If you feel like this market has sucked you down a rabbit hole, you have plenty of company.

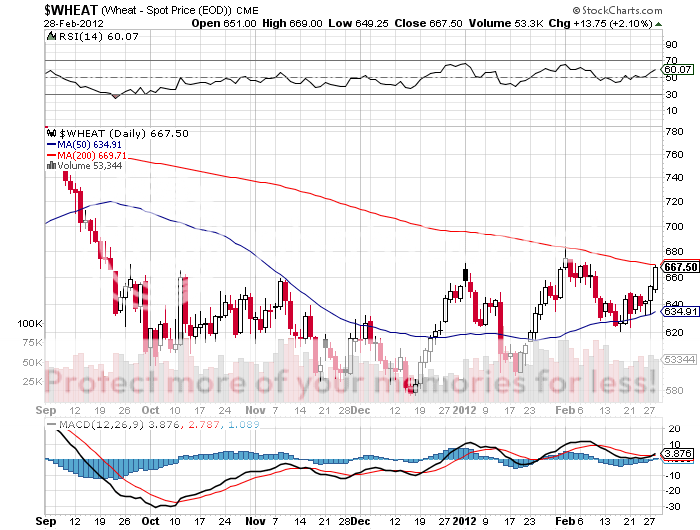

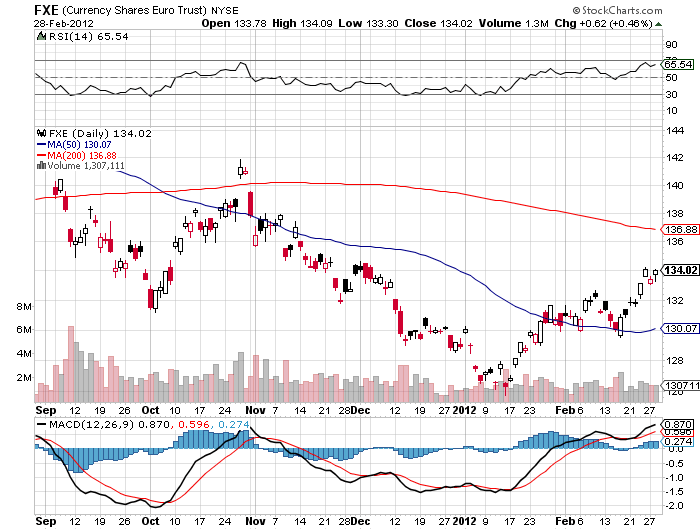

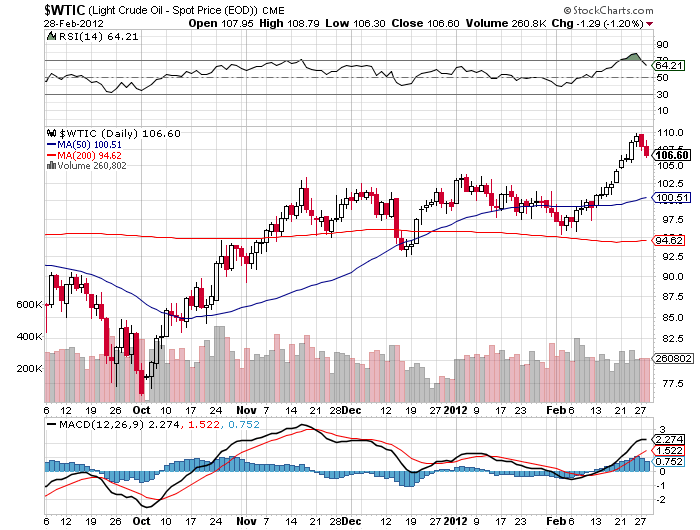

I have never seen such a profusion of contrary cross market indicators. Traders are running up shares prices while companies are cutting earnings forecasts. Economists are raising GDP forecasts as rising energy prices are taking them the opposite direction. Natural gas is crashing as oil spikes up.

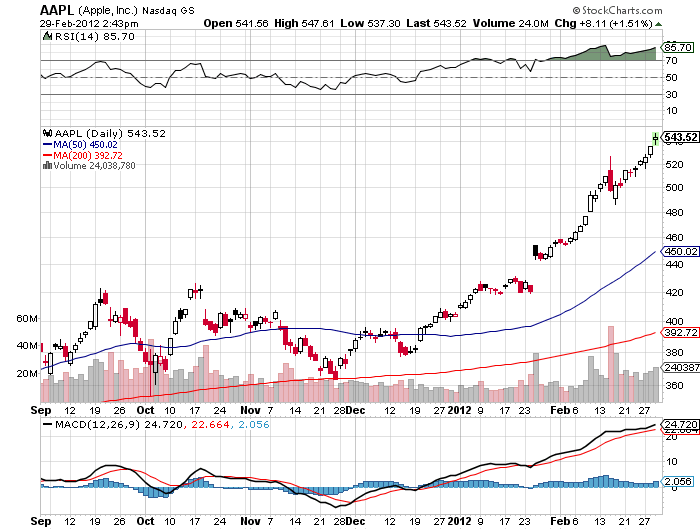

The bond market has gone catatonic, with billions pouring into bond mutual funds to keep them on life support. Dr. Copper, that great leading indicator of global economic activity, has gone to sleep, with investors pouring money into the entire spectrum of risk assets. An increasing share of the buying in equity markets is focusing on a single stock, Apple (AAPL), the world?s largest company.

They say the market climbs a wall of worry. This one is climbing the Great Wall of China. You have to assume that the people buying stocks here are doing so only for the very long term, Warren Buffet style, and are willing to look past any declines we may see this summer. They don?t care if the market drops 5%, 20% (my pick), or 50%.

In my new year Annual Asset Class Review I thought that markets might peak in January. I lied. Thanks to a global quantitative easing program, it is increasingly looking like 2012 will be another ?sell in May and go away? year, the fourth in a row. You might as well book that Mediterranean super yacht, the beach house in the Hamptons, or the bucolic chalet in Switzerland now to beat the rush.

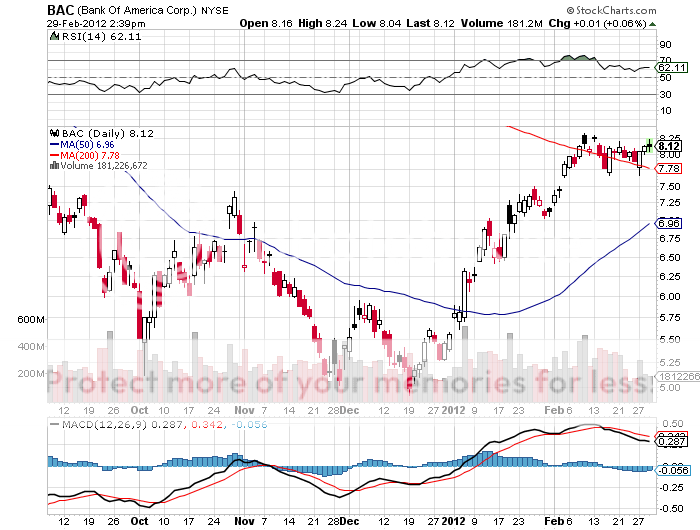

Another ?looking glass? element this year is the extent that last year?s dogs became this year?s divas. Just look no further than Bank of America (BAC), which did a 67% swan dive in 2011, but has soared a blistering 51% this year. This is a stock with a PE multiple of 812 and more investigations underway than Al Capone every saw.

It goes without saying then that those who did terrible in 2011 are looking like stars today. Look no further than hedge fund titan John Paulson, whose flagship fund was down 50% at the low last year, thanks to a big bet on financials. This year it appears his super star status is restored. Other funds that made big bets last year on European stocks and sovereign bonds have been similarly revived. If MF Global had only lasted two more months, John Corzine would be looking like a genius today, instead of a goat.

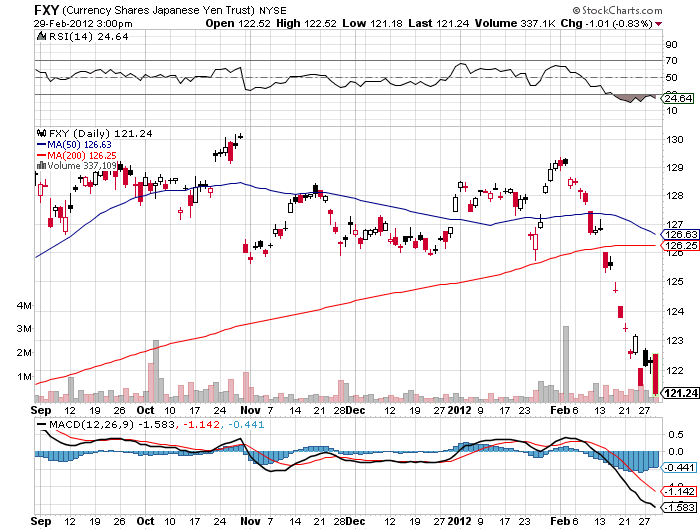

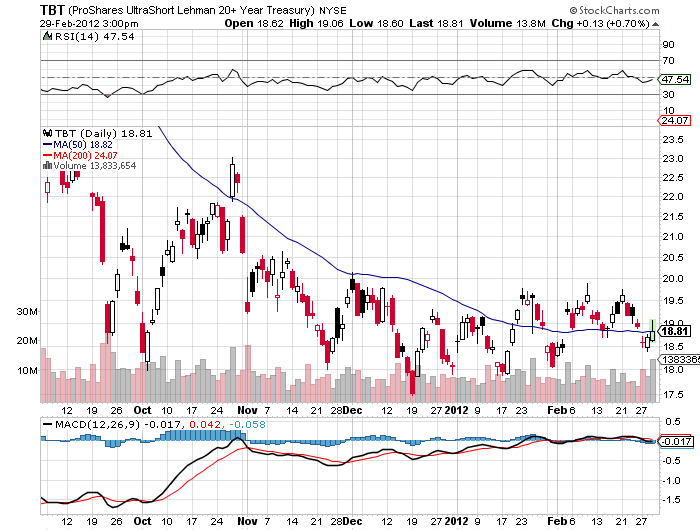

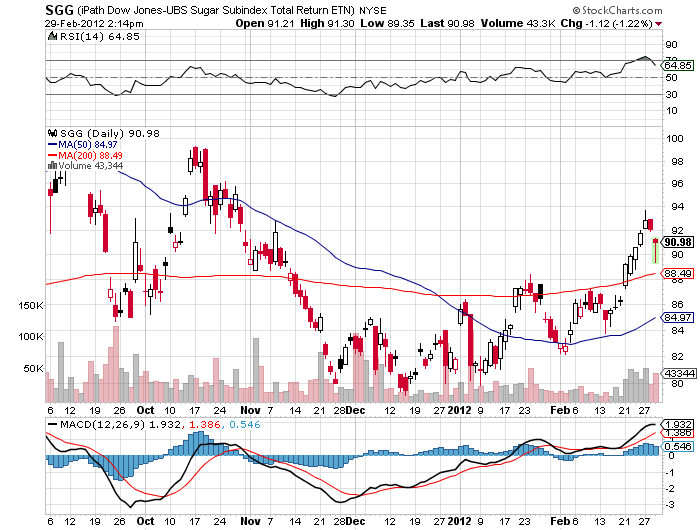

When I realized that this could be a ?dogs of the Dow? year with a turbocharger, I quickly reviewed by own money losing trades in 2011. That prompted be to rush out but puts on the Japanese yen, which doubled in short order, and haven?t looked back since. Now you really have to ask the question, will my other 2011 losers perform similar turnarounds? What?s at the top of the list? The (TBT), my bet that long term Treasury bonds would go down, which inflicted my biggest hickey last year.

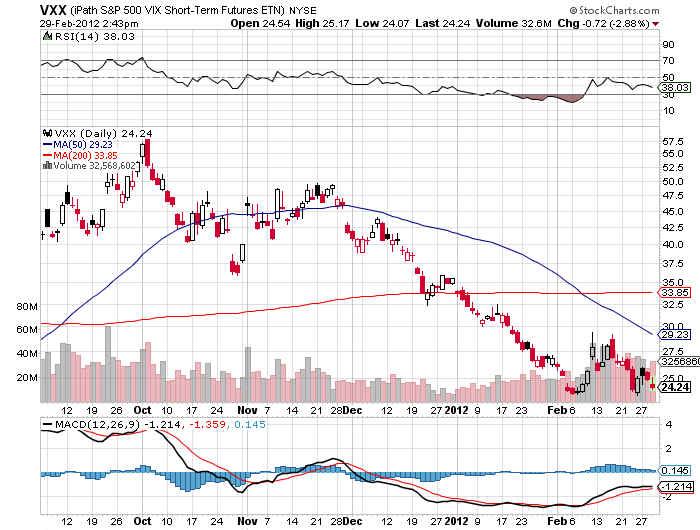

By the way, I?m kind of liking the volatility ETF (VXX) here. If the markets keep going up forever you might lose 10%. If they don?t, you will make a quick 30%, and 100% if volatilities return to the highs seen in October. The cost of carry is modest, there is no time decay as with options, and there is no contango. In fact, near month volatility is trading at half the levels of long term volatility. That is the kind of risk/reward ratio that I am constantly looking for.