Featured Trades:? (EMERGING MARKET DEBT), (PCY), (ELD)

PowerShares Emerging Markets Sovereign Debt Portfolio ETF

Wisdom Tree Emerging Markets Local Debt Fund ETF

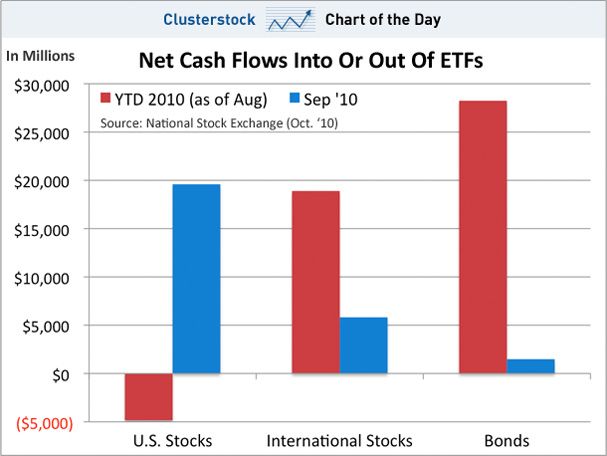

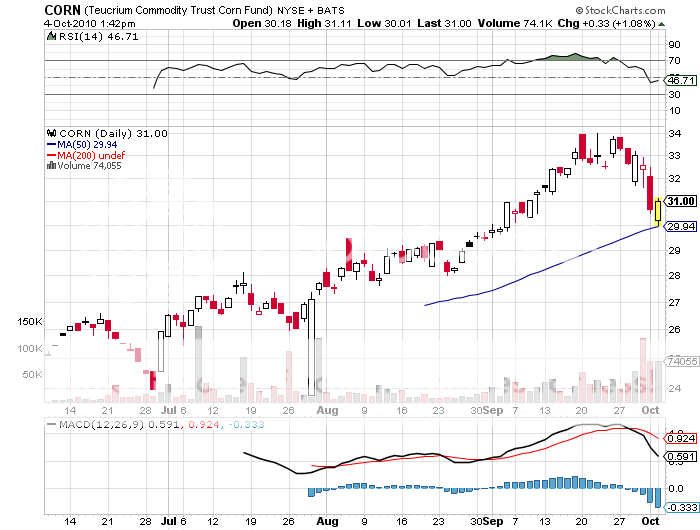

2) My Reconciliation With Emerging Market Debt. Last month, I advised readers to take profits on the emerging market debt ETF (PCY) after clocking a generous 30% total return over the previous year (click here for 'Sovereign Debt Was a Great Place to Hide'). As much as I liked the credit, the tremendous gains achieved by all fixed income instruments were starting to give me a definitely queasy feeling.

Well, Doctor Ben Bernanke rode to the rescue with a Costco sized bottle of Dramamine, and I am now feeling a million times better. Given the global surge that is going on in all asset classes, the (PCY), with its generous 5.82% yield, has to be on the menu in a yield hungry world.

One of the great ironies in the international capital markets is that emerging nation balance sheets are so healthy because the West refused to lend to them for so long. Several debt crisis during the seventies and eighties caused entire continents to be rated as junk. That forced these countries to pull themselves up with their own bootstraps, financing growth from savings instead of expensive foreign borrowing.

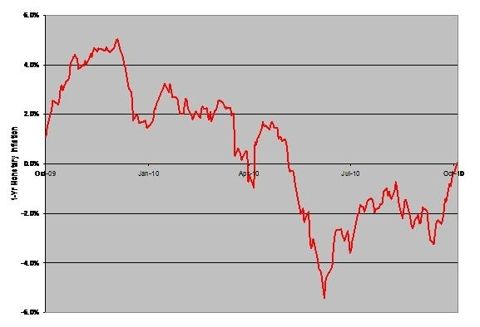

Now that I'm back in the game, I'll see you one ETF, and raise you another. While the (PCY) invests only in the dollar denominated debt of emerging markets, Wisdom Tree has just launched its (ELD), which gives you the local currency exposure as well, and still offers a healthy 4.8% yield. The fund invests in the bonds of Brazil, Chile, Columbia, Indonesia, Poland, Russia, South Korea, South Africa, and others, all countries you should know and love well after reading this letter. With large capital inflows expected to continue into these high growth countries for years to come, giving a steroid shot to their currencies, this is a bet that I am more than happy to make.

You get the a double play here: a continuous cycle of credit upgrades lead to lower interest rates, higher bond prices, in appreciating currencies. International capital flows are providing a tremendous wind at your back. Don't expect the de facto better quality credit to continue paying higher interest rates forever. This screaming contradiction can only be resolved through higher prices for both the (PCY) and the (ELD).

We're Getting Back Together