What Will Dropping Inflation Do To Tech Stocks?

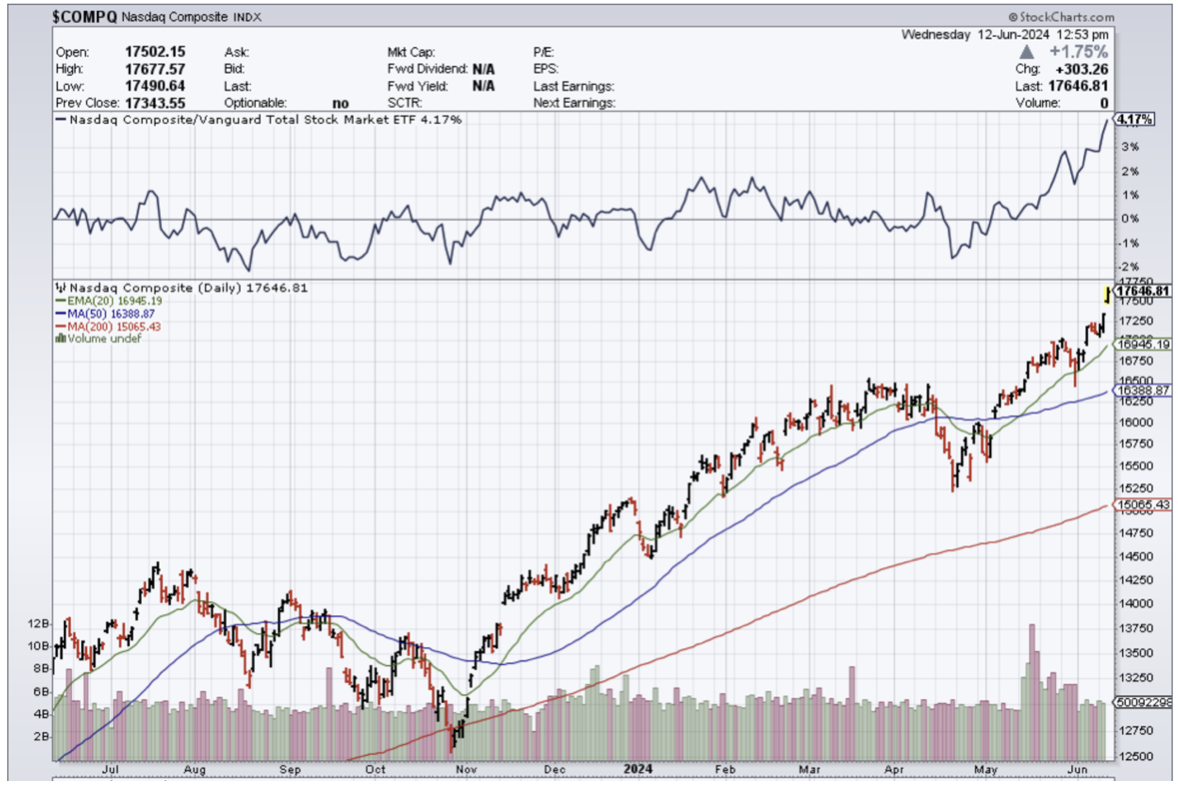

It’s “all systems go” for tech stocks ($COMPQ) as the latest inflation report offers us juicy morsels of data laying out a more attractive backdrop for tech companies in the short term.

The Mad Hedge Tech portfolio has benefited from this “bet on the Fed pivot” trend to great effect and I took profits on my Micron June bull call spread.

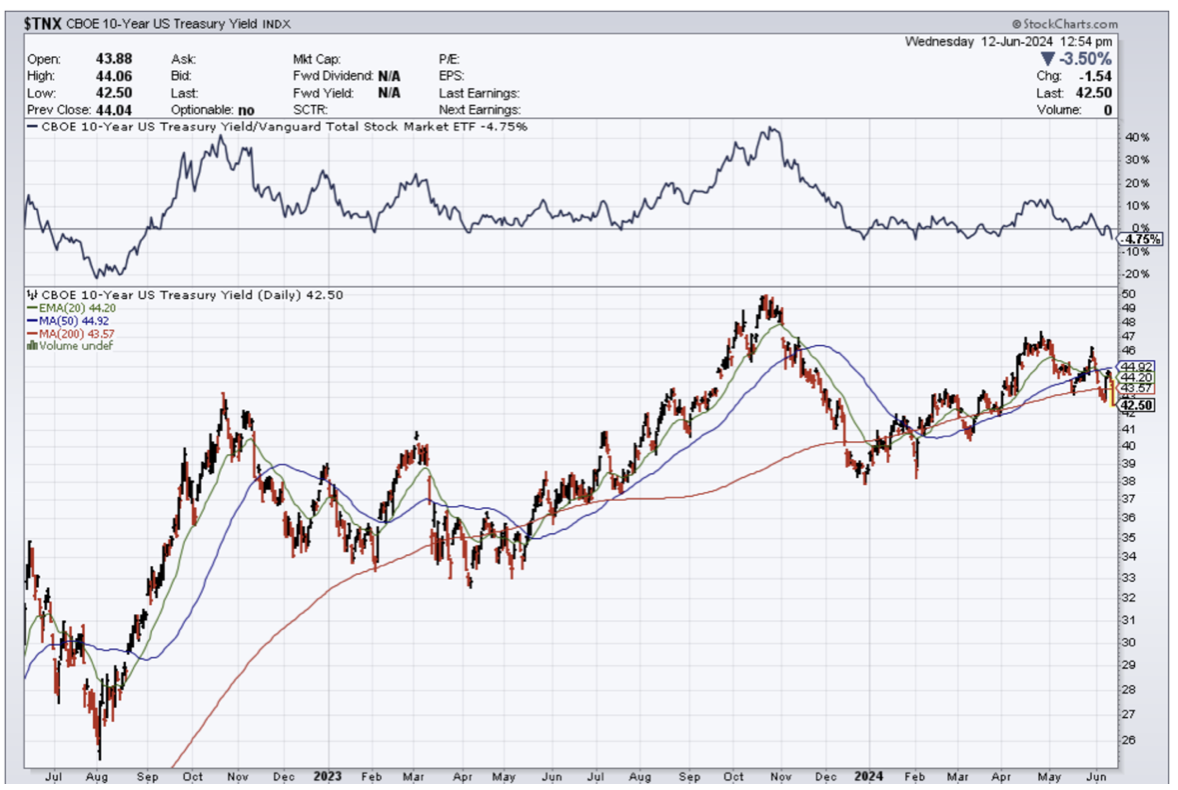

Remember that short-term rates ($TNX) are the most important variable to whether certain stocks go up and down in the short term.

Long term, the story could be very much different.

A higher-than-consensus report would have resulted in a red day for tech stocks, a pullback of commodities, bond yields spiking, and the dollar launching into the orbit.

We got the inverse of that and this is a strong signal that tech stocks will be like a stallion bolting out the back of the stable because tech stocks are the biggest winners of a lower rate environment.

The Consumer Price Index (CPI) remained flat over the previous month and rose 3.3% over the prior year in May — a deceleration from April's 0.3% month-over-month increase and 3.4% annual gain in prices.

Inflation has remained stubbornly above the Federal Reserve's 2% target on an annual basis.

Fed officials have categorized the path down to 2% as "bumpy," while other recent economic data has fueled the Fed's higher-for-longer narrative on the path of interest rates.

On Friday, the Bureau of Labor Statistics showed the labor market added 272,000 nonfarm payroll jobs last month, significantly more additions than the 180,000 expected by economists. Wages also came in ahead of estimates at 4.1%, although the unemployment rate rose slightly to 4% from 3.9%.

Notably, the Fed's preferred inflation gauge, the so-called core PCE price index, has remained particularly high. The year-over-year change in core PCE, closely watched by the Fed, held steady at 2.8% for the month of April, matching March.

The Fed has been unbelievably late in controlling inflation, but that market doesn’t care and tech stocks care less as the AI narrative has been able to supersede anything and everything.

The market is controlled and dictated to by a bunch of algorithms.

Food up 2% after a double is in fact a “victory” to the algorithms even if the middle class in the United States has felt the heavy brunt of it.

It is probably accurate to say that tech stocks are in a world of their own and the price action certainly behaves as if this is the case.

What does this all mean?

Get ready for higher-tech share prices.

Lower rates will help emerging tech companies tap the debt market to fund operations.

Many smaller tech firms don’t have the privilege to tap a multi-trillion dollar balance sheet for cash whenever they want.

In the short-term, except the AI stocks to gap up yet another leg as the market prices at lower rates for companies that hardly need it.

Talk about having your cake and eating it too – this would be it!

For the best of the rest, it helps but won’t move the needle in terms of catching up to big tech, but this should stimulate the investors on the sidelines nudging them to handpick certain stocks that have been ignored during the time of high rates.

Either way, the Fed has really put itself in a box here and without even killing inflation to the 2% mandate.

The markets fully expect the Fed to cut once or twice by the end of the year.

Whether this decision is political or not, the new developments have put a floor under many high-quality tech names.

Consequently, the second half of the year should see some ample returns in tech stocks that preside over good business models.