Why Uber Tried to Buy Grubhub

To understand the unintended consequences of the Fed’s helicopter money to U.S. capitalism, we can put a magnifying glass over Uber’s (UBER) recent takeover attempt of Grubhub (GRUB) as what’s in store for not only the tech sector but the wider public markets.

Zombie companies parade around Europe and Japan because of an era of low interest rates and cozy bank relationships that keep these companies from dying out.

To read more about Allianz Economic Advisor Mohamed El-Erian’s take on zombie companies – click here.

It’s not a surprise that Japan and Europe are highly unproductive, and innovation ceases to exist when capital is being tied up in marginal companies with management happy to let capital slosh about without adding extra added value.

I get it that the Fed is trying to “save” the wider U.S. economy by bringing out the bazookas and even by buying junk-graded debt which was once seen as heresy.

But what we have now are inferior companies that will never turn a profit masquerading as real companies that would be on life support if not for cheap capital.

In almost every instance, the only winners are the executive management who pillage the system and cash out when they are allowed to sell their stock.

U.S. Representative for Rhode Island David Cicilline hit the nail on the head when he described the fluid situation by focusing on two of the bad apples, saying “Uber is a notoriously predatory company that has long denied its drivers a living wage. Its attempt to acquire Grubhub — which has a history of exploiting local restaurants through deceptive tactics and extortionate fees — marks a new low in pandemic profiteering.”

Uber is a taxi service that undercompensates its highest expense - the driver, and Grubhub delivers restaurant food but rips off the restaurants in doing it.

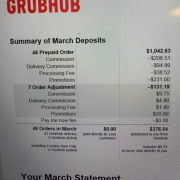

I defined exorbitant delivery fees as up to 40% which Grubhub is infamous for charging.

Yes, even with predatory practices, they cannot turn a profit.

Now, in this new normal of coronavirus, it would be a miracle to make any operational headway.

Uber’s attempted market grab is a giant red flag.

My guess is that they are doing this in order to jazz up the balance sheet and concoct some ridiculous new metric showing a pathway to growth.

By adding growth to revenue, Uber would be able to preach “growth” even if it’s of bad quality.

I thought the tech market was done looking through to grow by essentially killing off the “WeWork model.”

However, Uber is going for a model that is one notch above that model and repurposing it as something actually meaningful, which of course, it’s not.

They are already in litigious hell regarding driver’s remuneration, and that will not die down and could even destroy Uber.

Uber has in fact ignored California state orders to reclassify its drivers as employees and have appealed the court’s decision.

The New York state government has validated my theory of these fly-by-night delivery outfits being a net negative for business and society.

The New York City Council compared food ordering apps Grubhub and UberEats to blood-sucking parasites this week before passing emergency legislation aimed at helping struggling restaurants lower delivery costs during a precarious time.

During the state of emergency, a new vote passed capping food ordering and delivery app fees at 15% in delivery fees and 5% “other” takeout order fees.

To read more about this decision by the New York City Council – click here.

This was done to give some power back to the restaurants that have been getting fleeced.

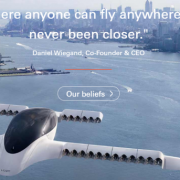

The balance sheet shows the whole story with Uber's net loss totaling more than $8.5 billion in 2019 and in February, they reported a net loss of $1.1 billion in the fourth quarter.

Let me remind readers that Grubhub posted a net income loss of $27.7 million for the last reported quarter as well.

As it turned out, Grubhub rejected Uber’s offer believing it didn’t meet their valuation of the company.

It would appear natural that a predatory company with no competitive advantage would set a market premium that would align with their borderline extortionate ways.

Do not own either one of these companies – there are far better ones out there in tech and no need to scrounge at the bottom of the barrel.

Monthly Grubhub bill for Chicago Pizza Boss During the Epidemic