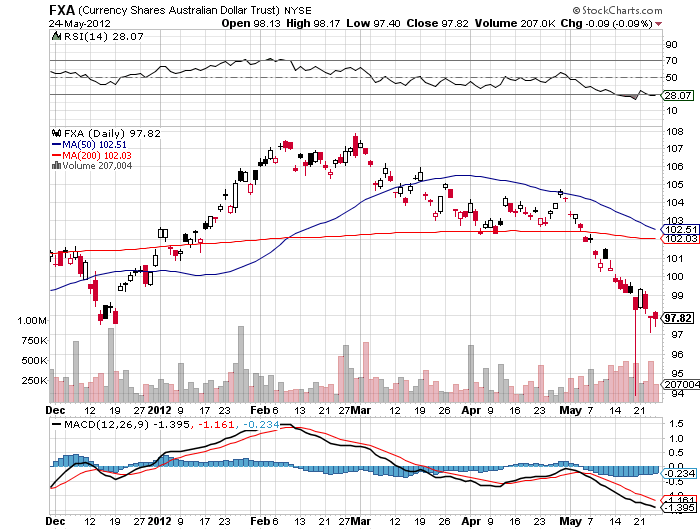

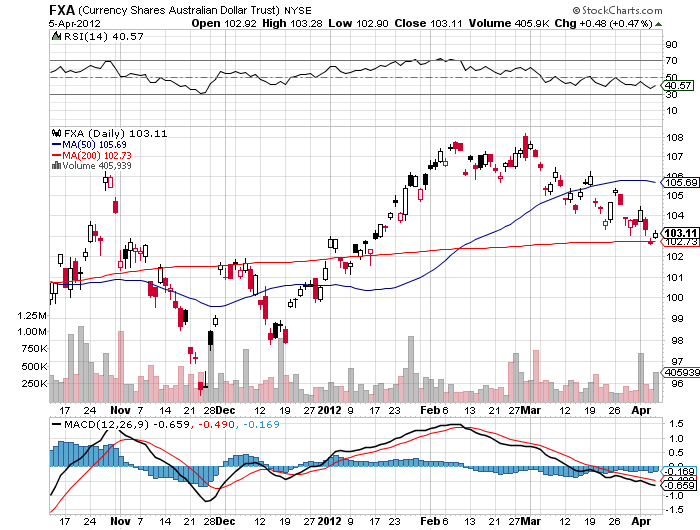

Discretion certainly can be the better part of valor. That was the feeling that came over me last weekend when I saw the Australian dollar (FXA) plunge to a new three year low against the buck.

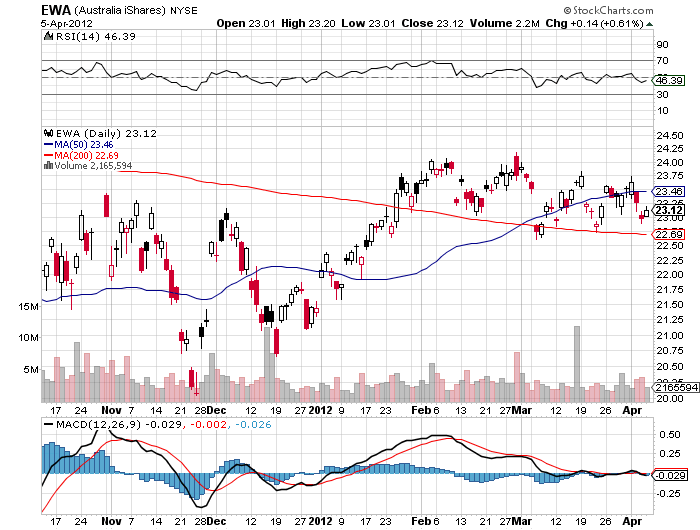

I had been mulling over buying the Aussie around the $88 support level for the past couple of months. After all, with a synchronized global recovery in progress, and an international bull market in stocks underway, Australia is usually your first stop on the buy side.

Then the Australian Bureau of Statistics (ABARE) showed up to take away the punch bowl. It reported that December job losses came to 22,600, when the market had been expecting a gain of 7,000. That leaves total employment at 11.63 million and the unemployed at 722,000.

This is the equivalent to a US monthly nonfarm payroll flipping from a forecast +100,000 to -300,000. Yikes! It?s amazing that the Australian All Ordinaries stock index didn?t go to zero yesterday. Talk about a party pooper.

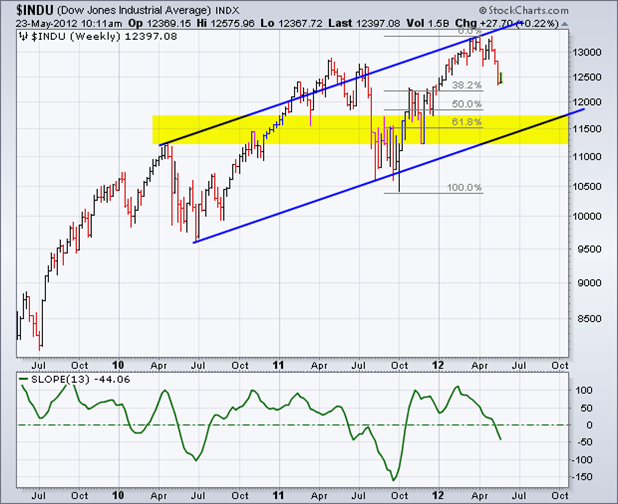

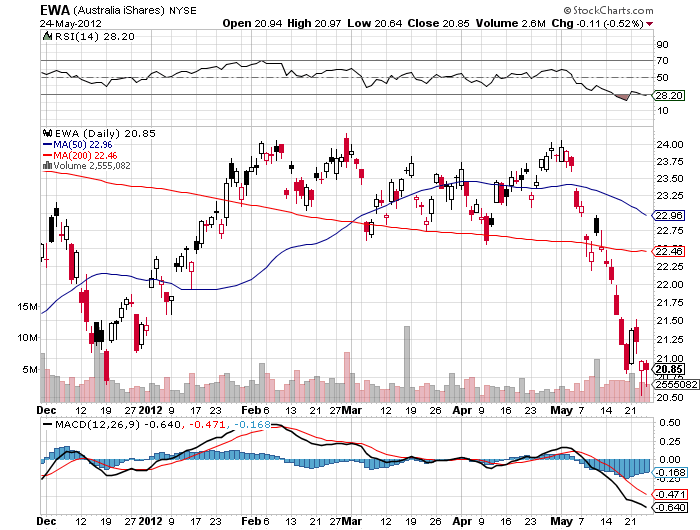

The technical picture couldn?t be more dire. A crucial support level at 88 cents that held all the way back to 2010 suddenly became a distant memory. A brief attempt to break the 50-day moving average to the upside at $90.50 failed miserably. Looking at the eight-year chart below, an undeniable double top is now in place at $105. The current downtrend has $85, and then $80, beckoning on the downside.

Further peeing on the parade from the greatest possible height has been the loose-lipped governor of the Reserve Bank of Australia, Glenn Stevens, who has been talking down the Aussie at every opportunity. In his latest foray, he declared large-scale currency intervention to be part of the central bank?s ?tool kit? to boost the economy. Translate this into plain English, and it means a lower Aussie soon.

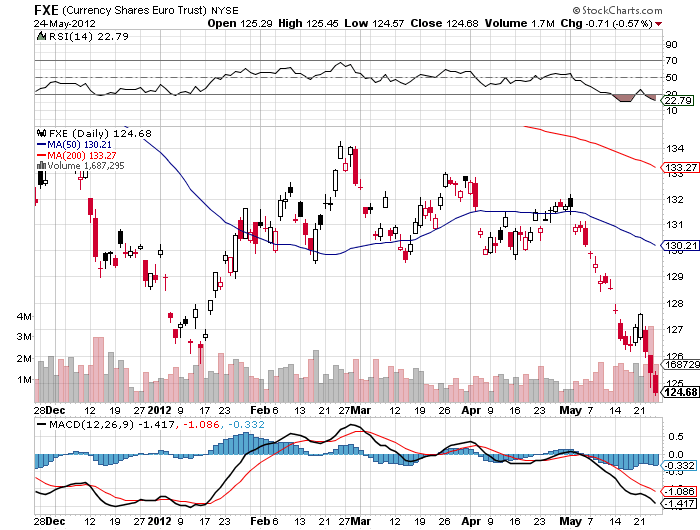

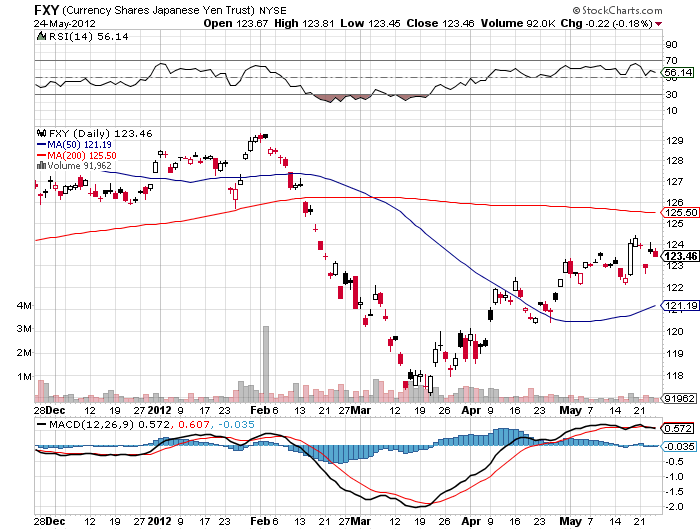

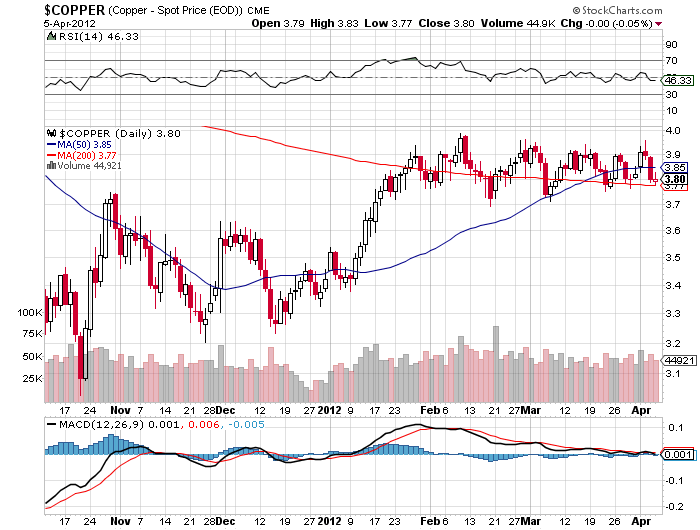

You really have to ask why all is not well in the Land of Oz in the face of such unremittingly positive news elsewhere. Looking at the charts below, it is clear that Australia is currently fighting a currency war with Brazil, the other major supplier of natural resources to the world economy. That?s because a lower currency makes a country?s exports cheap in the international marketplace.

So far, Brazil is winning big time. The Real having cratered some 26% against the dollar over the past year, compared to only a 17% decline for the Aussie. Governor Stevens obviously is trying to play a game of catch up. But he has a long way to go.

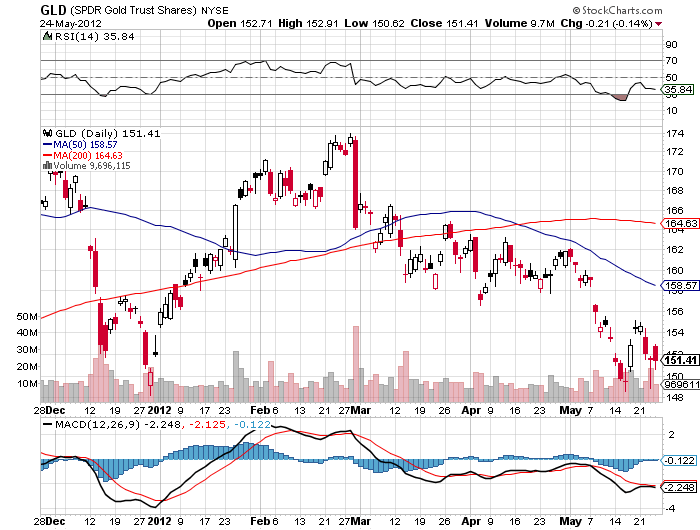

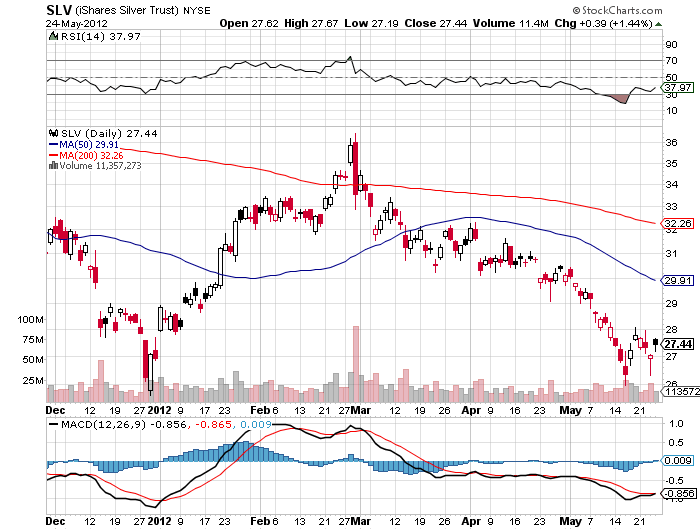

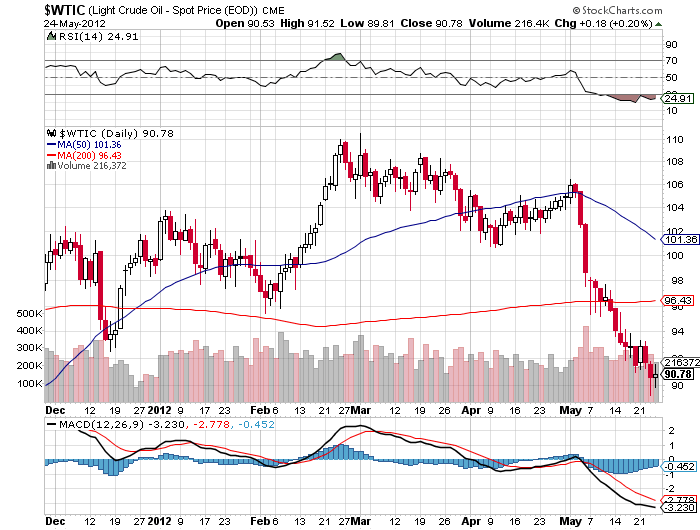

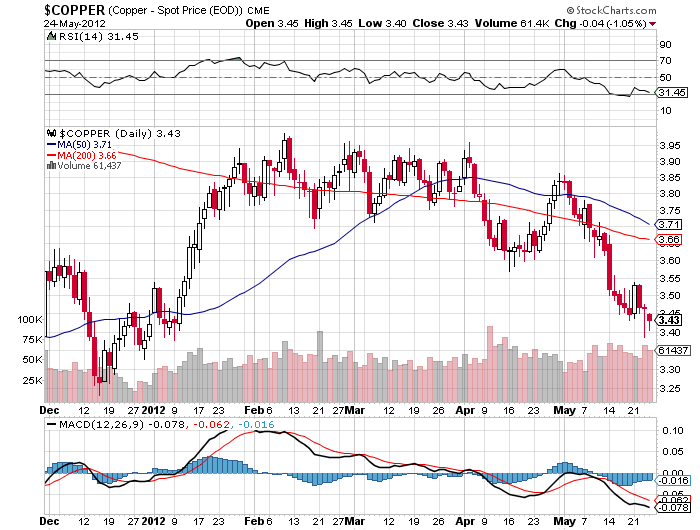

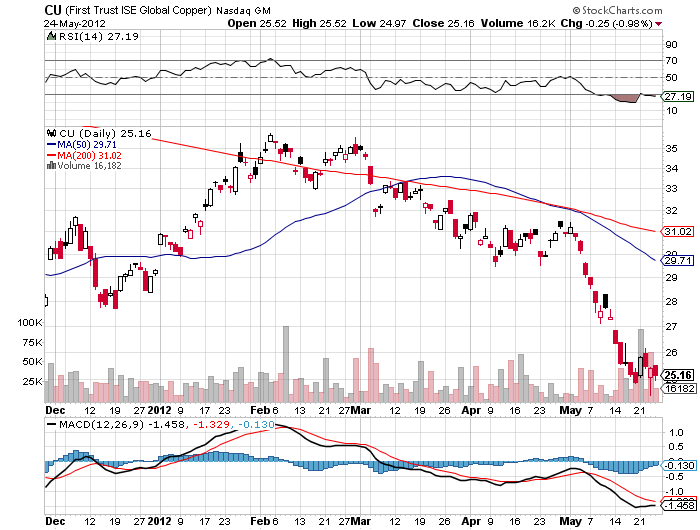

There are other reasons for the weakness in the Ausie. It may have contracted emerging market disease, whereby investors shun small undeveloped economies in favor of large developed ones. A dependence on commodities is not exactly something you want to wear on your sleeve these days in this deflationary environment. Why have any hard assets in your portfolio as long as paper ones are going to the moon?

The more frightening question is whether the global economy has evolved to the point where it no longer needs Australian exports as much as it did in the past. I have been warning readers for some time that the Chinese economy, Australia?s largest customer, is moving from a commodity consuming export model to a domestic services oriented one.

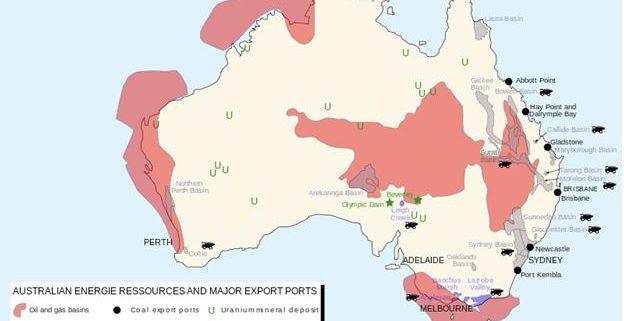

You don?t need as much iron ore, coal, or uranium when a growing share of your added value is intellectual, and not physical. Stabilizing population growth means you can get away with less food too. This explains why commodity prices have been flat in the face of a Chinese GDP that is still growing at a 7.7% rate. This is all bad news for Australia.

These are all vexing, important questions deserving more first hand, in depth, on the ground research. I think I?ll start by checking out the bikinis at Sydney?s Bondi Beach in two weeks.