While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

August 9, 2013

Fiat Lux

Featured Trade:

(AMBUSH IN AUSTRALIA),

?(FXA), (FXY), (FXE), (YCS), (NLR), (UNG), (GLD), (DBA),

(REPORT FROM MILAN)

CurrencyShares Australian Dollar Trust (FXA)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Yen (YCS)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

United States Natural Gas (UNG)

SPDR Gold Shares (GLD)

PowerShares DB Agriculture (DBA)

For a lifetime central bank watcher, like myself, this was one for the record books.

Reserve Bank of Australia, Glenn Stevens, said last week that he welcomed a weak Australia dollar and that it probably had further to fall. To put gasoline on the flames, he added that there was room for the RBA to further lower interest rates, assuring that more weakness in the Aussie was assured.

The Australian dollar didn?t have to be told twice what to do. All bids for the troubled currency immediately vaporized, and it gapped down two full cents to the 90-cent level, a three-year low. When the Aussie broke a crucial support level at parity in the spring, I predicted that 80 cents was in the cards.

That forecast, bemoaned and lambasted at the time, is now looking increasingly likely. This is why I have been warning my Australian friends all year to pay for their summer vacations in advance while their currency was still dear.

What is far more important here is what the RBA moves means for the global economy. It certainly raises the stakes in the international race to the bottom, where every country tries to devalue their way to prosperity. During the Great Depression, this was known at the ?beggar thy neighbor? policy, a term I?m sure you have all heard a lot about. A cheaper currency means your exports now cost less, so customers shift business from your neighbors to you, boosting your economy.

In recent years, the US was winning that game. Then Japan took over the lead in November, with a yen (FXY), (YCS) that has fallen 25% since. Now, Australia has grabbed first place, with a 15% plunge since March. Who is the big loser in all this? Europe, where even the guy who runs the beach mini mart in Mykonos tells me his economy sucks because his currency (FXE) is grotesquely overvalued.

The sad thing is, I don?t think a weaker Aussie will help the Land Down Under very much, if at all. Their problem is not a price one for their commodities, but a demand one. Everything Australia sells is a commodity where prices are set by a global marketplace.

The slowing of China?s economy is the big driver here, as orders for Australia?s exports of iron ore, copper, and coal fall precipitously. Grains (DBA) sales are hurt by America?s bumper crop, which is killing prices. Fukushima demolished uranium exports (NLR). Australian offshore natural gas (UNG), at $16/btu, doesn?t stack up very well against US fracking gas at $3.50. Gold (GLD) is not exactly flying off the shelf either, with prices at one point this year down 33% from the highs.

There is another big factor, which no one but myself seems to me noticing. The slowdown in Chinese commodity demand is not a temporary affair, it is a permanent one. The government there is making every effort to shift the economy away from commodity consuming, metal bashing exports, to a more services oriented one.

This more suitably matches the Middle Kingdom?s own resource base, of which there are few, towards a higher rung in its own development. You will probably start to hear about this from other strategists, gurus, and research houses in about a year. It is momentous in its implications.

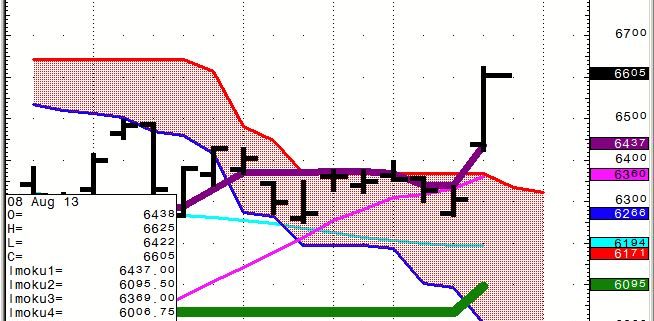

The RBA?s move caught many traders off guard, as they had already begun scaling into long Australian dollar positions, looking for an autumn rally. Mad Day Trader, Jim Parker, knew better, and was advising Aussie shorts up to the 94 cent level.

As for me, I?ll be selling every decent Aussie rally for the foreseeable future, until global commodity prices finally bottom, or Australia changes central bank governors, whichever happens first. I bet a lot of Australians right now prefer the latter over the former.

The Thunder Down Under is Fading

The Thunder Down Under is Fading

Milan, Italy appears to be a city entirely populated by fashion models riding bicycles on the city?s frenetic, cobblestone streets. That is one?s first impression coming out of the monolithic Milano Centrale train station, built by Mussolini to reaffirm faith in his state. Despite years of allied bombing during WWII, the building is as imposing as the day it was built.

You Think It?s Easy Fitting into a Size 0?

You Think It?s Easy Fitting into a Size 0?

I am here for a day, transiting from my flight from Mykonos in Greece to the train to Zermatt in Switzerland. There I wind up my trip every year with a stiff dose of penance for my gluttonous ways in the form of daily 10-mile Alpine hikes with a 4,000 foot vertical climb.

Milan?s breathtaking August sales make it a mandatory stop each year. There, you can buy the best designer clothes for 90% off because they are the remnants of last year?s collection. I buy clothes for all my kids, all my friends, and even people I don?t like, because the prices are so irresistible. I?m talking a pair of pants for $5 and shirts for $3. Even the extra suitcase I bought to ship everything back was half off. Note to travelers: Corso Buenos Aires is the street to visit.

Here is another tip to future travelers to the fashion capital of the world. Avoid those romantic sidewalk cafes and eat indoors. The clouds of mosquitoes emanating forth from the sewers will eat you alive. The Italians deal with this by placing Japanese mosquito coils under every table. But they can?t catch them all. Better to eat than be eaten. Indoors is also the de facto Italian no smoking zone as well.

On an extra afternoon to spend in this amazing city. I visited Michelangelo?s Last Supper at Santa Maria della Grazie monastery, looking for evidence of the conspiracy theories long ascribed to this masterpiece.

Strolling though the Galleria, the world?s first shopping mall, I stopped by the famed mosaic of a bull set in the floor to step on his balls. Done correctly, it is a swinging, rotating motion. Local custom says this is good luck. Was this the beginning of proto-feminism in the 18th century?

Yes, that was a McDonald?s shop in the background. The city has since banished it from the Galleria, as it is not representative of Italian culture in this important national landmark. Today, you will find a new Prada shop there, packed with Chinese elbowing each other to pay $4,000 for a handbag they can easily pick up in Shenzhen for $10.

I managed to scoot into the main Brioni store just before closing. There, I watched two Russian Mafia types in their thirties buy a half dozen exquisitely tailored, 200 thread count suits each for $8,000. That?s $96,000 worth of clothes?. for guys!

Alas, they don?t carry an American size 48 long in stock, it would have to be a custom order, so I left with only a couple shirts and some $200 ties in hand. In any case, I happen to know that I can get the identical suit at the Brioni shop Caesar?s Palace in Las Vegas for half, thanks to flaccid Uncle Buck, plus they likely have my size.

The next morning found me in a mad dash back to the train station, my taxi driver artfully weaving in and out of traffic, where I boarded a first class Eurostar train. The engine powered North towards the Italian Alps, passing through the Milan slums. Retracing the route seen in the classic Sinatra prisoner of war escape flick, Von Ryan?s Express. Unlike in Frank?s day, first class cars now include screens showing a Google mapping function showing the scenery ahead?from a viewpoint 200 feet above the train. Cool!

Next stop: Zermatt, Switzerland, and the Matterhorn.

To be continued.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.