What?s up with BYD?

When I first bought shares in the Chinese electric car manufacturer, BYD (BYDDF) (or Build Your Dreams) in 2009 on the heels of Warren Buffet?s 10% investment, it looked like a total home run. The stock soared from $1.50 to $11, given me a paper return of 730%.

Undercover, I Totally Blend

Last year, the stock started to roll over, retracing all the way back to my cost. I called the company?s Los Angeles office, but the line was disconnected. I tried the New York office, but my call was never returned. An email I sent their headquarters in Shenzhen, China went unanswered. I even had a friend in the Chinese government make some inquires, and he told me the company wasn?t seeing anyone.

That?s it! Off with the gloves. No more Mr. nice guy. I did what I usually do when a company I follow won?t talk to me. I fly to their headquarters and break into the facility.

It was easier than you think. I simply pulled up to the main gate in Northern Shenzhen and told security that I was a friend of Mr. Buffet and was there to see Mr. Li. They waved me through and went scurrying to find the appropriate Mr. Li. I knew full well that in a company of 100,000, at least 10,000 had to be named Mr. Li, and by the time they figured out that there was no Mr. Li, I would be long gone. It worked like a charm.

This Could Be Your Next Car

At this point, my editor is saying, ?You did what!?? Indeed, my staff worries about my antics from time to time, fearing the dole if I fail to return from one of my adventures. But the nine life limitation that cats face doesn?t seem to apply to me, so I just keep on going.

I then set off and roamed the factory floors freely, stopping workers wherever I could and asking about conditions. The great thing about this approach is that the man on the assembly line, in R&D, and the girl in accounting are totally unfamiliar with management?s sanitized view for public consumption, and haven?t been professionally trained to lie. As a result, I was able to get a first class read on the state of the company.

E-Taxis

When I met with the Shenzhen venture capital community in the days before, the rumors were rampant. When founder and CEO, Wang Chuanfu, launched his assault on the global car market three years ago, expectations were high. He promised investors, like Berkshire Hathaway?s Charlie Munger, that BYD would soon become the world?s largest car manufacturer. He ramped up production from 500,000 vehicles to 800,000 in 2010, anticipating a huge demand for the company?s conventional cars and hybrids.

But quality issues persisted, and the resale rate to past BYD car owners fell to zero. Sales peaked at just over 500,000, leaving the company with a huge inventory of unsold vehicles. Profits collapsed. Mercedes was brought in to provide technical assistance, but has so far been unable to improve sales. Was BYD going under? Was Warren Buffet pulling his investment? Speculation was rife.

One salesman told me that the information blackout was ordered not due to any financial problems, but because the company was releasing its new, all electric Model E6 the following week. This car is much larger than other electric cars, gets an amazing 186 miles per charge, and will be offered for sale for $39,000 after government incentives.

If true, this would be a revolutionary, highly disruptive advance. BYD plan to export the car to the US as soon as possible. It has already been test driving a fleet of ?E-Taxis? on the streets of Shenzhen for the past 18 months, with much success. If the company cans delivery on the vehicle, Wang Chuanfu might realize his ambitious goals after all.

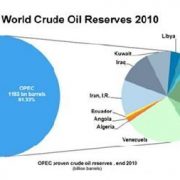

China currently subsidizes energy prices, with gasoline available for about $3.50 a gallon, or 10% lower than US prices. That means a smaller cost advantages for alternative car producers. That disadvantage could disappear during the next oil price spike. Government subsidies will also eventually have to disappear because they are too costly.

Finally, after two hours of scouring the grounds, inspecting the physical remains of their crash tests, inspecting the assembly line, and peeking through windows, I was ready to go. There once was a day when I could have been put in front of a firing squad for doing something like this. But the People?s Republic has grown soft in its old age, and I figured that, worst case, I would just get kicked off the grounds. Not, so for my Chinese staff, however, who were sweating bullets and begging me to leave.

So what are investors to take away from this? For a start, you run out and buy tsunami afflicted, beaten down Nissan Motors (NSANY). If BYD can squeeze 186 miles out of its batteries, so can Nissan, and there is already talk that the second generation all-electric Leaf will reach that target. That will eliminate the ?range anxiety? afflicting current owners with their 80 mile limitation.

As for BYD itself, the story is a little more complicated. At this share price, you are essentially getting a world class multinational lithium ion battery company with the car company thrown in for free. If the car division continues to sputter along, you can expect modest appreciation in the shares. But if the E-6 becomes the next big car of the future, the stock could go ballistic and potentially make a new high, delivering investors a multi bagger.

Whoa, That Was Close