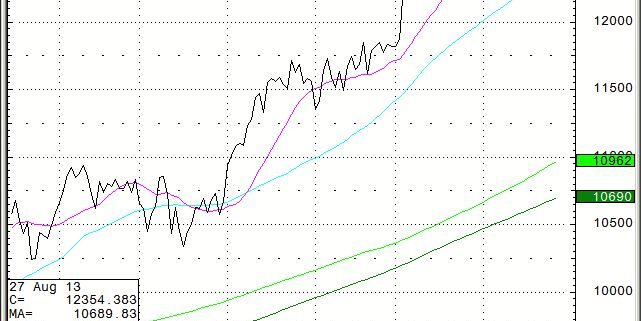

Wow! That was some speech! Secretary of State, John Kerry, was certainly rattling the saber last night when he laid out the irrefutable evidence confirming the use of chemical weapons in Syria. Defense Secretary, Chuck Hagel, then upped the ante by asserting that US military forces are ?ready to go.? Oil (USO) hit a two and a half year high at $109, and gold (GLD) finally resumed its ?flight to safety? character by spiking up $30.

I happened to know that the Joint Chiefs of Staff have been war gaming for Syria for over a year now, and have presented President Obama with a list of graduated levels of response. What is new is the movement off assets to the immediate area, like a major carrier task force, which will park 100 miles offshore in the Eastern Mediterranean for the foreseeable future.

My pick is for a no-fly-zone, which the administration should have executed a long time ago. It is cheap and can be implemented remotely, with no risk of casualties. Drones will come in useful too. F-16 fighters now carry smart missiles with a 70 range. If a pilot in Syria takes off, then poof, they?re gone in 30 seconds.

Although the financial markets are expecting immediate action, we may not get it. When traders started speculating about military strikes, you want to run a mile. Obama is first and foremost a pacifist and needs more than overwhelming evidence to fire a single shot. He even hesitated over taking out Osama bin Laden. He also is a lawyer, so he won?t move until the needed international legal framework is in place, such as a United Nations resolution.

The great irony in all this is that the current crisis has absolutely no impact on the actual supply and demand of oil. Syria doesn?t produce any. It is a net importer of oil. All of the other major crude producers in the Middle East are backing US action, except for Iran, a marginal producer at best. Pure emotion is driving the price here. That is why oil and gold have been going up in tandem, until recently a rare event.

If anything, there is a severe imbalance developing in the crude markets that will soon send prices sharply southward. Thanks to a triple barrel push of improving economic data, Egypt, and then Syria, Wall Street has built up a record long in the oil futures market of some 1.9 million contracts. That works out to an incredible 95 days of daily US consumption, or 256 days of imports. That is a lot of Texas tea sloshing around the books of hot handed traders.

We are just coming to the close of the strongest driving season in 31 years, and demand will soon ebb. And guess what? The economic data is now softening. Unwind just a portion of the speculative long position in oil, and we could quickly return to the $92-$95 range that prevailed before the multiple crisis.

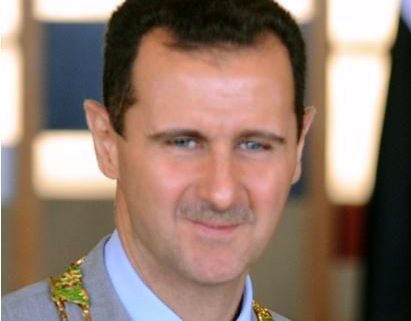

Don?t just stop at oil. Syria?s president, Bashar al-Assad is setting up a buying opportunity for the entire range of risk assets, including longs in US stocks and short positions in bonds, yen, and the euro.? If we get no Fed taper in September, as I expect, it could be off to the races once again.