Welcome to the Deflationary Century

Ignore the lessons of history, and the cost to your portfolio will be great. Especially if you are a bond trader!

Meet deflation, upfront and ugly.

If you look at a chart for data from the United States consumer prices are rising at an annual 3.2% rate. The long-term average is 3.0%.

This is above the Federal Reserve’s own 2.0% annual inflation target, with most of the recent gains coming from housing costs.

We are not just having a deflationary year or decade. We may be having a deflationary century.

If so, it will not be the first one.

The 19th century saw continuously falling prices as well. Read the financial history of the United States, and it is beset with continuous stock market crashes, economic crises, and liquidity shortages.

The union movement sprung largely from the need to put a break on falling wages created by perennial labor oversupply and sub-living wages.

Enjoy riding the New York subway? Workers paid 10 cents an hour built it 125 years ago. It couldn’t be constructed today, as other more modern cities have discovered. The cost would be wildly prohibitive. Look no further than the California Bullet Train, now expected to cost $100 billion. A second transbay tube in San Francisco will cost $29 billion.

The causes of the 19th-century price collapse were easy to discern. A technology boom sparked an industrial revolution that reduced the labor content of end products by ten to a hundredfold.

Instead of employing 100 women for a day to make 100 spools of thread, a single man operating a machine could do the job in an hour.

The dramatic productivity gains swept through the developing economies like a hurricane. The jump from steam to electric power during the last quarter of the century took manufacturing gains a quantum leap forward.

If any of this sounds familiar, it is because we are now seeing a repeat of the exact same impact of accelerating technology. Machines and software are replacing human workers faster than their ability to retrain for new professions. If you want to order a Big Mac at McDonald’s these days, you need a PhD in Computer Science from MIT. The new stores have no humans to take orders.

This is why there has been no net gain in middle-class wages for the past 40 years. That is until the pandemic hit which created labor shortages that are still working their way out. It is the cause of the structurally high U-6 “discouraged workers” employment rate, as well as the millions of millennials still living in their parent’s basements.

To the above add the huge advances now being made in healthcare, biotechnology, genetic engineering, DNA-based computing, and big data solutions to problems. Did anyone say “AI”?

If all the major diseases in the world were wiped out, a probability within 10 years, how many healthcare jobs would that destroy?

Probably tens of millions.

So the deflation that we have been suffering in recent years isn’t likely to end any time soon. In fact, it is just getting started.

Why am I interested in this issue? Of course, I always enjoy analyzing and predicting the far future, using the unfolding of the last half-century as my guide. Then I have to live long enough to see if I’m right.

I did nail the rise of eight-track tapes over six-track ones, the victory of VHS over Betamax, the ascendance of Microsoft (MSFT) operating systems over OS2, and then the conquest of Apple (AAPL) over Motorola. So, I have a pretty good track record on this front.

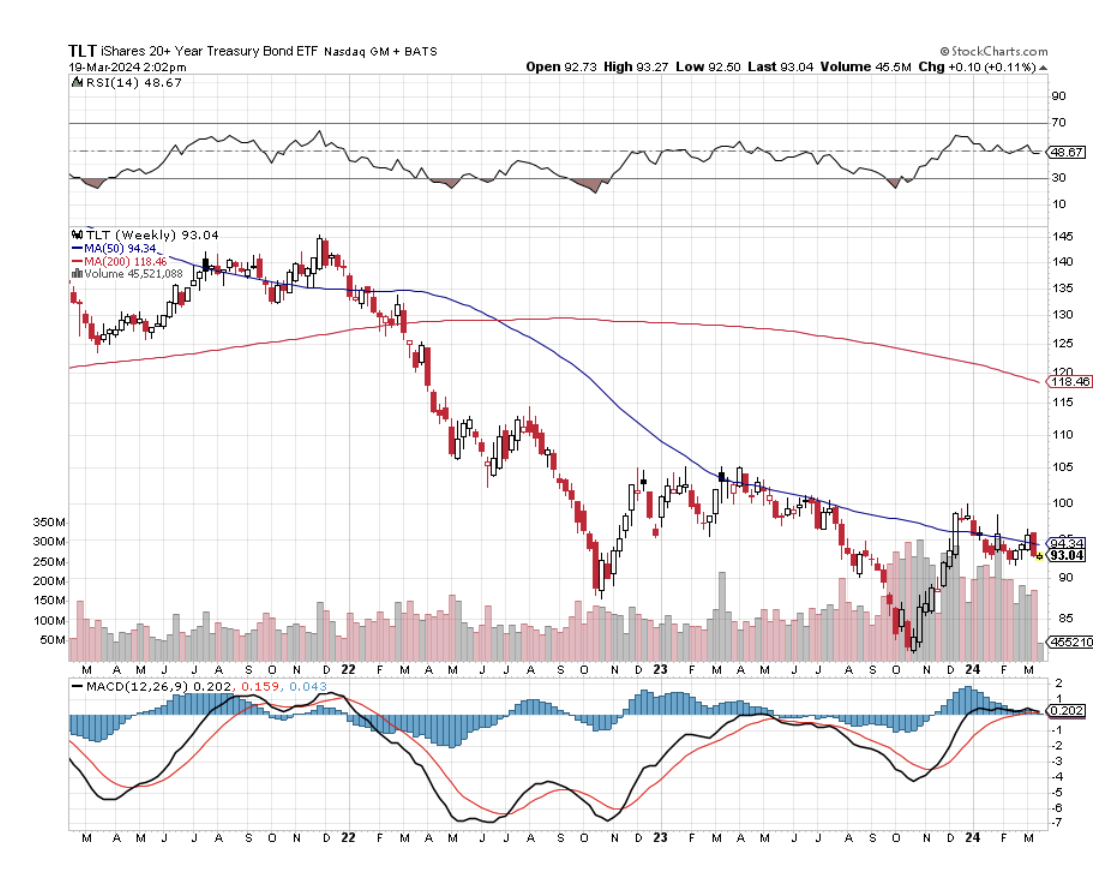

For bond traders especially, there are far-reaching consequences of a deflationary century. It means that there will be no bond market crash, as many are predicting, just a slow grind up in long-term bond prices instead.

Amazingly, the top in rates in this cycle only reaches the bottom of past cycles at 5.49% for ten-year Treasury bonds (TLT), (TBT).

The soonest that we could possibly see real wage rises will be when a generational demographic labor shortage kicks in during the late 2020s.

I say this not as a casual observer, but as a trader who is constantly active in an entire range of debt instruments.

I just thought you’d like to know.

Hey, Have You Heard About John Deere?