Why a US Housing Boom is Imminent

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the pandemic and if they should sell their homes.

They have a lot to protect. Since prices hit rock-bottom in 2011 and foreclosures crested, the national real estate market has risen by 50%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 125%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. The grim tidings are:

*2.9 Million Homes Now in Forbearance, and the number is certainly going to rise from here. Laid off renters are defaulting on payments, depriving owners of meeting debt obligations. It’s just a matter of time before this creates a financial crisis. Avoid the banks for now, no matter how cheap they get.

* Existing Home Sales Collapsed by 15.4%, in March. Realtors expect this figure to drop 40% in the coming months. Open houses are banned, sellers are pulling listings, and buyers low-balling offers. However, price declines in the few deals going through are minimal. When will the zero interest rates come through? Mortgage interest rates are higher now than before the pandemic because 6% of all home loans are now in default.

* Pending Home Sales Down a Staggering 20.8% in March, and off 16.3% YOY. The worst is yet to come. The West, the first into shelter-in-place, was down a monster 26.8%. Prices still aren’t moving because nobody can buy or sell.

*Chinese Buying of West Coast homes has vaporized over trade war fears, and then of the Covid-19 lockdown, which started with a shutdown of all flights from China.

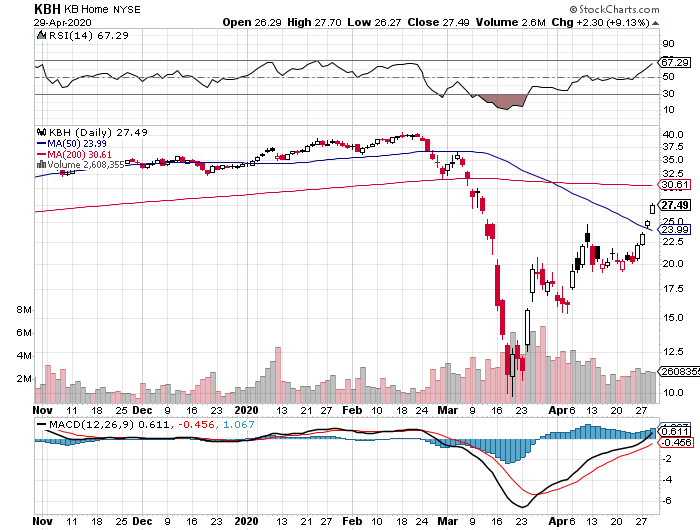

I have a much better indicator of future housing prices than the depressing numbers above. The way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading, I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 100% since the March 23 bottom.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s”. When you are losing 20 million consumers, economies don’t grow very fast. For more about millennial investing habits, please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “millennial” generation trying to buy their assets!

By then we will not have built new homes in appreciable numbers for 14 years and a severe scarcity of housing hits. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past three years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that a future administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

In Your Future?