Welcome to Nosebleed Territory

When climbing peaks in the Alps, the High Sierras, or the Himalayas, you know you?re getting close to the top when the air becomes thin, it is difficult to breathe, and your nose suddenly starts to bleed. I remember trying to smoke a cigarette at 20,000 feet on Mount Everest. If you didn?t keep puffing it went out immediately because of the lack of oxygen.

I am starting to suffer from a similar woozy feeling from the US stock markets. I have long since quit smoking, but the higher the indexes go, the more light headed I feel.

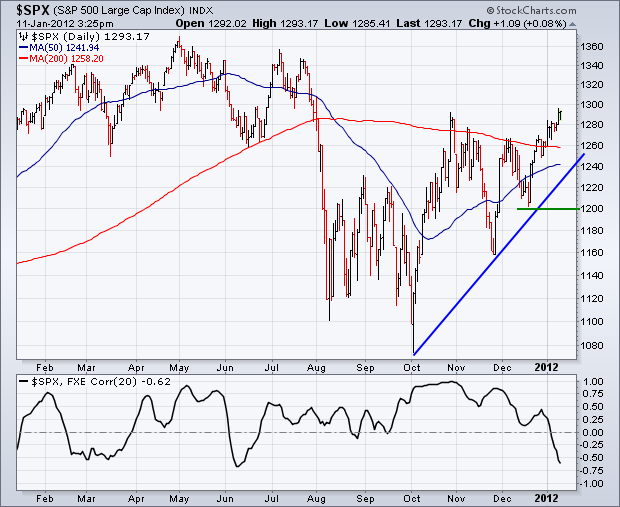

Take a look at the chart below produced last Friday by my friends at StockCharts.com. It shows the NYSE advance-decline ratio smoothed by a five day moving average. We have since blasted through to a new high for the year. The last time we were this high in July, the S&P 500 commenced a 23% swan dive down to 1068.

If you failed to protect yourself from this gut churning plunge, there is a good chance your clients fired you at the end of last year and you are now trolling through Craigslist looking for new employment opportunities. If you did follow the advice of this letter at the time, you sold short the S&P 500, the Russell 2000, gold, the Euro, and the Swiss franc. That enabled you to make a bundle, and your clients are now showering new money upon you.

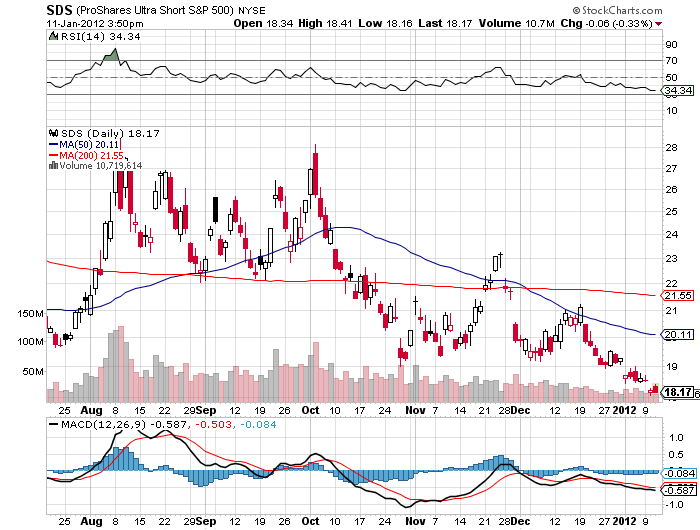

I was hoping a sweet spot would set up that would allow me to pick up some meaty short positions, like the leveraged short (SDS) and put options, once a squeeze took us up to 1,350 in the S&P 500. Looking at the slow, low volume grind we are getting, I may not get my wish. Instead, we may get a choppy, rolling type top at a lower level that frustrates the hell out of everyone. We could top out as low as 1,312 instead. Every hedge fund trader I know is just sitting on his hands waiting for a decent entry point to present itself.

Aggressive traders may start scaling in short positions from here in small pieces. Until then, discretion is the better part of valor. Only buy here if your clients have a long term view, a very long term view.

Mount Everest 1976

Is It Time to Sell Yet?