Global Market Comments

February 2, 2010

Featured Trades: (THE DISCIPLINED INVESTOR), (EWS), (EWZ), (EWY), (EPI), (GOLD), (SILVER), (COAL), (TM), (BOONE PICKENS), (Q4 GDP)

2) Reformed oil man, repenting sinner, and borne again environmentalist T. Boone Pickens says that ?when we turn the US green, it will have the best economy ever.? I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog? while oil was cheap. Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela is shifting its exports of its sulfur laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it. Unfortunately, unstable energy prices and the disappearance of credit have put alternative energy development on a back burner. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self interested foreign supplier (Saudi Arabia) to another (China), as was highlighted in the recent New York Times article on Sunday (click here for the link? ). Wind and solar alone won?t work on still nights, and can?t power an 18 wheeler. Don?t count on the help of the big oil companies, because they get 81% of their earnings from selling imported oil, and don?t want to kill the goose that laid the golden egg. The answer is a diverse blend of multiple alternative energy supplies from American only sources.? Although Boone now has Obama?s ear, it?s a long learning process. Boone has donated $700 million to charity, and says the 20,000 trees has planted should offset the carbon footprint of his Gulfstream V. I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 80, he has not slowed down a nanosecond.

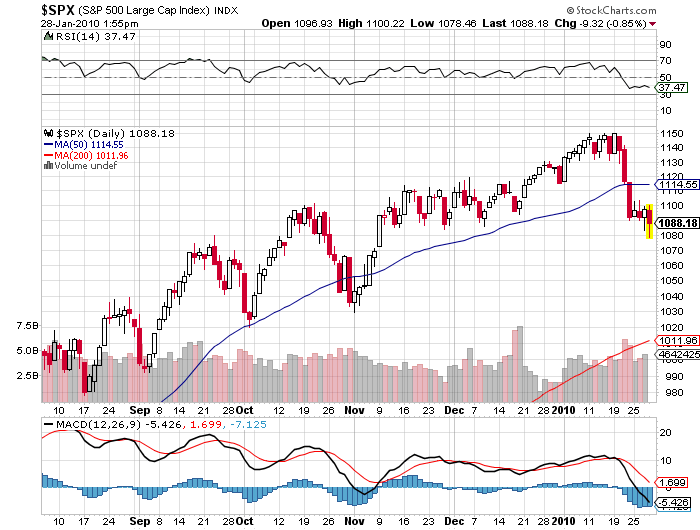

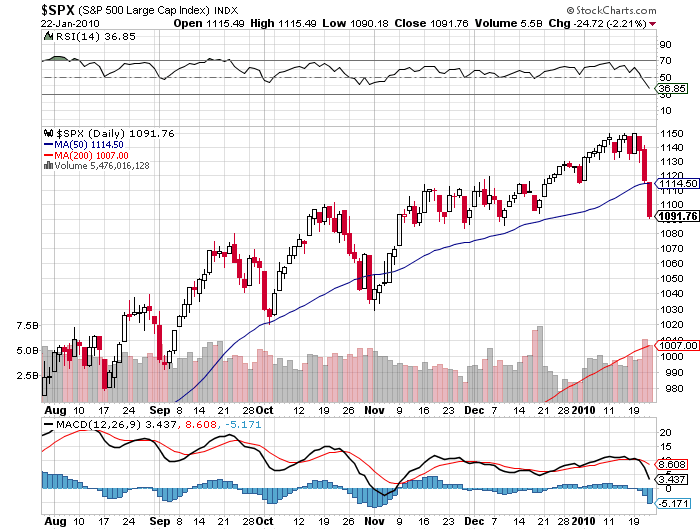

3) As I expected, the Q4 GDP blew out to the topside, coming in at 5.7%, the strongest performance since Q3, 2003. This is clearly what the stock market was seeing as the rally extended through the fall and into the winter, delivering an increasingly gob smacking return. Inventory rebuilding from bare shelf levels was the main impetus. Take that out, and the GDP grew only at a 2.2% rate. Another ominous development was that consumer spending fell from 2.8% to 2%. How an economy can grow without healthy spending by individuals is beyond me. I guess you don?t splurge at the mall over the weekend if you?re worried about getting pink slipped on Monday morning. It?s possible that this robust growth will continue for another quarter, completing the first part of my scenario for the ?square root? shaped recovery. You can also expect some major downward revisions in the headlines 5.7% number, as we have already seen in the past two quarters. For growth to continue from here you need a capital spending binge that will lead to hiring. But having just survived the near death experience of their lives, I don?t know a single businessman who?s will to go out on a limb here. So the ?V? may be in, and we?ll flat line after that.

QUOTE OF THE DAY

?The Roman Empire fell because its last six emperors were all faggots,? said President Richard M. Nixon. He also said that ?I would never shake the hand of someone from San Francisco.? No wonder even his friends hated him.

?

?