Why I Doubled My Shorts Yesterday

I did not buy the rally in stocks this week for two seconds.

Once the S&P 500 (SPY) bounced off of the $190 level the first time, it was only a question of how soon to sell again. When I said ?Sell every rally in stocks this year,? I wasn?t kidding.

As it turns out, I caught the absolutely top tick in the (SPY) at $195.

That?s where I quickly bought the (SPY) February $202-$207 vertical bear put debit spread. Within hours, the index cratered an awesome $70 handles, and I was already looking at 70% of the maximum potential profit.

The great luxury of the S&P 500 SPDR?s (SPY) February, 2016 $202-$207 in-the-money vertical bear put spread is that it allows you to cash in on continued extremely elevated levels of the Volatility Index (VIX).

This is why the potential return is so high for a front month options spread already 7 handles, and now 12 handles in-the-money.

In the meantime, I continued to run big shorts in the (SPY) with my February 187 and $190 puts.

This was on the heels of cutting by half my (XIV) position at cost, and taking profits on my (SPY) January $182-$187 vertical bull call debit spread during the rally.

Since yesterday, I have cut the net exposure of my sizeable trading book from 40% to 0%. This is how you do it.

My lack of faith in this market can be measured by the bucket load.

I believe that oil (USO) hasn?t bottomed yet.

All we are seeing here is a round of natural short covering you would expect as the price bounces off the big round number of $30, something which computer driven algorithms love to do.

There are many more visits to the $20 handle for oil to come. Brent is already there.

If you have some magical insight into the price of oil, better than the entire industry combined, and are convinced that Texas tea bottomed yesterday, then you shouldn?t touch the S&P 500 SPDR?s (SPY) February, 2016 $202-$207 in-the-money vertical bear put spread. In that unlikely scenario, stocks rocket from here.

Then there?s China (FXI), whose continued turmoil will bring further US stock losses. I assure you, not even the Chinese know what?s going on in China. They are more like the unfortunate deer that is frozen in the headlights.

If the stock markets of the Middle Kingdom were either up or down 10% tomorrow, I wouldn?t be surprised.

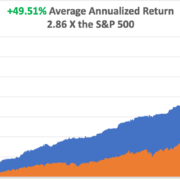

I?m quite happy with the performance of the Trade Alert service so far in 2016.

Here we are only 8 trading days into the New Year and many traders have already blown up, including quite a few trade mentoring newsletters. We should be hauling in some big numbers in January and February.

This is how you trade a crash. Watch and learn. The opportunities are legion.