?We?ve seen the S&P 500 drop 50% twice in the last decade. That is the new normal?, said Richard Kang of Emerging Global Advisors.

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Frankfurt, Germany on Wednesday, July 18, 2012. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $279.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a prestigious private club not far from the Botanical Gardens, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?LUNCHEONS?.

?Free choice is not relevant in financial markets because there are too many players. A stock with a million holders is much more predictable than one with five,? said Charles Nenner, of Charles Nenner Research in Amsterdam."

If you have been living in a cave for the last 72 years and missed the work of management guru, Peter F. Drucker, here is your chance to catch up. I just finished reading The Essential Drucker, a weighty tome of 368 pages which summarized the high points and pearls of wisdom of the author's 38 books published since 1939.

A self-described 'social ecologist', Drucker was a journalist who moved to Germany because job prospects in his native Austria-Hungary were so poor following its defeat in WWI. He became a close friend of Austrian economist Joseph Schumpeter, who popularized the term 'creative destruction,' and attended lectures by John Maynard Keynes. He fled to the US in 1934 after his writings were burned by the Nazis.

For most of human history, armies were the predominant management model, and most corporations today show the military influence. Management only emerged as a science during the 1920's, and Drucker was one of the founding fathers. Early adopters, like Coca Cola, Du Pont, IBM, and General Electric, went on to prosper mightily.

He observed that Franklin Delano Roosevelt set up the most productive administration in history. Taking even a single step was so painful for him that he, and all those who worked around him, had to organize the government with the maximum efficiency possible. This was a key element in America's victory in WWII.

Drucker writes at length on the risks and opportunities of entrepreneurship, and argues that all companies must innovate, or die, no matter how pedestrian their product. He predicted many of the trends that came to dominate the late 20th and early 21st century, such as privatization, decentralization, globalization, and the rise of the knowledge worker. He had a huge following when I was in Japan during the seventies, and his mark can be seen in today's global presence of the major Japanese keiretsu.

While most define a company in terms of producing products and making a profit, Drucker sees its mission as 'creating a customer.' He presents a rigorous process for decision making. He lauds nonprofits as the best run organizations in the country because they have to be. Groups like the Girl Scouts, the Red Cross, and United Way maintain an effective global presence without paying their people any money. He makes the distinction between efficiency and effectiveness; doing things well, versus doing the right thing.

Anyone who manages any business of whatever size, from a Fortune 500 company to a single individual banging away on a PC at home, will benefit from reading this book. It forces you to take a look at your own operation with a fresh set of eyes. It even advises on how to manage one's own time, from dispensing with unnecessary meetings to minimizing paperwork and bureaucracy.

Drucker moved to California during the seventies, where he set up one of the early MBA programs for Claremont College. He died in 2005 at the age of 96. To obtain preferential pricing from Amazon for this insightful book, please click here.

?We are still in the gravitational pull of the Great Recession. I would have to put the likelihood of a double dip recession now up to 50%,? said my old UC Berkeley economics professor, Robert

?Earnings models that have worked over the last 10, 20, or 30 years don?t hold water anymore,? said Paul Schatz, president of Heritage Capital.

Feel Like Investing in a State Sponsor of Terrorism? How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world?s highest AIDs rates, endures regular insurrections where all of the Westerners get massacred, and racked up 5 million dead in a continuous civil war?

Then, Africa is the place for you, the world?s largest source of gold, diamonds, chocolate, and cobalt! The countries above are Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms.

Goldman Sachs has set up Emerging Capital Partners, which has already invested $2 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa?s Standard Bank, the largest on the continent. There are now thought to be over one million Chinese agricultural workers in Africa.

In fact, foreign direct investment last year jumped from $53 billion to $61 billion, while cross border M & A leapt from $10.2 billion to $26.3 billion. The angle here is that all of the terrible headlines above are in the price, that prices are very low, and the perceived risk is much greater than actual risk.

Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of. These numbers remind me of those found in Japan during the fifties, right after it lost WWII.

The reality is that Africa?s 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies. The big plays are your classic early emerging market targets, like banking, telecommunications, electric power, and other infrastructure.

For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It?s like the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high.

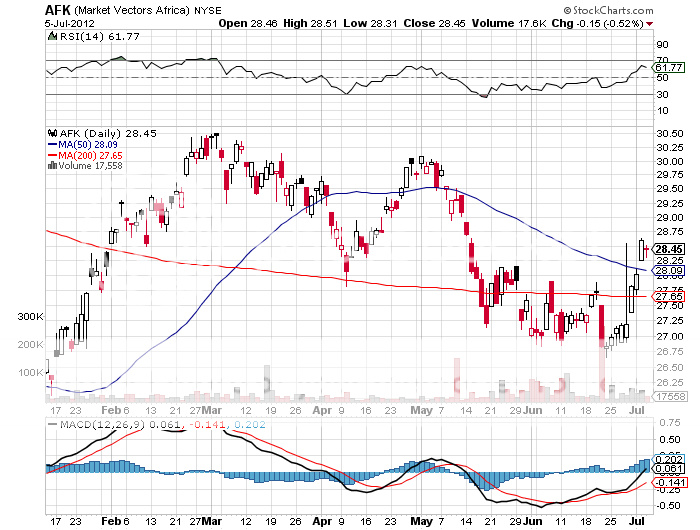

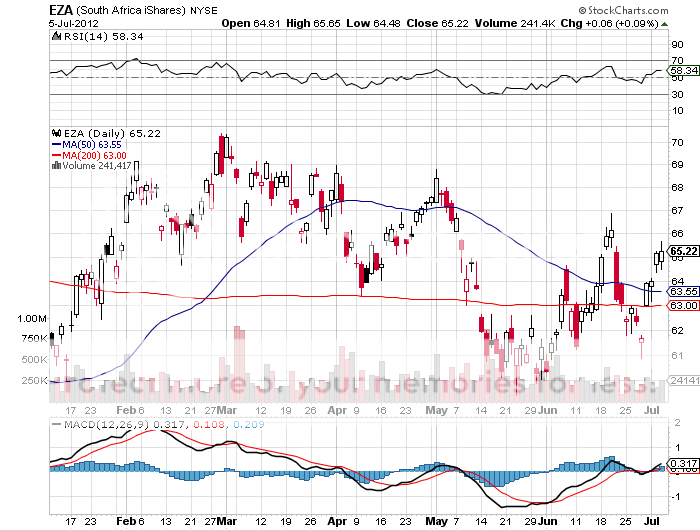

This is definitely not for day traders. If you are willing to give up a lot of short term liquidity for a high long term return, then look at the Market Vectors Africa Index ETF (AFK), which has 29% of its holdings in South Africa and 20% in Nigeria. There is also the SPDR S&P Emerging Middle East & Africa ETF (GAF). For more of a rifle shot, entertain the iShares MSCI South Africa Index Fund (EZA).

Meet Your New Partner

Where is the 2012 London Olympics turning to meet gargantuan cost overruns? None other than BP, which is going the extra mile to burnish its tarnished image.

With the British economy mired in a vicious financial crisis, many are wondering if hosting the games was such a great idea. The original plan was to convert the one square mile, Lower Lea Valley site into a new suburb, and sell the condos to speculative buyers at high prices.

Market conditions today couldn?t be more hostile. Cost overruns have pushed the budget from $4.9 billion to a back breaking $14 billion. It turns out that protecting a global audience from suicide bombers doesn?t come cheap. The East London neighborhood is so bad that ?when you take the tube out there, life expectancy declines with every stop,? said one staffer.

A profusion of undiscovered WWII bombs, a Stone Age cemetery, and a toxic waste dump have also caused delays. When I lived in England I flew over this area weekly to skirt the Eastern edge of the London air traffic control zone, and I will be charitable in calling this place an industrial wasteland.

The last time the British attempted a major project like this, the 2000 Millennium Park, multibillion dollar losses resulted. But who can forget that great film Chariots of Fire, which idolized the success of British runners in the 1924 Olympics? Maybe it?s worth it for the Brits after all? Just watch that delegation from Afghanistan carefully.

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations (click here for the story).

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation. What are its conclusions today? The Swiss franc, the Brazilian real, and the Euro are overvalued, while the Hong Kong dollar, the Chinese Yuan, and the Thai Baht are cheap.

I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

The Big Mac in Yen is Definitely Not a Buy

?When the fools are dancing, the greater fools are watching,? according to an old Japanese proverb.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.