That is what the head of Greece?s opposition party said this morning in the wake of elections where voters resoundingly rejected austerity in any way, shape, or form. Ditto for France, where the Socialists rode a wave of resentment against the incumbent conservative government. Looks like I will have to pack a red scarf and schedule some time for manning the barricades during my upcoming Paris strategy luncheon. My front teeth are still kicking around somewhere on the Left Bank from the last time this happened, in 1968.

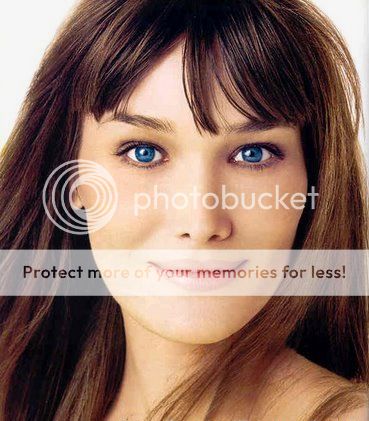

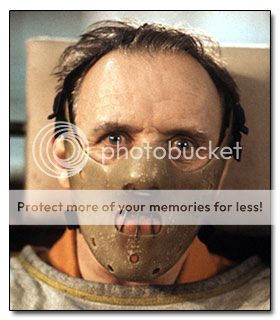

The results couldn?t have been more decisive, with president Francois Hollande capturing 51.7% compared to a stumbling 48.3% for Nicolas Sarkozy. Sarkozy conceded defeat five minutes after the polls closed, and presumably went back to the ?lys?e Palace with his fashion model wife, Carla, to start packing. After studying Carla?s picture below for a considerable amount of time, I would have to say that Sarkozy was the real winner of this election, as he now has plenty of free time to spend at home.

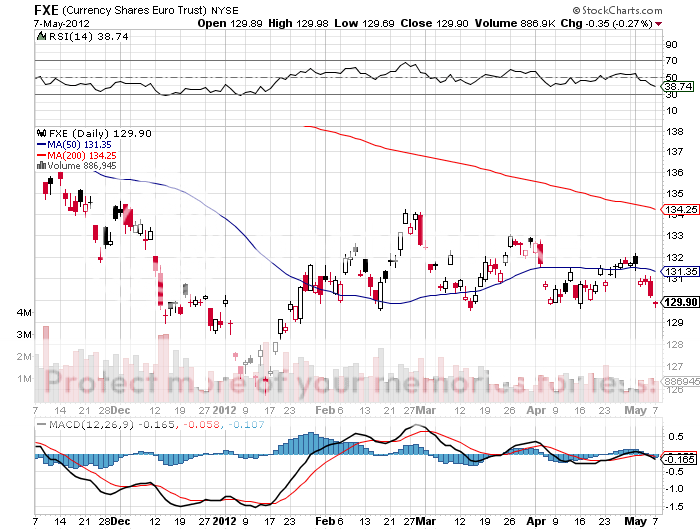

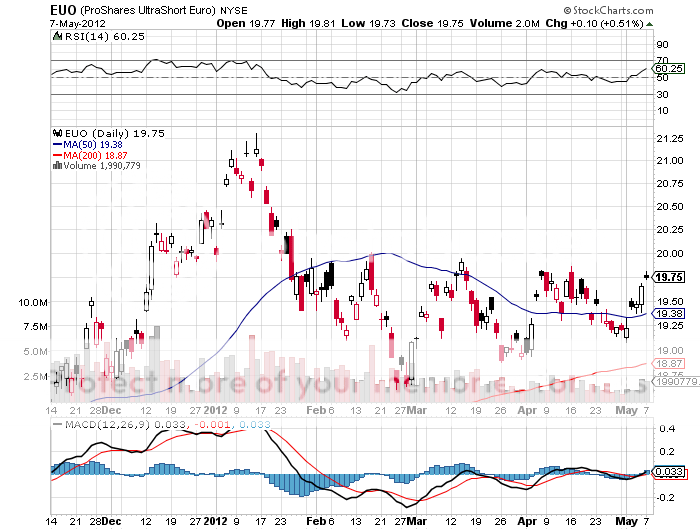

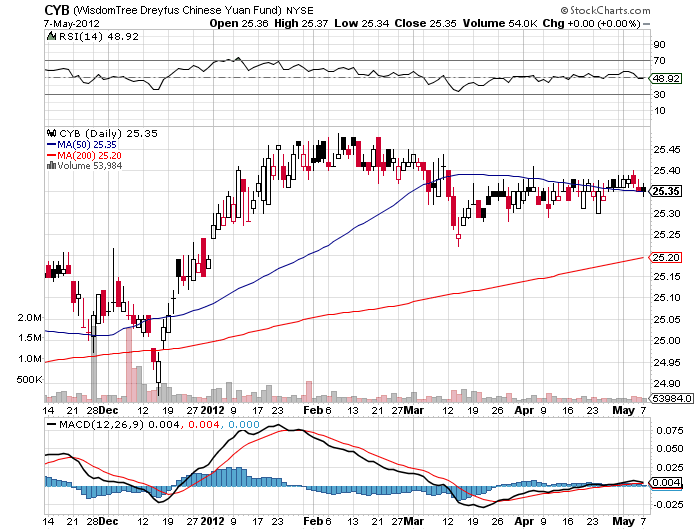

It turns out that I was also a winner of the French elections, as I went into them short the Russell 2000 (IWM), the Euro (FXE), Boeing (BA), Pulte Homes (PHM), and US Treasury bonds (TBT). Overnight, the S&P 500 (SPX) traded all the way down to 1,354 before rebounding during US time, putting 1,325 on the table.

Only my short in the Yen (FXY) came back to bite me, and that was just a nibble. I also used the big volatility spike last week to establish substantial short volatility positions which are doing quite well today. I think we may be able to really coin it in coming weeks with these positions, before the summer doldrums set in.

Longer term, I believe that the outcome of the weekend European elections will be a longer period of uncertainty with greater volatility for financial markets. If Europe kept you awake at nine before, now you have even more reasons to become a late nigh TV rerun addict.

French First Lady Carla Says Good Riddance