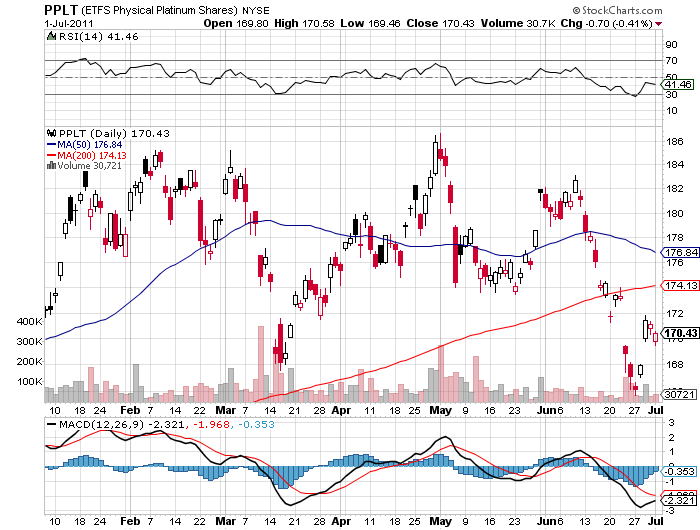

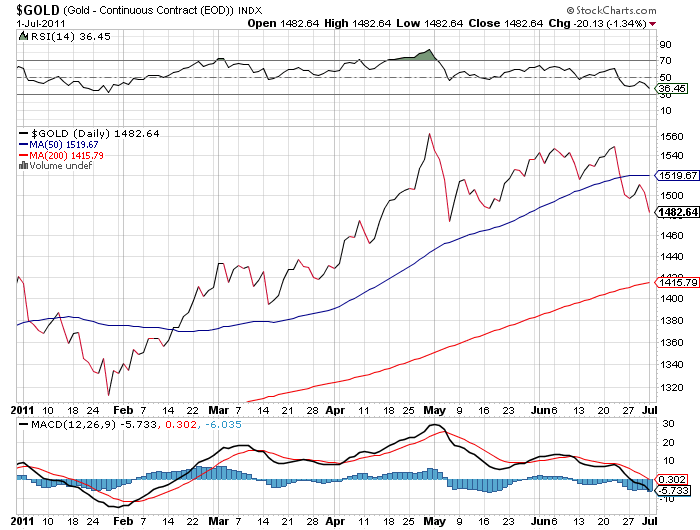

Featured Trades: (PLATINUM), (PPLT), (GOLD)

3) Time for Platinum to Play Catch Up. For those of you who have been romancing gold, you should check out platinum (PPLT), her younger, racier, and better looking sister who wears the low riders. The white metal usually outperforms gold in bull markets for precious metals, but this year has fallen 3.4%, compared to a 4.7% gain for the barbaric relic. No doubt the 'double dip' threat to the economy is having an impact.

While gold is just shy of its all-time high, Platinum has to rise a further 30% from here just to match its 2008 high of $2,200 an ounce, suggesting that some catch up play is in order. I have always been puzzled by the fact that platinum is 30 times more rare than gold, but at $1,720 an ounce, trades at a mere 15% premium to the yellow metal. And unlike gold, platinum has a wide array of actual industrial uses.

You have to refine a staggering 10 tons of ore to come up with a single ounce of platinum. The bulk of the world's 210 tons in annual production comes from only four large mines, 80% of it in South Africa, and another 10% in the old Soviet Union. All of these mines peaked in the seventies and eighties, and have been on a downward slide since then.

That overdependence could lead to sudden and dramatic price spikes if any of these are taken out by unexpected floods, strikes, nationalizations, or political unrest. While no gold is consumed, 50% of platinum production is soaked up by industrial demand, mostly by the auto industry for catalytic converters.

The Japanese earthquake and tsunami knocked out a good portion of the world's car production, hence the unexpected weakness this year. But Japanese recent industrial production data show that we are now witnessing the second leg of the 'V', the up one, and that should lead to a sudden lurch upward in platinum demand. That could take US car production alone from 13 million units a year to 16 million by 2015. That's a lot of catalytic converters. That assumes that 14.5 million American cars a year are scrapped, requiring almost no new net demand. Surprises will be to the upside.

Jewelry demand for platinum, 95% of which comes from Japan, is also strong, as the global pandemic of gold fever spreads to other precious metals. You can trade Platinum futures on the New York Mercantile Exchange, where one contract gets you exposure to 50 ounces of platinum worth $86,000.

For those who like to get physical, the US mint issued Platinum eagles from 1997-2008 in nominal denominations of $100 (one ounce), $50 (? ounce), $25 (1/4 ounce) and $10 (1/10th ounce) denominations. Stock traders should look at picking up the ETF (PPLT) on the next substantial dip.

-

-

Check Out Gold's Racier Sister