Global Market Comments

July 31, 2013

Fiat Lux

Featured Trade:

(REPORT FROM BERLIN),

(A SHORT HISTORY OF HEDGE FUNDS),

(FAREWELL TO SENATOR DANIEL INOUE)

I am sitting at my MacBook Pro typing this piece in the corner Suite on the sixth floor of the Hotel Adlon in Berlin.

A half finished bottle of 2001 Chateau Pech sits on my desk, a product of the French Mediterranean coast. Out the window hundreds of tourists are milling about the imposing Brandenburg Gate, taking pictures, posing with costumed cartoon characters, or texting their friends.

It is a scene of no small emotional importance for myself. I came here as a teenager to study German in the 1960?s. The Berlin wall had just gone up dividing the city in half, threatening the world with the prospect of global thermonuclear war.

I lived in the American Sector in Tiergarten, a mile from the hated wall, and recall with some dread, being kept awake at night by the angry growl of machine guns cutting down desperate, but helpless families as they attempted to flee to the West. That makes quite an impression on a young kid.

To make extra money, I used to escort small groups of nervous Americans through Checkpoint Charlie into East Berlin for a day of lunch, a visit to Queen Nefertiti at the spectacular Pergamum Museum, and the opera. I paid for it all with East German Marks that I purchased at a 75% discount on the black market, and that I smuggled into the communist territory in my boots.

You see, I?ve been in this currency game for quite a long time now. That was my first currency arbitrage, and it led to a pattern of ever-greater risk taking that could eventually lead nowhere else but the hedge fund industry.

About one third of East Berlin still awaited reconstruction from the Allied bombing and the 1945 Russian invasion that laid waste to the city, with every East facing wall still standing absolutely pock marked with bullet holes. As up to 10% of the bombs failed to explode, construction companies were still digging them up at the rate of three a week. Occasionally, they exploded and killed the workers.

My dalliance with the cold war was brought to an abrupt end when the Stasi caught me trying to sneak in a copy of the banned Berliner Zeitung newspaper, which landed me in an East German prison for a day. The hapless people I met there! Thank goodness they let me out, because I was only 16!

Some 21 years later, tears streamed down my cheeks as I watched the wall fall on a TV screen at a Swiss Bank Corp trading desk in London. I immediately flew over to Templehof to join the party, taking my turn with a sledgehammer at the crumbling reinforced concrete barrier with great pleasure.

The dominoes then fell. The Soviet Union collapsed shortly thereafter, and China quietly turned capitalist, enabling two thirds of the world's population to join the international economy. Globalization was born, followed by the Internet and the World Wide Web.

That led to the peace dividend, which helped finance the nineties dotcom bubble, and opened up new international trading opportunities on which the early hedge funds feasted to the point of gluttony. Ahhh, those where the days!

Only eight years later, Europe moved to establish a single currency bloc, creating the Euro, and confining the mark, the francs, the lira, peseta, drachma, guilder, and escuedo to the dustbin of history. Only the British pound, the Swiss franc, and the Scandinavian kroner were left standing. That demolished the intra European currency trade, said to be worth about $5 billion a year, and realigned the world into the big currency blocks of the dollar, euro, and yen.

Some 45 years later, I rode my rented bicycle over the site of the old wall, through the Brandenberg Gate, across the area once known as the ?death strip? and into ?no man?s land?, putting me at the front door of my hotel. The guard towers and searchlights were gone. The statue of Vicktoria, the goddess of triumph riding a chariot with four horses, on top of the gate, now faced west instead of east. It was all very satisfying and humbling, if not invigorating.

Checkpoint Charlie, where American and Soviet tanks faced off and almost started WWIII three times, is now a tourist attraction. The building where I was imprisoned, wondering if I would live another day, is now a McDonalds hamburger stand.

That?s the way it works. You lose the cold war and have to eat our crappy cheeseburgers and sell the tourists pieces of your old wall.

Talk about life going full circle.

Up Goes the Wall

Up Goes the Wall

Down Goes the Wall

Down Goes the Wall

Legendary Fortune Magazine editor, Winslow Jones, created the first hedge fund out of a shabby office on Broadway in New York City in 1948, and generated monster returns over the next 20 years. He got the idea of a 20% performance bonus, now an industry standard, from ancient Phoenician sea captains who kept a fifth of the profits from successful voyages. Jones must have had an historical bent.

Then came the second generation titans, George Soros, Julian Robertson, and Michael Steinhardt, who made their debut in the sixties. I count myself among the third generation along with Paul Tudor Jones and Louis Bacon, who launched funds in the late eighties, when there were still fewer than 200 funds and $25 million was still considered a lot of money. The really big money showed up in the nineties when the pension funds found them.

After that, we suffered through the many ordeals that followed, including the collapse of Long Term Capital in 1995, the Amaranth blow up in natural gas in 2006, the Lehman Brothers bankruptcy in 2008, and John Paulson?s 50% draw down in 2011. Today there are over 8,000 hedge funds, thought to manage some $2.2 trillion, which dominate all financial markets.

Hedge Funds Do Have Their Advantages

I was greatly saddened when I had learned of the passing of Senator Daniel Inoue of Hawaii, the Senate?s longest serving member, and a close friend. After 50 years last August the legislative body had come to dominate the all powerful Ways and Means Committee, eventually becoming the President Pro Tem. He was 88 when he died.

As a young correspondent for The Economist magazine, I was sent to New York to cover the 1980 Democratic convention, where Senator Ted Kennedy was attempting to wrest the nomination from President Jimmy Carter. It was there that I met the young, up and coming Governor of Arkansas, Bill Clinton, and his assertive wife, Hillary, for the first time. As a bonus, I snared an exclusive interview with Treasury Secretary G. William Miller, who graciously signed one of his dollar bills for me.

As I had spent the past decade in Tokyo, the organizers didn?t know what to do with me, so they seated me next to the only Japanese-American member of the Senate, Daniel Inoue. As the long speeches droned on, we talked about every topic under the sun. As a second generation Nissei, his Japanese was still passable, but dated, so we used that tongue when ever covering sensitive subjects. An endless procession of admirers passed by awkwardly shaking his left hand, the right having been lost in battle in WWII.

Inoue was working at Pearl Harbor when the Japanese Navy carried out their infamous December 7 attack. As a Hawaiian resident, he avoided internment suffered by mainland Japanese Americans. He later joined the 442 Regimental Combat Team made of Japanese Americans to fight in Europe.

While assaulting the impenetrable German Gothic Line in Northern Italy, an enemy rifle grenade severed his right arm. He pried a live grenade out of the useless hand with his remaining good one and threw it at a machine gun nest, destroying the position, despite having been shot in the stomach. What guts! He was later awarded the Medal of Honor for this action, and I often saw him at reunions while accompanying my Uncle Mitch, a Medal winner himself (click here for ?Tribute to a True Veteran?).

After the convention, Daniel was always my first stop during my frequent visits to Washington DC. Through him, I learned of the intricate inner workings and machinations that regularly occur on the Hill. While most in the financial community are confused and befuddled by what is going on there now, for me, it is all clear as day, thanks to the breadth of knowledge and understanding I gained from Inoue.

Daniel was a young Honolulu boy who eventually became third in line to succeed the President of the United Sates. Modest, yet outgoing, he hung on every word you said, as if you were the most important person in the world. An ?old style? politician, a true gentleman, a hero, and a patriot. He is sorely missed.

Global Market Comments

July 30, 2013

Fiat Lux

Featured Trade:

(REPORT FROM VENICE),

(AN EVENING WITH TRAVEL GURU ARTHUR FROMMER)

Travel guru, Arthur Frommer, says that now is the best time to travel in 20 years, thanks to a combination of a strong dollar and desperate price-cutting forced by the recession.

Five years after oil hit an historic peak at $148/barrel, when $500 fuel surcharges abounded, and the demise of the travel industry was widely predicted, costs in some countries, like Mexico and Costa Rica are 50% lower than a year ago. Talk about price elasticity with a turbocharger!

Frommer believes there are three sea change trends going on today. Business is moving away from the big three travel websites, Travelocity, Orbitz, and Priceline, who have more preferential side deals with airlines than can be counted, towards pure aggregator sites that almost always offer cheaper fares, like Kayak.com, Momondo.com, and travel.yahoo.com.

There is a move away from traditional 48 person escorted bus tours towards small group adventures, like those offered by Gap Adventures, Intrepid Tours, and Adventure Center, that take parties of 12 or less on eye opening public transportation.

There has also been a huge surge in programs offered by universities that turn travelers into students for a week to study the liberal arts at Oxford, Cambridge, and UC Berkeley. His favorite was the Great Books programs offered by St. Johns University in Santa Fe, New Mexico. He says that the Internet has given a huge boost to international travel, but warns against user-generated content, 70% of which is bogus and posted by the hotels and restaurants themselves.

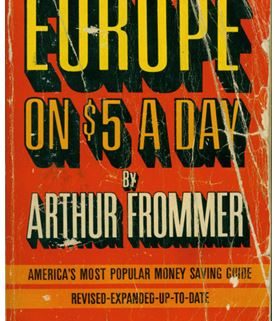

The 82-year-old Frommer turned an army posting in Berlin in 1952 into a travel empire that publishes 340 books a year, or one out of every four travel books on the market. I met him on a swing through the San Francisco Bay Area (his ticket from New York was only $150), and he graciously signed my original 1968 copy of Europe on $5 a Day, which was crammed in my backpack for two years.

Which country has changed the most in his 60 years of travel writing? France, where the citizenry have become noticeably more civil since losing WWII. Bali is the only place where you can still travel for $5/day, although you can see Honduras for $10. Always looking for a deal, Arthur?s next trip is to Chile, the only country he has never visited, because the currency there has crashed. Sounds like a man after my own heart.

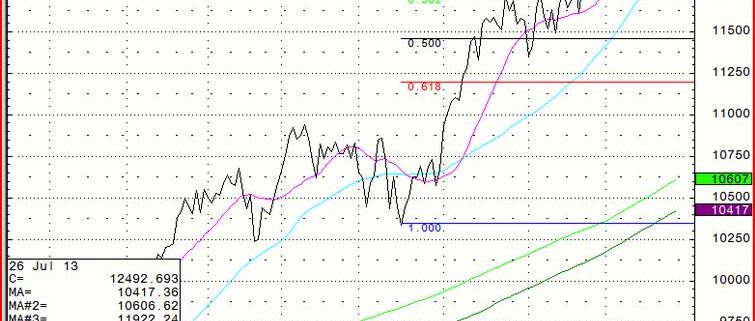

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

July 29, 2013

Fiat Lux

Featured Trade:

(AN AFTERNOON WITH GOVERNOR JERRY BROWN),

(TESTIMONIAL)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.