“We can lead, but we cannot carry,” said Mike Ryan, chief investment strategist at UBS, about America’s role in the global economy.

Global Market Comments

August 15, 2025

Fiat Lux

Featured Trade:

(AUGUST 13 BIWEEKLY STRATEGY WEBINAR Q&A),

(ALB), (TSLA), (FCX), (GLD), (NVDA), (TLT)

“It’s really dangerous to look for rationality in the market, so much of it is psychology…. Stocks will rotate from flawless to hopeless,” said Howard Marks of Oaktree Capital Management.

Global Market Comments

August 14, 2025

Fiat Lux

Featured Trade:

(THE GOVERNMENT’S WAR ON MONEY)

(TESTIMONIAL)

“This turning 80 thing is not all it’s cracked up to be,” said Rolling Stones legend Mick Jagger.

Global Market Comments

August 11, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HOW TOOK COOK PLUCKED APPLE OUT OF THE FIRE BACK INTO THE FRYING PAN),

(SPY), (NVDA), (AAPL), (PANW), (CYBR), (META),

(MSFT), (TSLA), (FCX),(NFLX), (GLD), (DGE), (PERP)

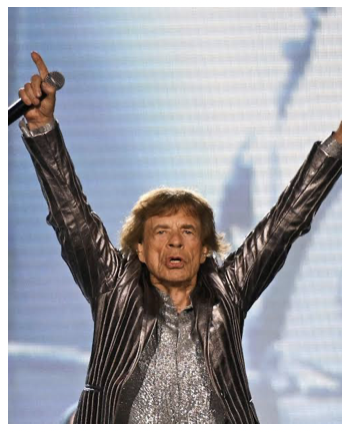

“Man will not fly for a thousand years,” said Wilber Wright in 1901, right after he crashed on a test flight. He became the first man to fly two years later. In 1909, he flew his Wright Flyer around Manhattan, watched by an amazed crowd of one million. Toda,y his image adorns every US pilot license.

Global Market Comments

August 8, 2025

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

I would like to say a big Thank You for presenting such an amazing event, the Mad Hedge Traders & Investment Summit.

I really enjoyed it and learned a lot of amazing insights that I never knew were possible.

I do not know if you guys have sent out the recorded copies or if these are still in the works so let me know.

Can you please send me a copy or let me know how the process of this is going as I would really like to hear some of these speakers again.

Absolute Appreciation and Wishing You All Prospering Success!

Best regards,

Troy

"Everything is expensive now. Worries about the future can cause safe assets to become highly priced ... I call it the 'Titanic Effect.' When the Titanic was going down, people would pay a fortune for anything that floats. We may be in a Titanic situation now," said my buddy, Nobel Prize winner Robert Shiller.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.