What the Downgrade Means for Tech

Fitch Ratings’ decision to strip the US of its AAA credit ranking to AA+ sets the stage for inflation to come roaring back, and tech stocks to underperform in the short term.

Why?

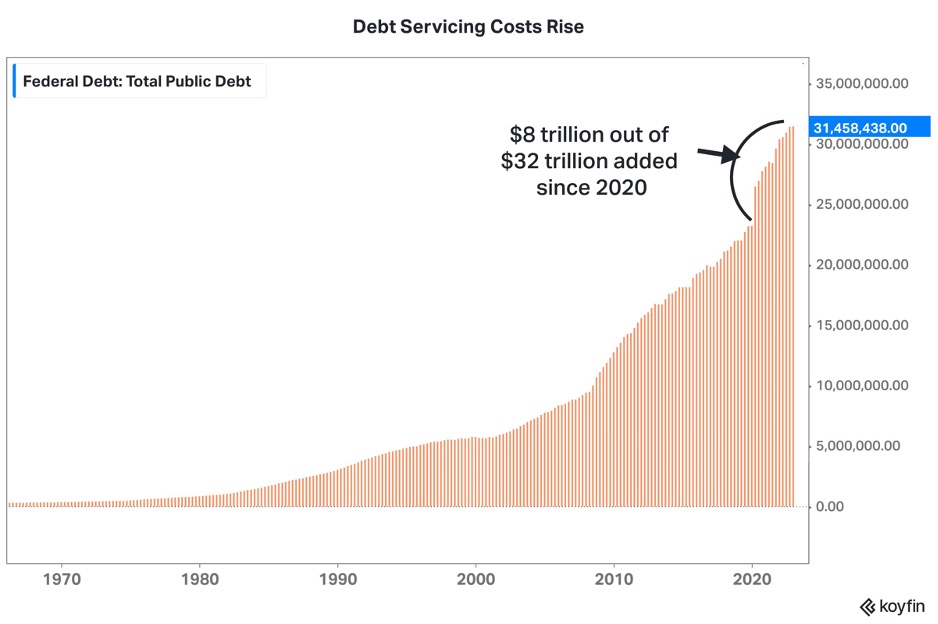

The downgrade risks bond yields blowing out, which in turn will potentially cause the U.S.’s interest payments on the debt to shift substantially higher.

That is exactly what investors don’t want to hear, in particular concerning technology stocks.

Tech stocks, along with U.S. housing prices, are most susceptible and sensitive to interest rate shocks and this could be a doozy.

The smaller the tech company is, the more reliant they are on initial debt funding to develop the company.

Big tech will be more insulated from this chaos because they are the equivalent of the reams of home buyers that purchased homes at a sub-3% interest rate that is fixed for 30 years.

As long as revenue is growing okay-ish, big tech will be fine, and the latest earnings reports have proved that with big tech’s unimpressive single-digit growth.

It’s nothing special but good enough for the times.

The booming federal deficits are the heart of the bear case for Treasuries and, even more poignant, the massive federal mismanagement of the country, no matter which political party has been in charge.

Take for instance, over 20 years and 3 presidents, a certain country would spend over $10 trillion in Afghanistan and the result is replacing the Taliban with the Taliban.

Many would say that wad of federal money probably wasn’t worth the paltry result.

Now, what we finally have is a real-life example of the consequences of government underperformance.

The U.S. economy is the most vibrant, productive, and profitable economy in the world.

Free market capitalism has catapulted the U.S. to build the largest and most successful tech industry in the world that is the envy of the rich world.

Now, exploding bond yields move to the fore as the largest risk for technology stocks.

The downgrade also means that Fed Chair Jerome Powell and the Central Bank will have a harder time pivoting when they want to because yields could spike and could have another dose of inflation to fight against.

The downgrade could invite a horde of algo traders and hedge fund pros to pile into the short-bond trade because where there is smoke, there is fire.

In the short term, don’t expect the 30-year US treasury yield to hit 10% which was the case in 1987.

However, a turn for the ugly and yields surpassing last year’s 4.35% is just in sign after this last melt up.

The stage could be set for the 30-year to reset at higher increments between 5%-6% with no relief in sight.

This sort of level is highly prohibitive to tech stocks in the short term, therefore, I would believe a repricing would need to take place to balance itself out.

In all honestly, tech needs a break and this appears as if it is the trigger to cool down tech stocks which have been on a pulsating trend to the upside in 2023.

Ultimately, I would describe the downgrade as inevitable. The rising (and accelerating) deficit begs the question of fiscal amateurism.

Congress has been behaving as if unlimited dollar binge spending has no consequence.

Furthermore, we can kiss smaller tech companies tapping the debt market goodbye.

Conditions keep tightening in tech and it’s becoming harder to thread the needle for the unknown quantity.

I would stick with investments in known quantities with strong balance sheets, as they will perform better in a spiking bond yield scenario.

Reload the ammo to buy the dip on those guys.

U.S. Congress is now on call to reign in the massive fiscal deficits or face yet another downgrade and even higher interest payments on federal bonds.

That would be materially negative for tech stocks in the medium term.