As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

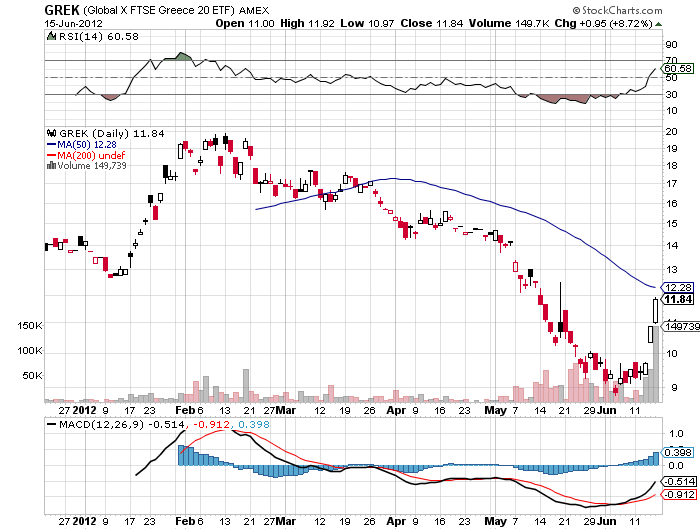

The victory of the centrist pro bailout New Democracy Party in the Sunday Greek elections sparked a furious rally in the overnight Asian markets, much of it driven by hedge fund short covering. The socialist, anti-bailout parties went down in flames. As I write this on Sunday night, the Dow futures are trading up 78 points from the Friday close and the Japanese yen is in free-fall. Too bad that I?m 110% long ?RISK ON? positions in my model portfolio.

That was no surprise as 70% of Greeks want to stay in the EC. The way is now paved for a more civilized workout of the country?s financial problems which spreads austerity out over many more years, making it more tolerable and digestible for its citizens.

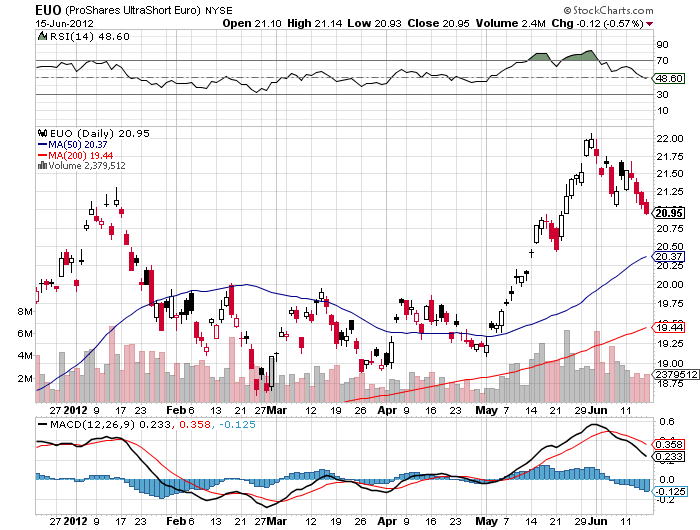

The latest Commitment of Traders report showed the Euro (FXE) (EUO) shorts in the futures hit yet another all-time high, and that the underlying was now worth $20 billion in the foreign exchange market. Shorts in the interbank cash market and ETF?s are thought to be much larger. On top of that, central banks have been seen unloading reserves denominated in Euros.

This witches brew of one-sided positions made up the perfect ingredients for the type of rip-your-face-off, snap back short covering rally that we have seen in past days. This is why I covered my own shorts three weeks ago when it pierced the $126 handle.

Keep in mind that the media has a lot of blood on its hands with its wild over exaggeration in its predictions of the imminent collapse of Greece and its withdrawal from the European Community that was never going to happen. It is focusing 99% of its attention on the Land of Socrates and Plato that accounts for 1% of European GDP. In the meantime, it is ignoring Germany which has 30% of GDP and is still growing, albeit at a slower 1% rate.

CNBC, in particularly, seems to be mercilessly beating this dead horse, holding it out as an example of what will happen to the US if it pursues similar high spending polices. This is why they send a Tea Party activist out to Athens at great expense every week to provide your coverage and to bait the Socialist candidates. They haven?t been this wrong since they reported that the Facebook issue was 30 times oversubscribed in Asia the night before it became the worst IPO in history.

But Greece has about as much in common with America as the US Treasury has with the bankrupt city of Vallejo, California. If anything, Greece is a perfect example of what happens when the wealthy get away with paying no taxes. Anyone with substantial means there stashes their dosh in Swiss bank accounts, leaving only the poor to cough up government revenues. Rich Greeks are just better at it than Americans. After all, they have been practicing for 5,000 years.

Greece is so small that it would be economic for Germany to just pay off half of its national debt just to maintain stability for its largest export markets. Should they spend $270 billion to protect $1.27 trillion in annual exports? It makes sense to me.

And let me give you a little back story here which you probably haven?t heard. Where did all this debt come from? Greedy unions? Careless bureaucrats? Spendthrift socialists? Expensive national health care?? A very big chunk was the result of the 2004 Athens Olympics where the government spent billions on huge sporting facilities and infrastructure that would only be used once and that it could never afford. Who constructed these massive edifices? German engineering firms. I know because I was there. There is always more to the story than the headline.

I hope my guests at my upcoming July 18 Frankfurt strategy luncheon don?t tar and feather me, or whatever they inflict on miscreants there, for expressing this opinion.

All of this is leading up to a great shorting opportunity for the beleaguered European currency. Given the current positive background, it could make it all the way back up to $127.80. That is a neat 50% retracement of the recent move down from $132.80 to $123.00. But be careful not to fall in love with it. The major trend in the Euro is still down, aiming for $1.17. And with a 0.50% interest rate cut by the European Central Bank imminent, that target could be hit sooner than later.

Don?t Fall in Love With the Euro

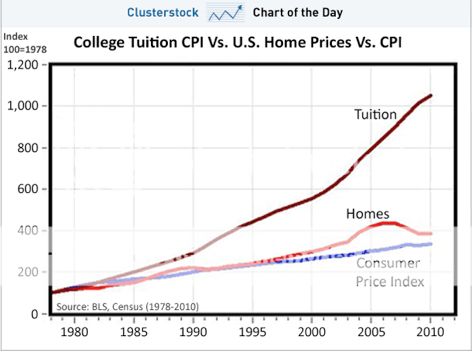

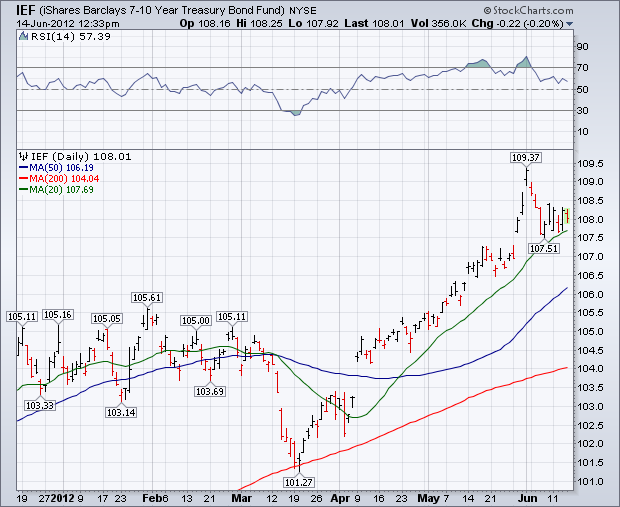

It seems that all you hear about these days is deflation. That is certainly what the bond market is telling us, with my screen blaring at me a miserable 1.58% yield for the ten year Treasury bond.

But there is a new definition for this economic malady that applies to we hapless consumers. In the new deflation, the value of our income falls, while the prices of things we need to buy are going through the roof. It is a particularly pernicious form of deflation, as it is burning our candles at both ends at the same time.

Take a look at the chart below, showing the cost of college tuition versus the consumer price index and home prices. This hits home particularly hard, as I have just put three kids through college, and am reduced to riffling through the sofa cushions looking for spare change or washing windshields at street corners on weekends in order to meet the bills. When I graduated from the University of California in the seventies the tuition was $3,000 a year. Today it is $16,000, and climbing at a 20% annual rate.

The saddest part of the story is that rampant wage deflation means that recent graduates have a grim choice between taking a poorly paid job, or no job at all. That leaves them woefully unable to repay the student loans they ran up to obtain their rapidly devaluing diplomas. The $1 trillion in outstanding student loans is begging to become the next subprime crisis.

And if you were planning on becoming a teacher, forget it, unless you want to move to Saudi Arabia, Russia, or South Korea. After watching tens of millions of jobs get shipped to China over the last decade, did you expect anything less? Just add this problem to the ever lengthening list of ways we are getting screwed.

Deflation Can Be a Bitch!

?For the last 20 days, I feel like I have played psychologist more than I have played money manager,? said financial talk show host, Kyle Harrington.

The wild whipsaw movements in the markets on Thursday reminded us once again how dependent they have become on monetary stimulus from central banks. As if we needed reminding. Almost simultaneously, officials from the US, Japan and the UK hinted at a coordinated move at this weekend?s G-20 meeting in Cabo San Lucas, Mexico.

Let?s hope for the sake of global financial stability that no one eats a bad taco down there. And say ?Hello? to Miguel for me at the notorious drinking establishment, The Giggling Marlin. Just make sure he doesn?t pick your pocket when he hangs you upside down by your ankles with a block and tackle to give you a tequila shot.

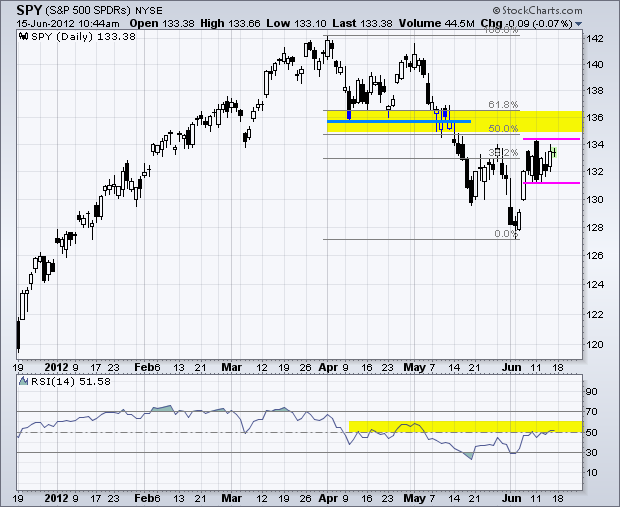

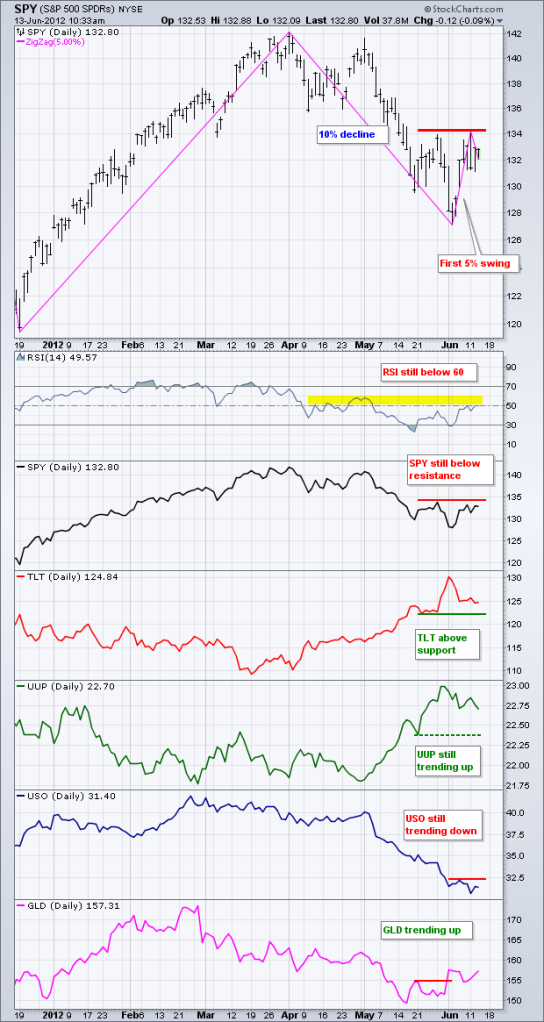

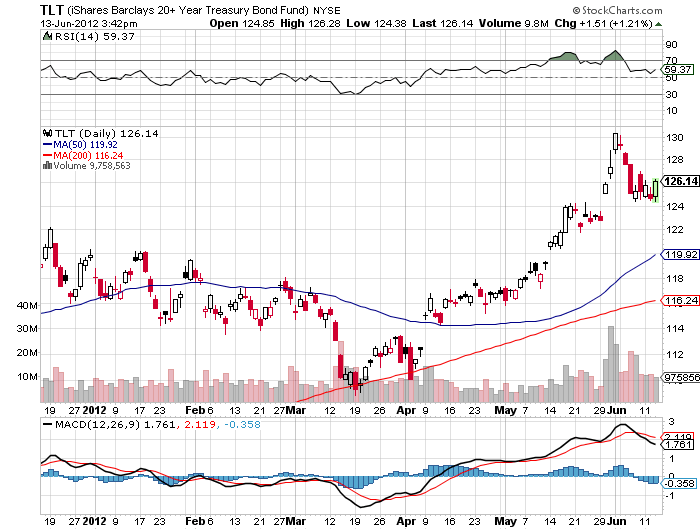

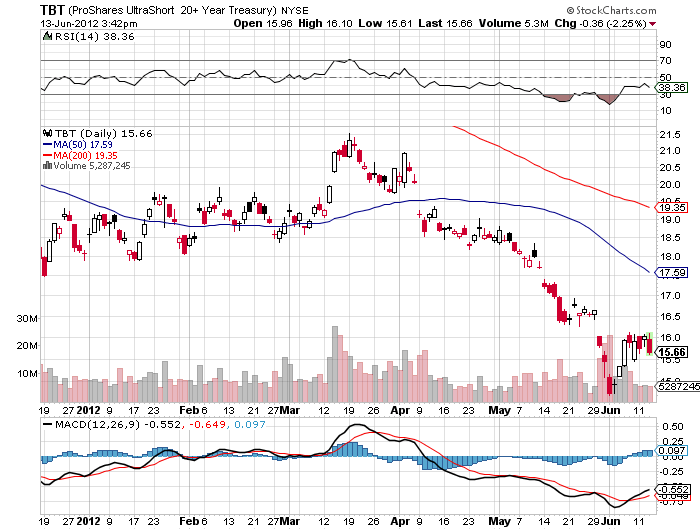

The rumors were enough to cause me to cover my sole remaining short position in the S&P 500 (SPY) and bat out some additional shorts in the Japanese yen, which would go into free fall in such a scenario. If the rumors are true, they will take the (SPX) up to 1,400 and I will make a killing on my hefty long positions in (AAPL), (HPQ), (JPM), (DIS) and shorts in (FXY) and (TLT). If not, then the large cap index will revisit 1,290 one more time and I will be left looking like a dummy while posting an embellished resume on Craig?s List.

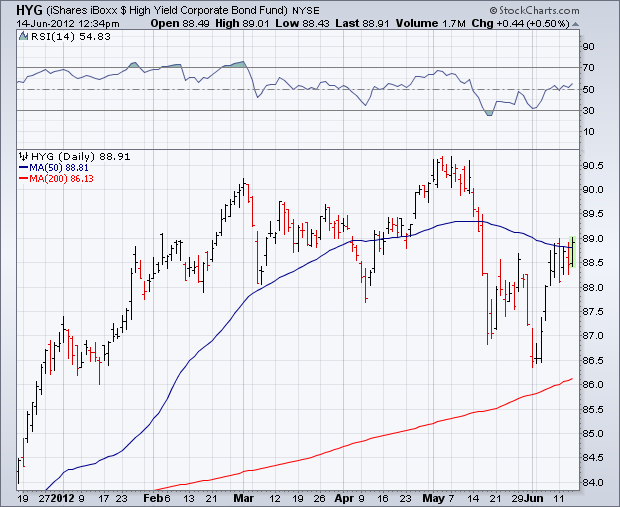

To see how closely risk assets are correlated with quantitative easing, take a look at the chart produced below by my friend, Dennis Gartman of The Gartman Letter. It graphically presents the market response to QE1, QE2, and Operation Twist, which are highlighted in green. In fact, quantitative easing has become the on/off switch of the financial markets. Hence, we get ?RISK ON?/?RISK OFF? gyrations in spades.

While on the topic of monetary policy, let?s consider the implications of a Romney win in the November presidential election. The former Massachusetts governor and son of a Michigan governor has said that he would fire Federal Reserve Governor, Ben Bernanke, on his first day in office.

Well, he actually can?t do that, although it is great fodder for the faithful on the hustings. What he can do is appoint and anti QE, pro-austerity replacement when Ben?s second four year term is up on January 31, 2014. At the top of the list of replacements are Stanford University?s John Taylor of Taylor Rule fame and sitting non-voting board member, president of the Dallas Fed, and noted hawk, Richard Fisher.

How would the financial markets react? Much of the recent buying of stocks and other risk assets has been on the assumption that the ?Bernanke Put? would kick in on any serious selloff. No Bernanke means no Bernanke put. I can already hear portfolio managers thinking ?What, you mean there is risk in these things?? and heading for the exits as quickly as possible. The resulting market crash could make 2008-2009 look like a cakewalk. Your 401k would rapidly shrink to a 201k, and your IRA would become DOA. So be careful what you wish for.

That is unless you are a reader of this letter and a subscriber to my Trade Alert Service. Such a market meltdown would be one of the great shorting opportunities of the century. But to follow the game you have to have a program.

?This is not 2008 or 2009. People are getting overblown with this hysteria. We are only 10% off the highs and have only given back gains. It?s like your wife may have been expecting diamond earrings and now she got a blender,? said Alan Knuckman, chief trading advisor at onestopoption.com.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

I was as stunned as anyone when the yield on the ten year Treasury bond (TLT), (TBT) plummeted to 1.42% two weeks ago. Predictions that long dated government paper would reach subterranean Japanese levels, considered loony as recently as a few months ago, are now donning the mantle of respectability, and even plausibility. Where will this end? With yields at 1.25%, 1%? 0.50%?

As with any ground breaking, epoch making, even cataclysmic change in the fundamental structure in the global financial markets, I searched for the reasons why I didn?t see this coming. How could I be so wrong? What did I miss? I haven?t been this far off base since the term ?blue dress? entered the political lexicon.

Then I looked at the recent ownership of the Treasury bond market and the answer was so obvious that it practically lifted me up by the lapels of my Brioni jacket and shook me until the gold inlays fell out of my teeth. The implications for international finance are huge, and are even bigger for your own net worth.

It turns out that governments have been steadily taking over the global bond market, not just Uncle Sam, but all major countries that have been pursuing quantitative easing. As a result, private ownership of Treasury bonds has shrunk from 55% thirty years ago, to only 23% today. Foreign holders, primarily central banks, have increased their portfolios from 13% to 34% during the same period. The Federal Reserve?s ownership of the Treasury market has soared from 5% to 11% since 2012, thanks to QE1, QE2, and the twist policy.

Therein lays the problem. Governments aren?t like you and I. They are the ultimate ?dumb money?. Once they buy a bond, they don?t care what the price is. They just carry it on their books at face value. They don?t need to mark to market. When debt matures, they just roll it over into similar issues. If you or I tried this, we would go to jail, and possibly even share the same cell.

The bottom line on all of this is that governments are uneconomic, irrational, and even price insensitive buyers. If the price goes up they don?t care. They also don?t do what the rest of us do when prices spike, as they have done, and that is sell. That?s because they don?t have clients like we do. This has created an unnatural market where the demand for government paper is nearly limitless, and the supply is inadequate.

Using this analysis, the big surprise is not that ten year yields hit 1.42%, but that they took so long to get there. This also suggests that bond interest rates will stay unbelievably low far longer than anyone realizes, possibly for years more.

There is another angle to this, which the pols on Capitol Hill failed to recognize. As a result of the new Dodd-Frank financial regulation bill, many derivatives contracts will become marginable for the first time. With the aggregate amount of such contracts estimated at $700 trillion, even just a minimal 1% collateral requirement would automatically create $7 trillion in potential Treasury paper buying.

That is little less than half the current $15 trillion national debt. In fact, it was massive government mandated bond buying in Japan just like this that kept interest rates so low there for so long. I know because I have written three books on this topic.

Much of the current political debate revolves around the belief that the US government is borrowing too much money. But the markets are screaming at us that the complete opposite is true. It is not borrowing enough. There is in fact a global savings glut and bond shortage that looks to get worse before it gets better. As for the monstrous, untamable inflation that such high levels of borrowing created in the past, like the Loch Ness Monster, the Yeti, and Bigfoot, and I?ll believe it when I see it.

Look, There Goes Inflation

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.