Why Residential Real Estate Will Not Recover

One of the most frequently asked questions at my recent round of strategy luncheons, seminars, and keynote speaking engagements has been ?Is it time to buy a home?? I responded with ?No, no, a thousand times no,? and proceeded to rail off the countless reasons. My answer always piques listeners? interest, as 67% of Americans are still homeowners, and probably more at these assemblies.

My expectation is that house prices have another 25% to go before we reach a final bottom. Of course, such comments invite truckloads of abuse from the real estate industry, which has been insisting that a recover is just around the corner for at least five years now. For those of you who were unable to attend these events, let me list off everything that will go wrong with real estate over the next two years:

*80 million baby boomers are attempting to sell their homes to 65 million Gen Xer?s who make a lot less money than their parents did. Don?t plan on selling your house to your kids, especially if they are still living rent free in the basement.

*Fannie Mae and Freddie Mac, which are currently refinancing 95% of US home mortgages, are in receivership. Having wiped out their capital in the housing crash, they are unlikely to get refunded by congress. A wholly privatized home loan market is likely to raise borrowing costs by 200 basis points, as it already does in the non-conforming jumbo market.

*Get ready to say goodbye to that home mortgage deduction as part of any budget balancing effort in Washington. This government subsidy, worth $13,000 per homeowner with a mortgage less than $1 million, is costing the government $250 billion in tax revenues annually. Any flat tax proposal does the same thing. How long should renters continue to subsidize homeowners?

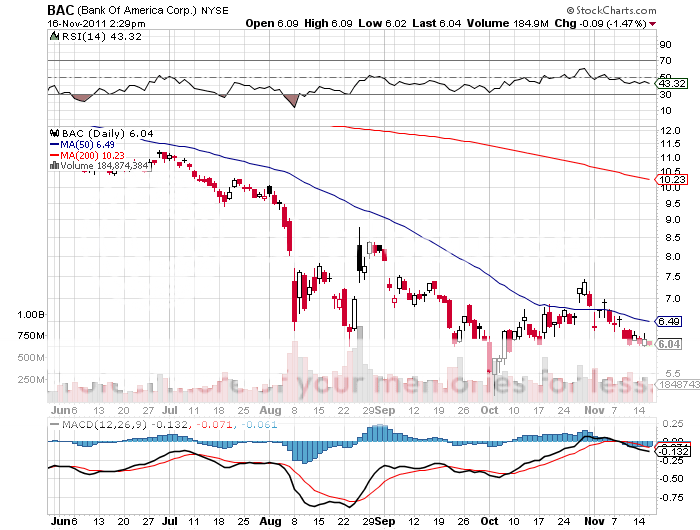

*Ben Bernanke?s ?twist? program has dramatically flattened the positive yield curve, depriving banks of recapitalizing themselves with the shrunken positive carry. This is what bank share prices have been telling us with their horrific performance, with lead stock Bank of America (BAC) plunging from $14 to $5 in just six months. Translation: fewer bank loans for you and I mean lower house prices.

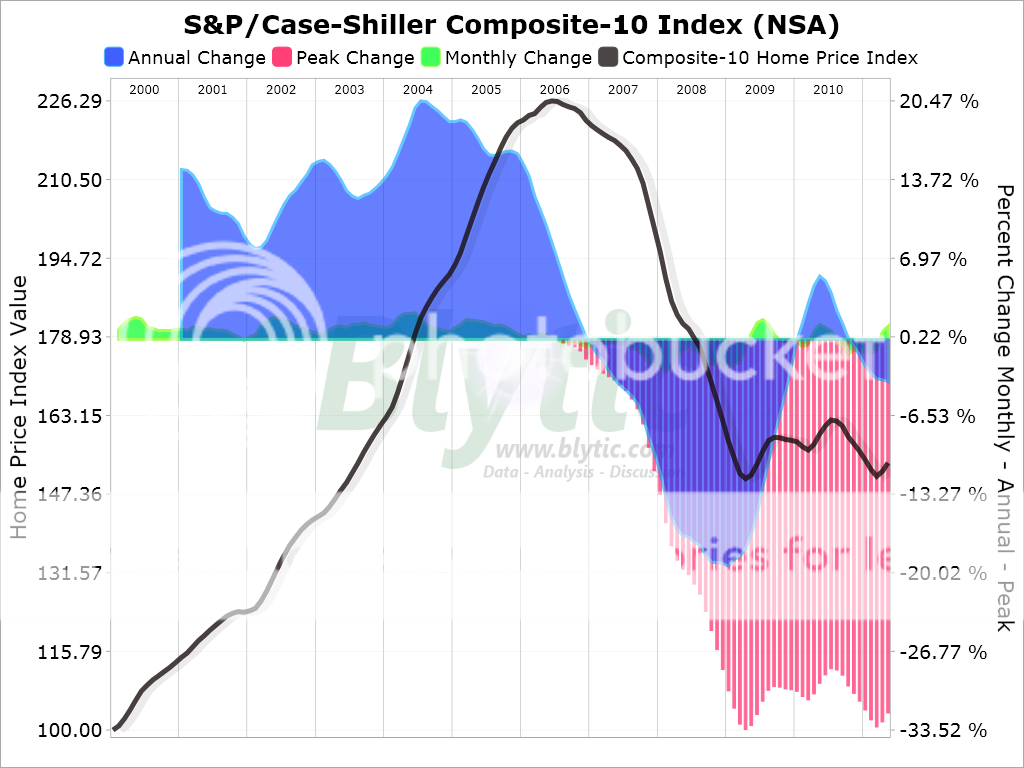

*Look at the chart of September Case-Shiller data below. Despite the greatest real estate stimulus in history, prices have flat lined in for two years. The 30 year mortgage is under 4%, a 60 year low, and affordability is at a 60 year high. Until this year, buyers in California were getting a combined state and federal tax breaks of $18,000 to buy a house. What happens when the stimulus ends?

* According to the Federal Reserve, 35% of US homes have less than 10% equity or negative equity. That means that 50 million homeowners will have nothing left after a sale, including closing costs. We now have negative equity states, like Nevada and Arizona.? People are trapped in their homes, and can?t move to accept new jobs elsewhere.

*To say there is an inventory overhang would be a huge understatement. There are 1 million new homes and 5 million existing homes now on the market. According to Zillow.com, another 10% of homeowners, or 15 million, would sell on any improvement in prices.

*Add up all the above, and of a total market in the US of 150 homes, there are 21 million homes for sale, and 50 million buyers shut out of the market.

*Has anyone heard there might be a recession next year? What little buying that is going on has to dry up. The expanded U-6 unemployment rate, including ?discouraged? workers and those with expired benefits, is likely to soar from the current 16% to 25% to match Great Depression highs.

*After the 1929 stock market crash, home prices took 25 years to recover pre-crash levels. I think that we are seeing a repeat of this phenomenon, with 2006 as the start date. Get ready to cash in on the new bull market in real estate in 2031, when newly enriched Millennials start to join the fray in large numbers.

With all that said, I am still looking for a home to buy. That will most likely occur on a courthouse?s steps, where cash is king. Why not, if I can get the 2020 price today, down 50% from today?s level? Until then, I will happily rent, not buy.

Is This a Sell Signal?