Featured Trades: (ITS OFF TO THE RACERS FOR NATURAL GAS)

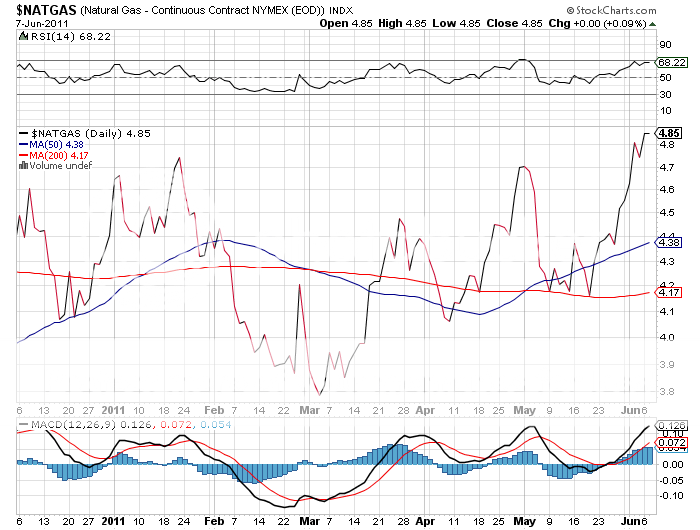

1) It's Off to the Races for Natural Gas. Name one of the best performing assets since the 'RISK OFF' trade started and it would have to be natural gas. You may recall my waxing bullish on this simple molecule in my piece seven weeks ago (click here for 'Something is Bubbling in Natural Gas'). Since then, natural gas has rocketed by 30%.

My call then was to wait for the cold summer that the weather models were then predicting to crater this clean burning fuel and load up on the cheap. It seems that the weather models are never right. Instead, The US East Coast is suffering a broiling summer, and it has been off to the races for natural gas.

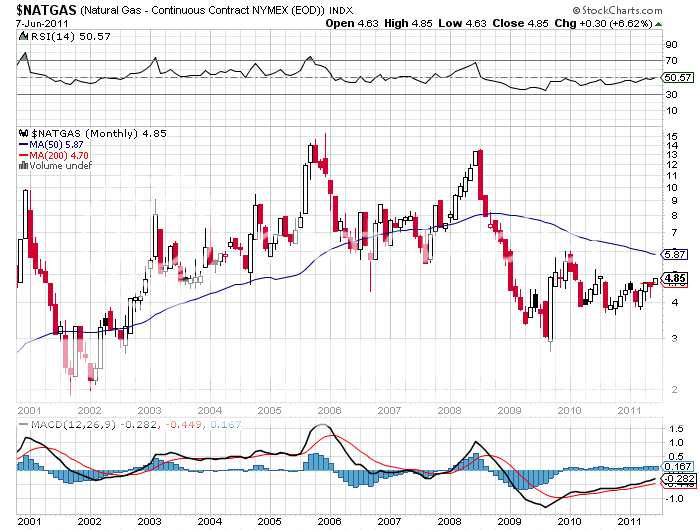

There have been other structural developments that have helped boost prices for CH4. With oil prices over $100 a barrel, the integrated majors are diverting rigs to new onshore oil development where the huge profits are, instead of using them to extract more underpriced gas. So gas rig counts are down, and industry insiders don't expect an upturn until gas gets up to $7-$8/BTU, up from the current $4.85. This is limiting new supplies coming on stream from shale gas unlocked by the new 'fracking' technologies.

On top of that, an increasing number of utilities are taking advantage of low gas prices to switch over from coal. Others are making the change purely for environmental reasons, as natural gas produces only half the CO2 emissions and none of the NO2 or SO3 when compared to oil fired plants. The last coal fired plant in California was recently closed, where utilities like PG&E (PGE) are racing to obtain 30% of their power from alternatives by 2020. This is why the International Energy Agency expects American natural gas demand to increase by 50% over the next five years.

What's more, traders no longer have to fear weather spikes from gas prices, like the hurricanes of the past, as so much of the new gas supplies are coming from onshore. Very little new gas now comes from the Gulf of Mexico when compared to past years.

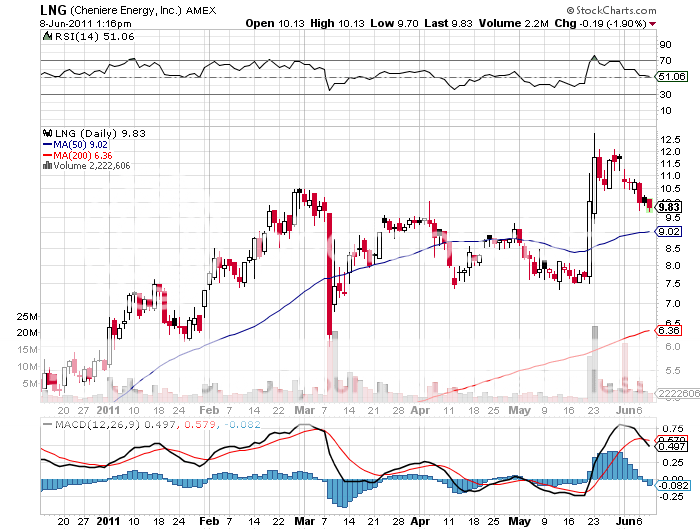

Longer term, the 800 pound gorilla for this market is the prospect of exports to Asia, especially energy hungry China. They haven't started yet as the infrastructure is not in place, but it is under construction. When that happens you can expect the crude/natural gas price gap to disappear. Gas currently sells for 20% of the price of crude on a BTU basis.

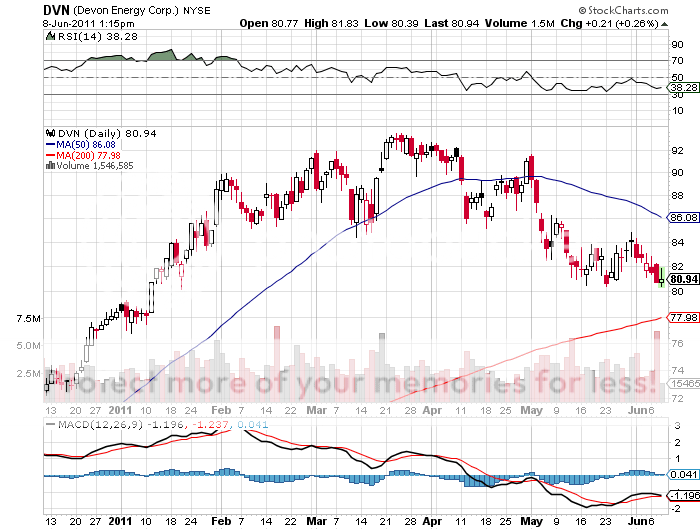

How to play it? Don't touch the ETF (UNG) which has one of the worst tracking errors in the industry. Instead, invest in individual producers, equipment suppliers, and pipeline companies, like Chesapeake Energy (CHK), Devon Energy (DVN), Cheniere Energy (LNG), and Southwestern Energy (SWN).

-

-

-

-