July 7, 2009

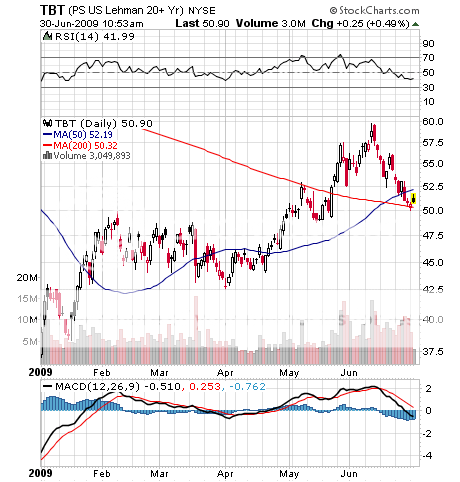

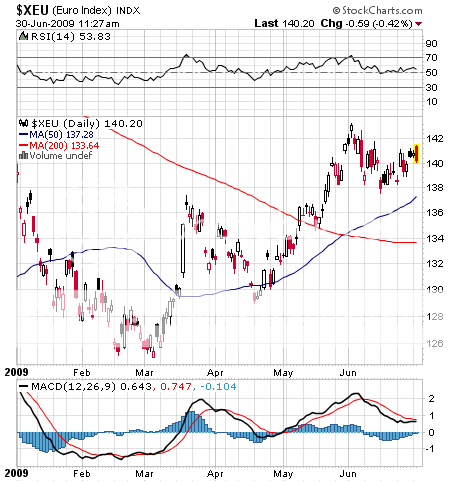

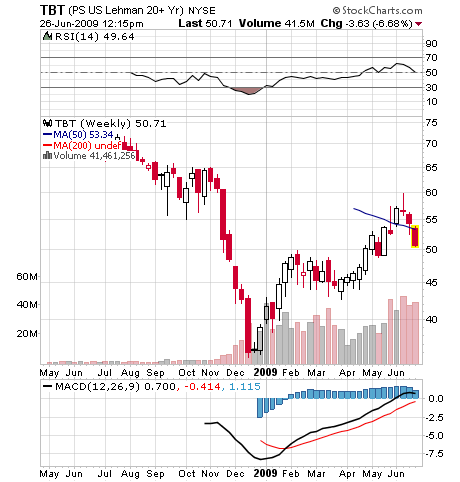

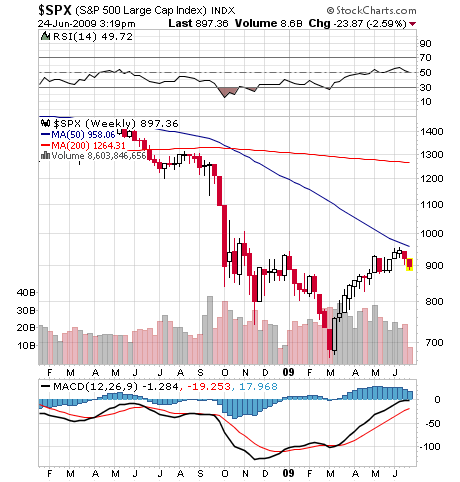

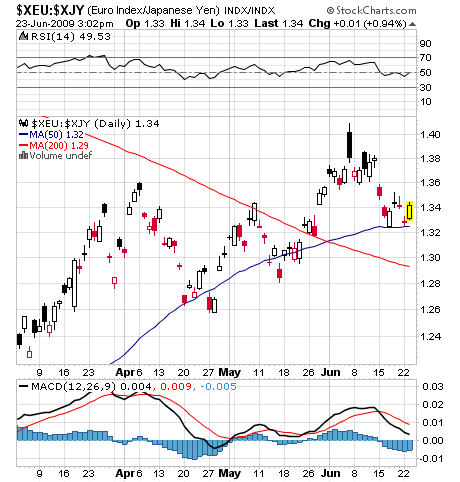

1) The stage is now set for the dollar. With the US 20 months into a recession, it?s just a matter of time before the Feds pull us back from zero interest rates. With the ECB late to the funeral, European Central Bank president, Jean-Claude Trichet, last week reaffirmed his commitment to keep their benchmark rate at 1% to restore the economy. There?s your trade. The next move in the euro/dollar spread will be in favor of the greenback, as the US will be the first out of recession. On top of that, you can pile a fading US stock market and a back off in commodity prices, which are also dollar positive. You can expect the euro to trade down to the low $1.30s. Mind you, this is still a counter trend trade, which I generally try to avoid. It?s a one night stand, not a marriage. Anyone reading the National Enquirer knows the dollar is sick, and even my cleaning lady has a major position in the futures. Thus, the street is overdue for a spanking, the inevitable outcome when there are too many bets on one side of the table. I still think it will cost two BUCKS to buy a EURO sometime in the foreseeable future. For those hardy souls willing to scoop up some pennies in front of a steam roller, look at the 200% short euro ETF (DRR), which has backed off 34% from $63 to $42 since November.

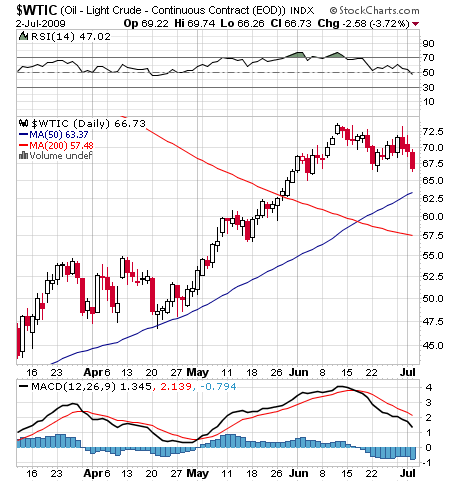

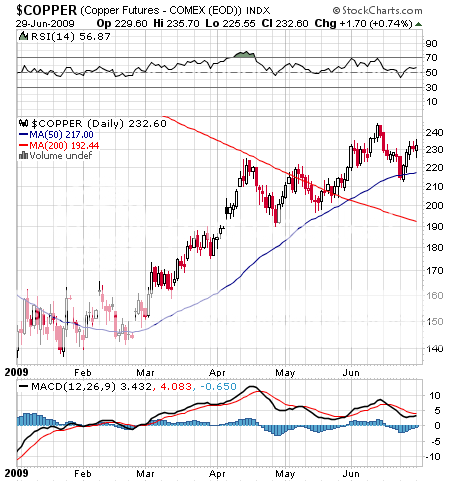

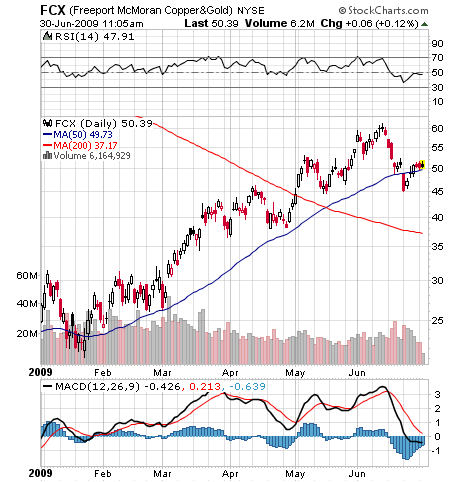

2) When crude suddenly spiked $4 to make a new high for the year at $73.50 on June 30, many in the industry, myself included, smelled some three day old fish. So I was not surprised to learn that the move was caused by a rogue trader trying to artificially engineer a short squeeze. According to the Financial Times, the perpetrator was PVM Oil Associates broker, Steve Perkins, who entered bogus orders to buy 16 million barrels of oil in one hour, double the daily production of Saudi Arabia. This was on a day mysteriously devoid of the nerve rattling news that usually drives prices up, leaving us all scratching our heads. By the time the firm discovered and unwound the trades, it had lost $10 million. The scandal had the unfortunate side effect of creating a failed double top in the oil charts, paving the way for a broader sell off in crude and other commodities as well. With hedge funds dominating trading, a large portion of their purchases going into storage in tankers chartered on the cheap, and all of this acquisition going on in the face of a death spiral in the economy, I have been avoiding this space since the first time it ran up to $72 on June 9 (see ?Get me out of Oil? ). I think you?ll see a pull back in crude to the high fifties, bringing the price more into balance with the true supply/demand situation. Gee, I wonder if they?ll ever catch the rogue trader who ran it up to $148 last year?

3) For the latest news from the front trenches of the solar industry, listen in to the all day analyst meeting given in Las Vegas by First Solar (FSLR) by clicking here .?? If you don?t want to wade through six hours of data that could only arouse a bachelor engineer, here are the highlights. The headline is that the cost of solar is now down to ten cents per kilowatt hour, versus three cents for coal. But the Clean Energy Act of 2009 is certain to make solar cheaper and coal more expensive. The industry will face a completely new set of challenges gearing up from a few rooftop panels on environmentalist rooftops to becoming a major portion of the US power supply. For a start, solar energy is most abundant where there are no people, because these areas were uninhabitable until air conditioning came along. That means building a huge network of power lines from scratch, something that will require Federal Energy Regulatory Commission (FERC) shepherding. Unlike other power sources, solar is highly variable, hour by hour and even minute by minute. Not a problem when you are running a freeway sign, but a big problem when running a large regional network, so ?smart? grids will be the order of the day. The technology to do this on a large scale hasn?t even been invented yet. The ongoing credit crisis is a major problem, since one gigawatt of capacity will cost $800 million in capex. Nevertheless, this industry now has a huge global tailwind and should remain permanently on your radar. Consider FSLR on the next big dip. For more, see my earlier piece.

4) I thought you would be fascinated to read these headlines from the Wall Street Journal:

?Washington Officials Will Be Looking Carefully at Whether Record Low Interest Rates will Revive Business?

?Current Speculative Sentiment is Bearish?

?Market Observers See Hopeful Signs?

?Senator Glass Considers Changes in Banking Regulation?

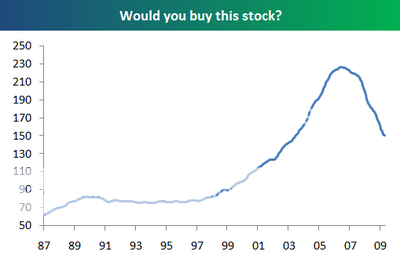

This last one was the tip off, Glass, of Glass Steagle fame. A thoughtful blogger has started posting daily headlines from today?s date in the year 1930 (check out his site). Terms like ?over leverage? and ?green shoots? abound. Do any of these sound familiar? The famous Winston Churchill quote comes to mind ?the nation that forgets its past is doomed to repeat it.?

QUOTE OF THE DAY

?I think it?s almost inevitable that, with a billion people in China wide awake for the first time, and a billion people in India, there?s going to be some kind of a terrible run against the dollar. And I doubt it can stay orderly, because all of our own hedge funds will be right in the vanguard of the operation,? said Nobel Prize winning economist Paul Samuelson.