?Each politician pursues self-interest while the common cause imperceptibly decays,? lamented the Greek philosopher and historian, Thucydides.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

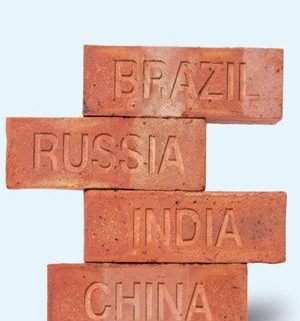

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter, this is music to my ears. By 2018 the combined GDP of the BRIC's, Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that requires is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate.

'BRIC' almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

If you believe that the global financial markets will go back into risk accumulation mode by the end of the summer, as I do, then you probably should use the dip to top up your Brazil position, as it has lagged in the smaller emerging markets so far this year. Jim Chanos, you may be right about a China crash, but you're early by a decade!

Dennis Gartman, of the ever interesting The Gartman Letter, published an interesting analysis on the 'Monday-Friday' effect. If you bought every Friday close last year and sold the Monday close, your return would have been 14.20%, versus a 0.42% return on the S&P 500 (SPX). Virtually all the gains would accrue at the Monday morning gap opening.

If you did the reverse, bought the Monday close and sold the Friday close, then your YTD loss would have been 11.00%. Apparently, the market is paying a huge premium for traders willing to run the weekend risk, which during the financial crisis is when all the disasters occurred. I know of several desks that have been working this trade all year long, with much success. On paper you could have made 25.20% on a non-leveraged basis, and less once you take execution and other frictional costs out.

The longer this works, the more who will pile into it, until it blows up, as all of these purely quantitative approaches always do. This is symptomatic of a market dominated by short terms traders, arbs, and hedge fund where the end investor has fled. Expect things to get worse before they get better. By the way, don't try Googling the word 'exposed'. You'd be shocked, shocked.

I opened the e-mail at my usual wake up time of 4:00 am. President Bill Clinton was playing with Tiger Woods at the Presidents? Cup PGA tournament at the Harding Park Golf Course in San Francisco today. Would I have time for a chat about US economic policy afterwards?

That afternoon, in walked Bill, sunburned from his morning on the links, to chew the fat with some Bay Area business leaders. I can?t say who else was there, but I?ll give you a hint: I was the only one without a NYSE listing.

Bill says that the US needs a new job engine every five to seven years to continue growing. Reagan had the personal computer, he had the Internet, but since then there has been nothing. As a result, new job creation fell from 23 million during his administration to a net job loss of 1.5 million during the Bush years (click here for BLS stats ), causing real standards of living to fall for two thirds of all Americans.

The big challenge is how to bring back the economy without burning up the planet. $1 billion of new spending would create only 870 jobs in a conventional coal fired power plant, but 2,000 jobs for a solar plant, 3,300 for a wind facility, and 6,000 from improved building efficiencies. So creating a new job engine is a matter of political survival for Obama and the Democratic Party.

Bill believes that getting health care costs off the back of corporations is also essential for recovery. As things now stand, all of our net new economic growth is going to cover increased health care costs. And that only gets us an outcome that ranks 25th globally.

Clinton now devotes himself to his Clinton Global Initiative, on non-profit which coordinates inter-governmental cooperation in health care, education, and the environment, and has raised $57 billion for new development projects (click here for their website).

He was incredibly well informed, obviously still has access to confidential intelligence briefings, and rattled off statistics like an M60 machine gun. You really get the impression you are dealing with a Rhodes Scholar. I reminded him of the 1968 anti-war demonstration we both attended in London and he laughed. It?s great to see someone still warding hard, even when they can sit back on their laurels and coast if they choose.

?The one thing that is not safe is the dollar in your pocket. That is certainly going to be worth a lot less over time. The greatest asset to own is your own ability,? said Oracle of Omaha, Warren Buffett, about the European debt crisis.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

I took advantage of an offer to subscribe to your service in early April and in Mid April of this year, received and executed on the Trade Alerts to buy puts on Boeing, IWM, FXE and GLD. Today, May 16th, I followed up on the trade alert and closed the GLD put position with a return of 155%. Overall, on the remaining positions in IWM, BA and FXE I have a 17% return however that may understate the actual return as I also took advantage of your hedge recommendation and sold puts 1:1 against my positions in BA and FXE.

As a technical trader with experience in Forex and commodities, I was drawn to your newsletter first and subsequently to subscribe to your service by your global macro view of the markets and your ability to simply express where a "tradeable opportunity" exists in response to the warp and waft of the fundamentals.

As a subscriber, I have come to appreciate your bi-monthly webinar updates and your balanced commentary, market insights over the short, medium and longer term, along with a healthy dose of risk management. I understand that nobody is right 100% of the time and I appreciate your integrity in taking credit for the wins as well as the loses. Looking forward to a profitable year of trading with MHFT and certainly with the GLD put option trade, I'm off to a good start.

I think MHFT is an excellent investment for experienced individual traders and please feel free to share my comments with prospective subscribers.

Good trading and kind regards,

Richard

Chicago, IL

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.