As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

That is the conundrum facing traders, investors, and individuals as we enter the new quarter. For some hedge fund managers, Q1, 2012 was clearly the quarter from hell.

I have been in the market for four decades, long enough to collect an encyclopedia worth of words of wisdom. One of my favorites has always been ?Sell in May and Go? away. On close inspection you?ll find there is more than a modicum of truth is this time worn expression.

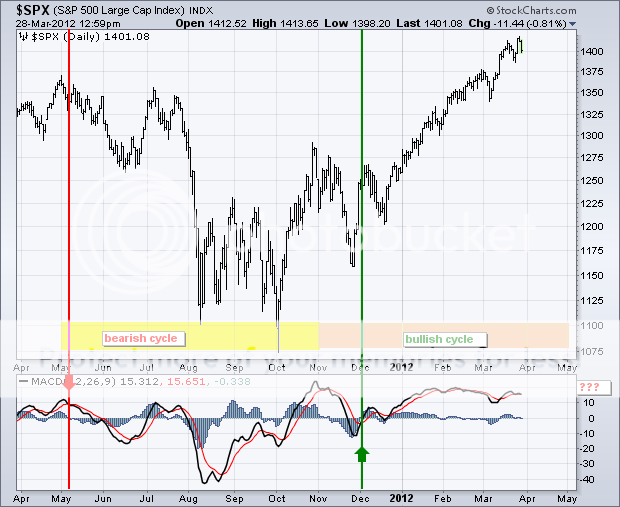

Refer to your handy Stock Traders Almanac and you?ll find that for the last 50 years the index yielded a paltry 1% return from May to October. From November to April it brought in a far healthier 7% return.

This explains why you find me with my shoulder to the grindstone from during the winter, and jetting about from Baden Baden to Monte Carlo and Zermatt in the summers. Take away the holidays and this is really a four month a year job.

My friends at StockCharts.com put together the data from the last ten years, and the conclusions on the chart below are pretty undeniable. They have marked every May with a red arrow and Novembers with green arrows.

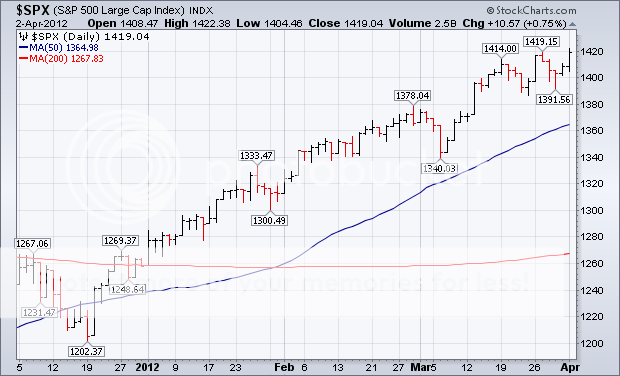

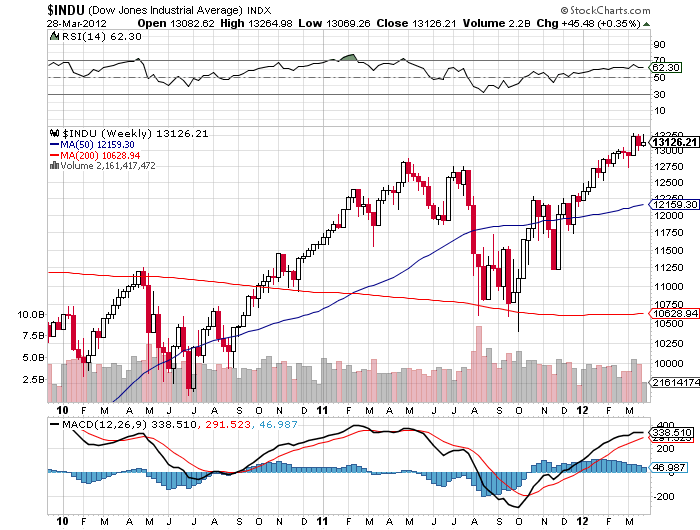

What is unusual this year is that we are going into the traditional May peak on top of a prodigious 12 % gain in the S&P 500, one of the sturdiest moves in history. History also shows that the bigger the move going into the April peak, the more savage the correction that follows. What do they say in golf? Fore?

Being a long time student of the American, and indeed, the world economy, I have long had a theory behind the regularity of this cycle. It?s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920?s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall, when their outlays for seed, fertilizer, and labor were at a maximum, but they had yet to earn any income from the sale of their crops. So they had to all borrow at once, placing a large call on the financial system as a whole. This is why we have seen so many stock market crashes in October. Once the system swallows this lump, its nothing but green lights for six months.

Once the cycle was set and easily identifiable by low end computer algorithms, the trend became a self fulfilling prophesy. Yes, it may be disturbing to learn that we ardent stock market practitioners may in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

Are the Bull?s Days Numbered?

You know how I love second helpings, especially when the sushi bar is involved. I especially like unagi, or cooked eel, which is said to be an oriental aphrodisiac.

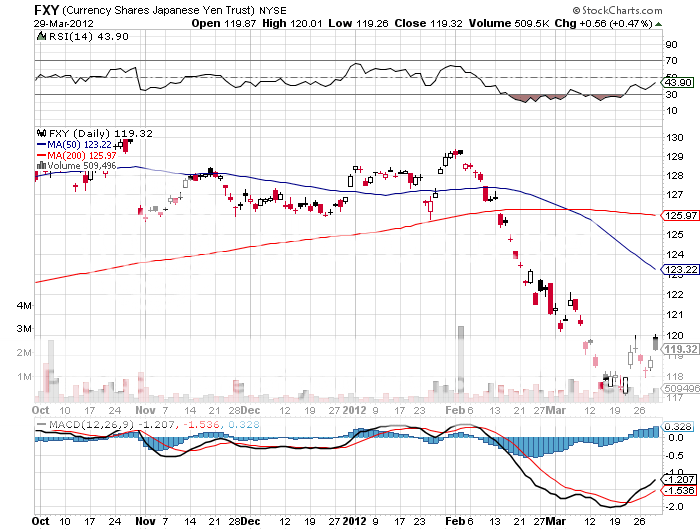

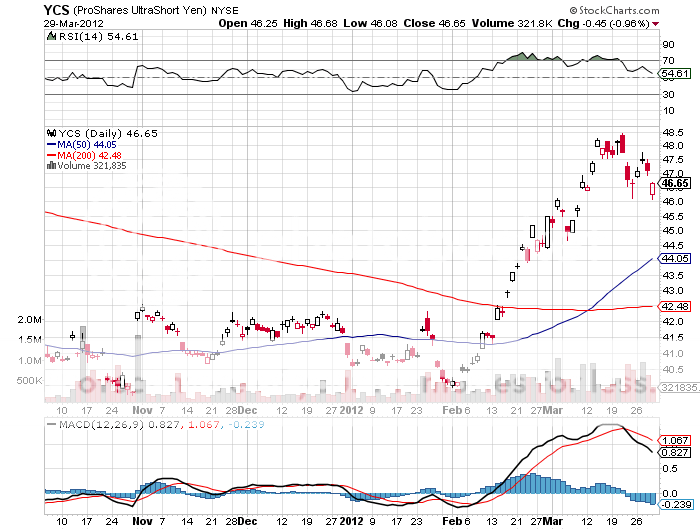

I am going to take advantage of Japan?s fiscal year end book closing on March 30 to reenter my short position of the Japanese yen. This is the one time a year when Japanese corporations suddenly repatriate yen back to Japan to beef up the cash on their books for their annual reports. Every year, this creates a quick boost to the yen against the US dollar which fades away in the following weeks like so much smoke.

Like everything else this year, the yen has had a straight line move since I put out my last call to sell the yen at the end of January. So while I made a nice profit on the first trade, I was never given another chance to reenter on the way down. Now I have that opportunity.

Since the yen bottomed on March 21, it has given back 25% of the move. Sure, I would prefer to get back in on the traditional one third pull back. But there are so few attractive trading opportunities out there right now that I am happy to jump the gun. If the yen strengthens more from here I will simply double up the position. This is a trade that I?ll be happy to live with for a while.

I have hammered away at the structural weakness of the Japanese economy ad nauseum for the past year. The one liner is that buyers of the country?s 1% yielding ten year bonds are dying off in droves, it has the world?s worst debt to GDP ratio, and labors under an Armageddon like demographic burden. It doesn?t help that they haven?t invested anything new since Godzilla ate the big screen. Sony (SNE) should have become Apple (AAPL). For those who wish to undertake a refresher course, please read the research pieces listed below:

* ?Momentum is Building for the Yen Shorts? on March 26 at http://madhedgefundradio.com/momentum-is-building-for-the-yen-shorts/

*? ?Nikkei Shows the Yen Move is Real? on February 20 at http://madhedgefundradio.com/nikkei-shows-the-yen-move-is-real/

*? ?Global Trading Dispatch Hits 64%, 11 Day Home Run on Yen Short? on February 13 at

http://madhedgefundradio.com/global-trading-dispatch-hits-64-11-day-home-run-on-yen-short/

*? ?Rumblings in Tokyo? on February 5 at http://madhedgefundradio.com/rumblings-in-tokyo/

*? ?Is This the Chink in Japan?s Armor?? on January 29 at http://madhedgefundradio.com/is-this-the-chink-in-japans-armor/

My preferred instrument here is the Currency Shares Japanese Yen Trust ETF (FXY) , where I will be buying the June, 2012 puts. At the very least, the (FXY) should make it back down to $117 in the near future, a price we visited just a week ago, which should give you a quickie 70%? return on the June $120 puts.

For those who are unwilling or unable to play in the options space, you can invest in the ProShares Ultra Yen Short ETF (YCS), a 2X leveraged bet that the yen falls against the dollar.

Do I hear Any Bids?

Japan?s Last Good Invention

This time I am going to start with the fundamental argument first, then follow up with the Trade Alert.

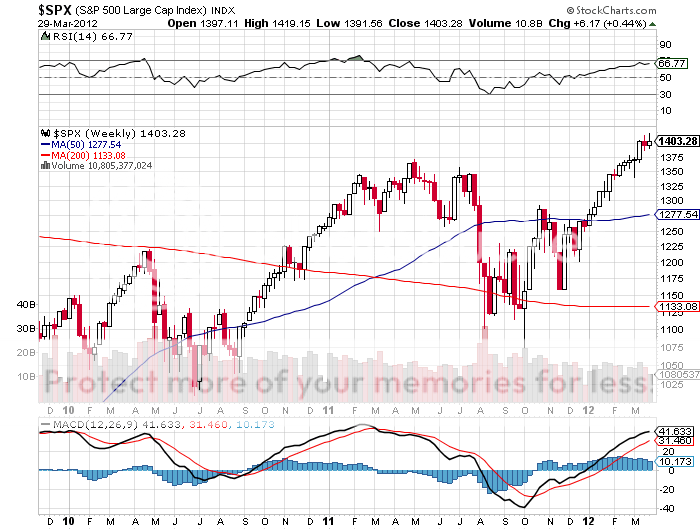

We are getting perilously close to a substantial pull back in global risk assets. While this has already started in commodities, the ags, oil, copper, and precious metals, we have yet to see the whites of their eyes in equities. I believe at these levels stocks are the planet?s most overvalued assets, at least on a short term trading basis. So I have begun more aggressively searching for plays that would benefit from substantial moves southward.

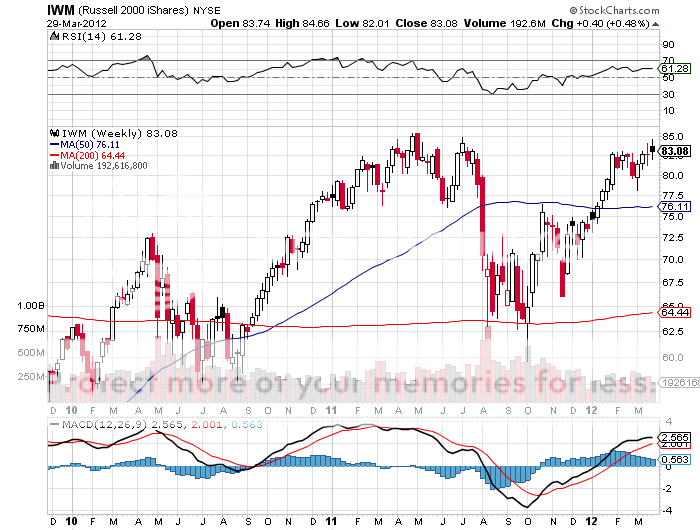

My personal preference is to gain downside exposure on small capitalization stocks. You can achieve this through buying put options on the Russell 2000 iShares ETF (IWM).

You have several things going for you in falling markets with this ETF. Small stocks are illiquid and therefore suffer the biggest pullback during market corrections. If Heaven forbid, double dip fears return this summer, small caps will fall the farthest and the fastest. They are most dependent on outside financing which rapidly dries up during times of economic distress.

You can see this clearly during last year?s summer swoon. The last time we thought the world was going to end, the (SPX) fell by 20% while the (IWM) plunged by 29.5%. This means that small cap stocks are likely to deliver 150% of the downside compared to big cap stocks. Making money then with shorts in the (IWM) was like shooting fish in a barrel.

You see this on the upside as well. Since the October, 2011 lows, the (SPX) leapt by 30% compared to a much more virile 38% move by (IWM). The (IWM) really does present the scenario where the smaller (or higher) they are, the harder they fall.

If you go into the options market you get this extra volatility at a discount. June at-the-money puts for the (SPY) carry an implied volatility of 15%, compared to 20% for the (IWM) puts. That means you get 50% more anticipated movement in the index for a premium of only 33%.

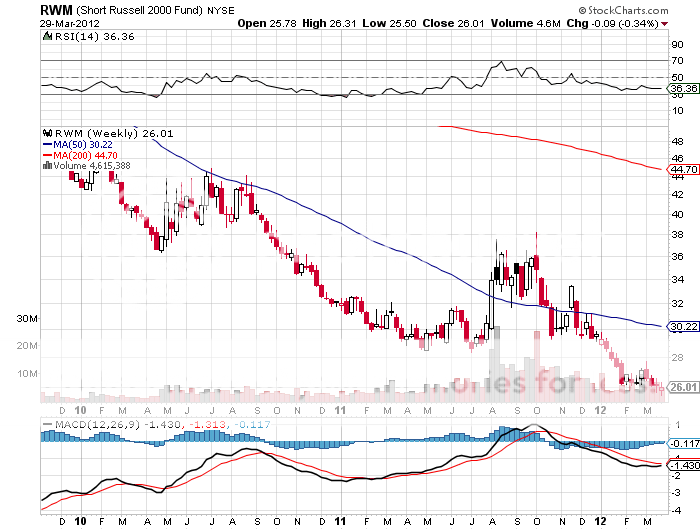

For those who wish to avoid options, you can buy the inverse ETF on the sector, the (RWM). But the liquidity for this instrument is a mere shadow of its upside cousin, the (IWM). You are better off shorting the (IWM) than buying the (RWM).

These Look Pretty Interesting

The handful of Chinese army officers I huddled with in the underground bunker all stared intently at their watches. Three, two, one, and then KABOOM! At exactly 12:00 noon, the blast of distant artillery sent a five inch shell screaming over our heads and exploded into the hill above us. The ground shook under our feet, causing dust to drift down from the concrete ceiling above us. It was 1976, and The People's Republic of China just let lose its daily symbolic protest against its errant rebellious province, known locally as the Republic of China, and to you and me, as Taiwan.

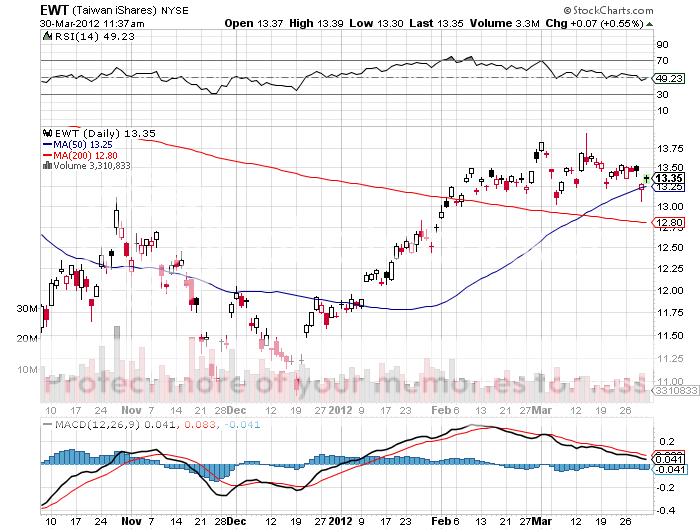

Fast forward 36 years later and the Middle Kingdom is sending salvos of money raining down on that prosperous island. Two years ago, China Mobile (CHL), the world's largest cell phone company, bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represented the first ever direct investment from China into Taiwan. The move triggered a takeover binge by big Chinese companies of their offshore cousins.

It was only a few years ago Taiwanese businessmen suffered long prison terms for just visiting, let alone investing in China, which they have done in a major, but surreptitious way, for 30 years. Readers of this letter are well aware of the long term attraction of both of these countries, which see GDP growth rates at a multiple of our own.

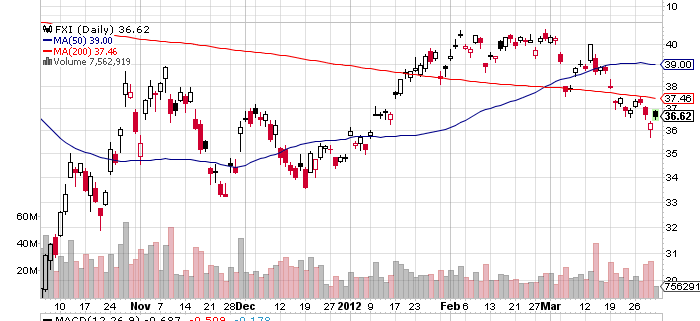

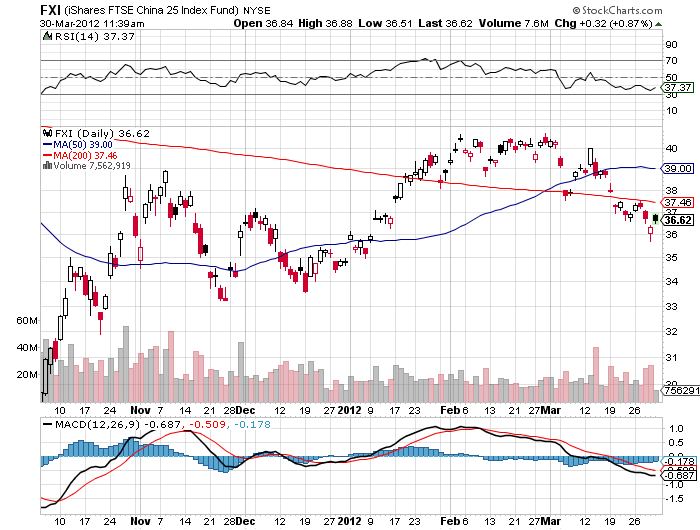

Closer ties between China and Taiwan auger well for the stock markets of the two high growth countries. The iShares MSCI Taiwan fund ETF (EWT) jumped by 17% in Q1, 2012. The iShares FTSE China 25 Index (FXI) has done less well, up 5%, as the country grapples with a temporarily slowing economy. At some stage, a country that is growing at four times our own rate, but at the same earnings multiple, will be a buy. But it appears not yet.

In the meantime, I guess that Beijing figured out that if you can't beat them, buy them. The proxy takeover bid is mightier than the sword.

?It's very difficult to navigate a business through a paradigm shift. You must hard wire your system to second guess all the time, questioning what is next, and then what is next. You've got to retain optionality for both investment portfolios and the business your run to navigate this well,? said Mohamed El-Erian, co-chairman of the bond house PIMCO.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

A few years ago, I went to a charity fund raiser at San Francisco's priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war for one of the Bay Area's premier hotties, who shall remain nameless. She?s happily married to a tech titan now, and gentlemen don?t tell. Suffice it to say, she has a sports stadium named after her.

The bids soared to $10,000, $11,000, $12,000. After all, it was for a good cause. But when it hit $12,400, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer's remorse came to me and offered his date back to me for $12,000.? I said ?no thanks.? $11,000, $10,000, $9,000?? I passed.

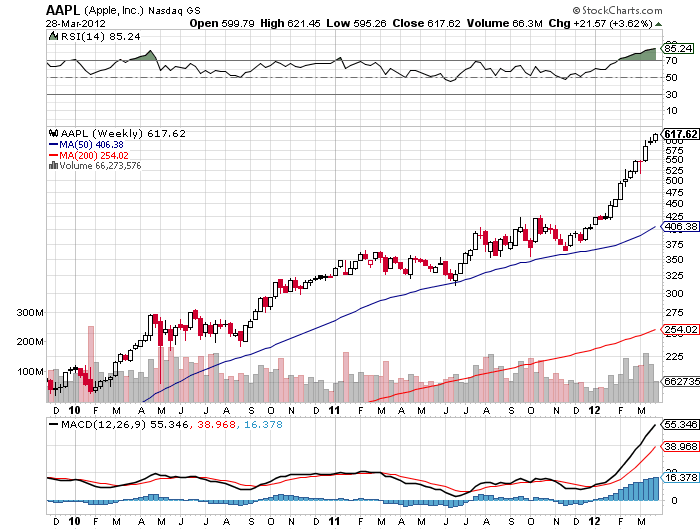

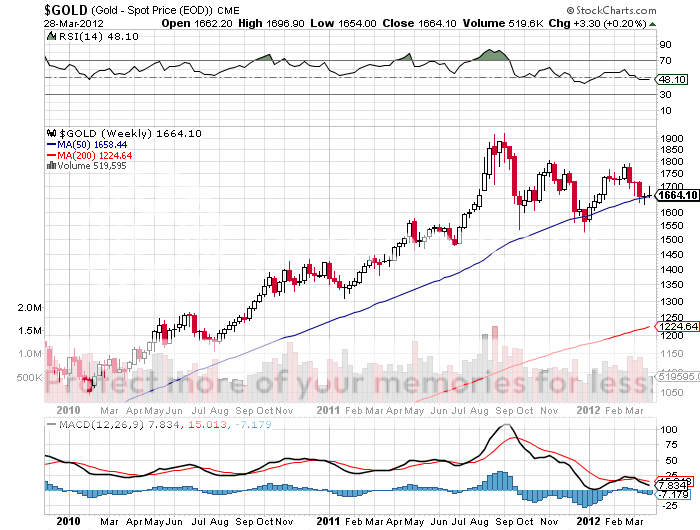

The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,900, oil, from $35 to $110, and Apple (AAPL) from $200 to $610, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I have a feeling that those who loaded up on stocks in March may develop the same sort of buyer?s remorse that I witnessed at Shreve?s.

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me, ?There is a time to fish, and a time to hang your nets out to dry.?

At least then I'll have plenty of dry powder for when the window of opportunity reopens for business. So while I'm mending my nets, I'll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

See Any Similarity?

Time to Mend the Nets

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.