into the closest competitor to Amazon.com (AMZN).

The company from Arkansas has pivoted hard to the e-commerce side of business pumping billions into developing its infrastructure.

Like many CEOs, management has understood for quite some time that the future is e-commerce and the delivery of products to people’s homes.

Walmart’s management saw this trend early and pounced on it and at one point during this year during the Trump rally, shares of WMT were up 60%.

That meant it was on track to have its best year since 1999 because the market came crashing down to reality. Back then, the retailer was building a bunch of superstores and making a bigger name for itself in Canada and Mexico.

Roughly 60% of Walmart’s business is groceries and consumers have relied on WMT to deliver competitive pricing during a high inflation environment. It’s improved its delivery and curbside pickup services, and that’s made it an attractive option.

WMT quickly has evolved into a digital package of services that is a worthy rival to Amazon.

The website, the app, and the annual membership have brought in new customers.

WMT has attracted the $100,000 per year household which they never did before and they will continue to deliver earnings to WMT as inflation and interest rates stay sky high.

Walmart has created an artificial intelligence (AI) agent for its merchants called Wally to help “get to the root cause of issues related to things like out of stocks or overstocks with more accuracy and speed.”

Walmart expanded its store-fulfilled delivery to reach 93% of U.S. households with same-day delivery, its chief financial officer said.

Sam’s Club ecommerce sales grew 24%, including triple-digit growth in club-fulfilled delivery.

Walmart Inc. announced 16% growth in its global online sales for its fiscal Q4 2025, which ended Jan. 31, 2025.

That’s about four times faster than the retailer’s overall Q4 revenue growth rate. Meanwhile, although Walmart didn’t specify its year-over-year ecommerce growth for the full 12-month period, Walmart said it grew revenue in that time frame.

Walmart’s fiscal 2025 marked the 10th consecutive year in which it grew its total annual revenue. Moreover, it has only had one year-over-year annual decrease — in 2016 — since at least its fiscal 2009.

Although, the recent short-term price action has been brutal to say the least, once all the bad news is priced into the stock, I do see the stock rallying to the upside.

Meanwhile, WMT becomes more and more like a tech company and pushes competitors like Amazon to raise its level of services to customers.

In the crush of higher inflation, WMT has delivered value to a higher income bracket in the United States and I believe that will continue as we me further into 2025 and 2026.

In the next few years, we will also see $200,000 per year salaried consumers grace the aisles and digital services of WMT to the benefits of the underlying stock.