Featured Trades: (OIL), (XOM), (CVX), (OXY), (COP), (RSX)

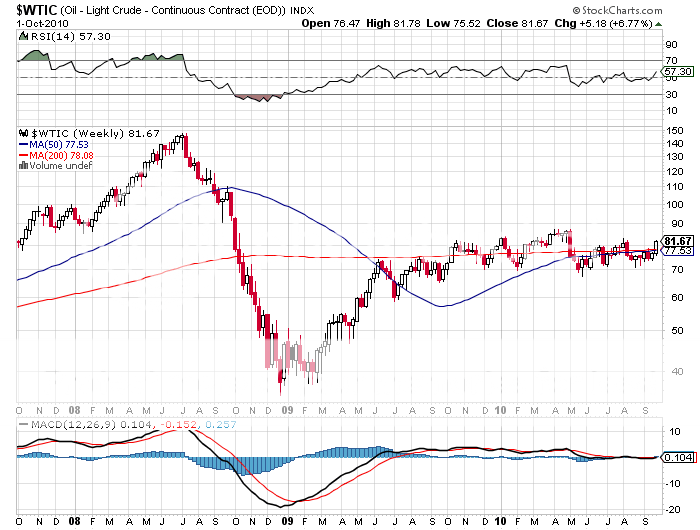

1) Contemplations on Oil.? After a tumultuous 2009, oil has been one of the least volatile assets of 2010, confined to a tortuous $68-$88 range, frustrating momentum players to no end. How many city morgues are packed with the bodies of those who sold every dip and bought every rally, vainly hoping for a break out? By Friday, crude was down 3% on the year, virtually, the only hard asset showing a negative number this year.

Oil traded like it was on Ambien because it spent most of the year discounting a double dip recession. Bloated inventories encouraged hedge funds to build up substantial short positions. Some traders were targeting prices as low as $40.

After last week's sudden burst, it now appears that this crucial commodity is stretching its muscles, limbering up, and getting ready for a serious move. The short position started to go badly wrong in early September. Forecast hurricanes failed to show. Wells in Nigeria, America's third largest foreign supplier, started to explode again. Word has slowly been seeping out that the net effect of the BP oil spill, and the industry curbs that followed, will be a cut of one million barrels a day of Gulf production fairly soon. That is about 5% of the country's total consumption.

Then, Ben Bernanke threatened to launch a hoard of helicopters dumping money on the economy reminiscent of a scene from the classic Vietnam War flick Apocalypse Now, smothering any prospective double dips in the crib. All it took was a surprise plunge in inventories last week, and the short covering was off to the races.

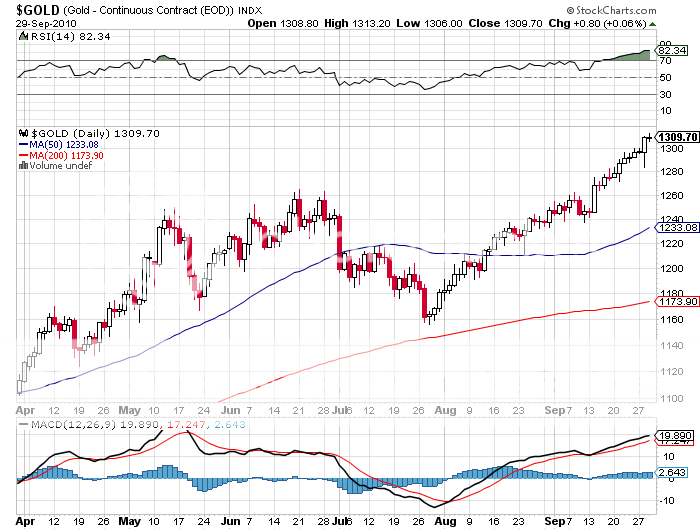

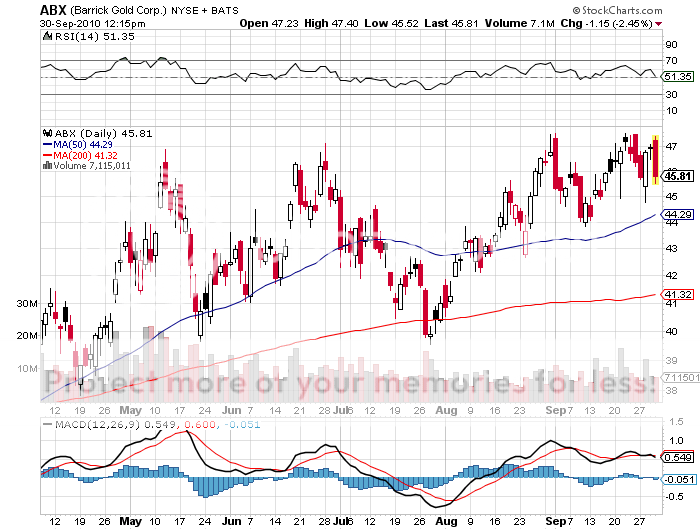

A serious run on the dollar has added fuel to the fire. After running up virtually every hard asset to unimaginable heights in such a short time, investors desperate for returns in a zero return world are now rotating into Texas tea as a laggard. Until Ben Bernanke figures out how to make a barrel of oil with a printing press, money should pour into oil, as it has already into precious metals, industrial commodities, rare earths, and food.

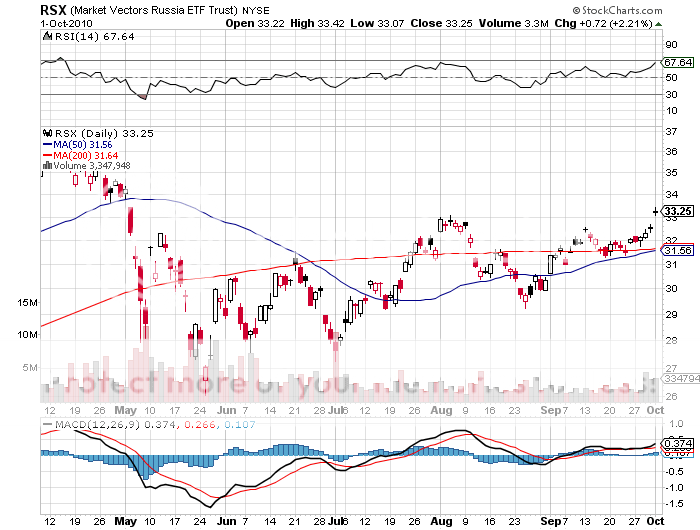

I have always viewed any weakness in oil as temporary, and urged readers to accumulate positions on the cheap on many occasions. This extends to longs in the Russian ETF (RSX), the world largest oil producer and a major exporter (click here for 'Buy Russia When Oil is Cheap').

I must confess that I am an out-of-the-closet, card carrying 'peak oiler', and believe that it is just a matter of time before we punch through the 2008 $150/barrel all time high (click here for 'The Price of Oil is Going Up').

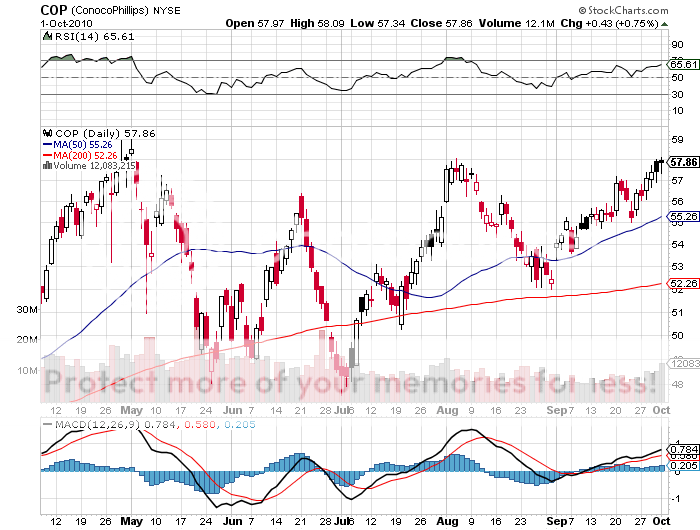

Avoid the ETF here (USO) because the tracking error is so huge. You would be better off buying my picks in the industry on any dips, including Chevron (CVX), ExxonMobile (XOM) (click here for 'Pick up Big Oil While it is Still Cheap'), Occidential Petroleum (OXY) (click here for 'Looking for Value at Occidental Petroleum'), and ConocoPhillips (COP) (click here for ConocoPhillips Looks Like a Steal'.

Pass the Wrench Please, Will You?