Why the Stock Market Will Peak on May 10, 2019, at 4:00 PM EST

This prediction is not as absurd as it sounds.

There is in fact a logical mathematical path that gets us precisely there.

If there is one question I get asked more than any other as a 50-year market veteran, it is "When will stocks peak out?"

You can blame recent memory.

Those who followed my advice, bailed at the market 2008 top, and then heavily shorted bank shares laughed all the way to the bank.

Nonbelievers who didn't got slaughtered, questioning whether they'd ever touch another stock again.

We're about to replay that movie.

By now, the reasons behind the runaway bull market are familiar to all.

Even my gardener, cleaning lady, and shoeshine boy know by now.

They are also asking if they should be buying bitcoin, after it has made the move from $1 to $6,000.

So let me tell you how I get to such a precise top in the current move.

This time it WON'T be different.

The Fed will definitely trigger the next recession.

But it will be different in that the next recession will be prompted by a much lower interest rate spike than seen at past market tops.

Blame deflation.

We already know that stock markets accelerate their appreciation at the beginning of every tightening cycle.

So far, so good.

Assume that the Fed continues "normalizing" interest rates by raising 25 basis points a quarter for the next five quarters.

That takes the overnight Fed funds rate up to a 2.50% to 2.75% range by December 2018.

This will create an inverted yield curve whereby short-term rates are higher than the present 2.38% 10- year Treasury bond yield.

Bond yield will also rise and prices fall, but not by much.

There is just too much money around.

Over the past 100 years, inverted yield curves have had an average life of 14 months, within a range of nine to 19 months.

At first, rising interest rates INCREASE borrowing dramatically, as investors scramble to beat the move.

This enables them to make up for shrinking profit margins caused by higher rates by increasing size.

This is already happening in a major way.

When the return finally turns negative, they then dump EVERYTHING, causing interest rates to explode, igniting a recession.

That's when 10-year Treasury bonds spike to 4%, or even 5%.

This has a recession beginning 14 months after the December 15, 2018 Fed meeting, or February 2020.

Historically, stock markets peak exactly 7.2 months before a recession, so this takes us back to August 2019.

Back out three more months for a "Sell in May and go away" effect.

Bear markets usually begin on Mondays (remember the many Black Mondays of our careers?) because investors are prone to digest deteriorating market technicals and fundamentals over a weekend and then panic at the first opportunity.

I expected the Dow Average to plunge at least 400 points at the following that Monday opening.

Add all this together, and you arrive at my target market peak of Friday, May 10, 2019 at 4:00 PM EST. Look for a final spike into the close.

You may catch me gingerly stepping out of the market a few weeks or months before that.

As my late mentor Barton Biggs used to say, "Always leave the last 10% of a move for the next guy."

Remember also that once stocks start to go in reverse, liquidity will completely vaporize right when numerous risk protection algorithms simultaneously kick in.

So the bigger institutions will start scaling out of major positions well before then. This, by the way, helps set up the negative technicals that create the top.

Of course, any number of black swans can move this timetable forward, which I have covered in previous letters (North Korea, impeachment, no tax cuts, etc.).

So I may be making necessary adjustments to my market top target date along the way.

And here's the scary part.

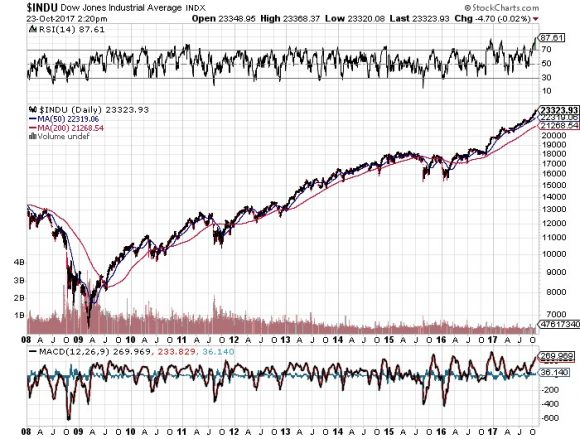

Stock markets could rise another 20% to 25% before they peak out. That takes the Dow Average to a neat 28,750.

So despite knowing the blowup day well in advance, you're still going to have to stay in the market, lest you lose all your clients.

After all, they don't pay fat fees for us to hide in a cave somewhere and sit on our hands.

So, you wanted to be in show business?

When a client asks you the favorite question of the day, he will be suitably impressed when you provide him with the above answer, as he should be.

In fact, he will probably give you more money to manage.

As he should do.

Remember that date, May 10, 2019 at 4:00 PM EST!

I have already marked it on my calendar.

Picking a Market Top is Simple Logic