Watch Out for Bears!

I just got off the phone with a hedge fund veteran who I have long known and respected. He showered me with 27 reasons why stocks were peaking out and were about to crash.

I told him he was right on every point, but that these were all arguments that future historians will put forward giving the origins of a bear market that started years before.

Right now there is only one bit of analysis that counts for traders and that is the amount of cash in the system, and that indicator is screaming “BUY.”

There is $50 trillion is excess liquidity sitting in cash accounts around the world looking for a home. With both Europe and Japan still in the quantitative easing business that number is expanding.

And what is the primary target of all this money? U.S. stocks, particularly technology ones.

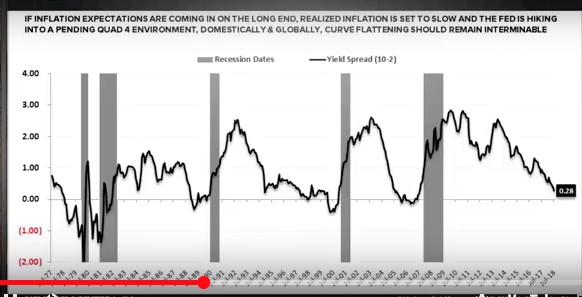

In fact, I have been recently showered with charts, reports, and even tea leaves showing that stock markets are ridiculously high and headed for a fall. Look at the chart below showing the yield curve for the bond market and it shows that whenever it inverts, recessions and bear markets follow in every single case!

Warning: Yield curves are only months away from inverting.

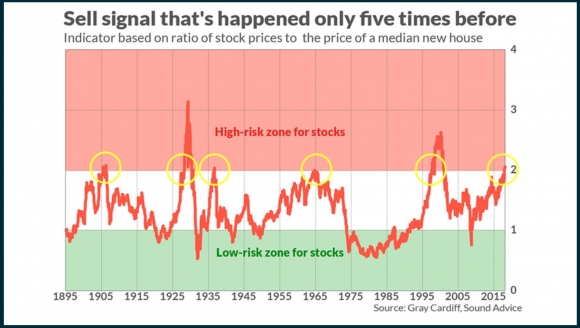

There is another chart below a friend sent in illustrating the ratio of stock prices to home prices for the past 123 years. It is now approaching a peak seen only three times over the past century.

And it’s not like home prices have been sitting stationary either. The price for your personal residence has been rocketing as well, no matter where you live.

However, this chart shows something far more important. Market tops aren’t one-off events. They can take five or more years to play out. And we have just entered one of those long-term topping processes now.

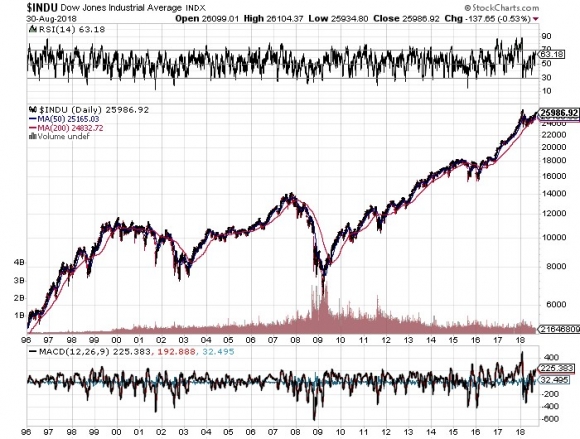

Roll back the video tape. Remember our old friend, Federal Reserve governor Alan Greenspan? He uttered his “irrational exuberance” prediction for the stock market in 1996.

The Dow Average ($INDU) rose for four more years, nearly doubling in the process. Portfolio managers who followed his sage advice were later seen driving taxis in Manhattan.

So, while markets may be topping, this action could continue for quite some time, possibly well into the next decade. Therefore, don’t let news like we received today about the president imposing tariffs on $200 billion worth of Chinese imports scare you out of the market.

And I say this in full knowledge that September and October are usually the worst-performing months of the year. The six months after a midterm election are usually the best, always.