While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

January 21, 2014

Fiat Lux

Featured Trade:

(FEBRUARY 12 AUCKLAND NEW ZEALND STRATEGY LUNCH),

(HOW OBAMACARE WILL BOOST YOUR PORTFOLIO),

(XLV), (GILD), (XLS), (XPH), (XBI), (GOOG)

Health Care Select Sector SPDR (XLV)

Gilead Sciences Inc. (GILD)

Exelis Inc. (XLS)

SPDR S&P Pharmaceuticals ETF (XPH)

SPDR S&P Biotech ETF (XBI)

Google Inc. (GOOG)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Auckland, New Zealand on Wednesday, February 12, 2014. An excellent meal will be followed by a wide-ranging discussion and question-and-answer period.

I?ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I also hope to provide some insight into America?s opaque and confusing political system. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets. The lunch will be held at a downtown boutique hotel the location of which that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheon, please go to my online store.

Still basking in the glow of 2013?s spectacular 26% gain in the Dow, I sat down on a rock on a high mountain the other day to try and figure out what happened.

The last time I saw a move this healthy was back in the nineties, when a perfect trifecta of the internet going mainstream, cheap graphical user interface enabled personal computers, and an easy to use World Wide Web conspired to create a Dotcom boom and send risk assets everywhere ballistic.

Sure, the advent of cheap domestic energy unleashed by the fracking and horizontal drilling of natural gas is a game changer. But that isn?t enough to suddenly convert every investor from a pessimist to an optimist, a Cassandra to a Pollyanna, or a bear to a bull. So what else is helping to send stocks ever Northward?

Fortunately, I brought along an abacus with me to my high altitude retreat. So I ran a few numbers. Approximately 18% of US GDP is derived from the health care industry in some form or another. In Europe they spend only 8%, live longer, and certainly eat better food (I spent two months field testing it last summer).

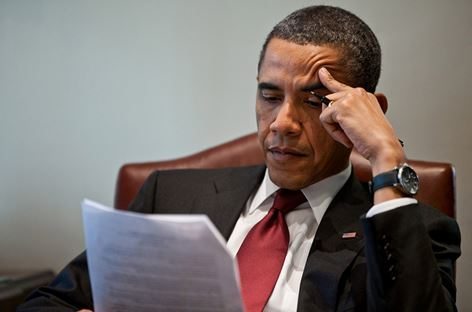

So what happens when America?s Affordable Care Act, otherwise known as Obamacare, brings our spending down to European levels? The savings would amount to 10% of GDP, or $1.6 trillion. That is a handsome amount of change.

Where would all of this money go? The short answer is: to you and me. To be precise, I get half, and you get half, which works out to $800 billion for each of us, per year.

The reality is a little more complicated than that. We are not going to get our new found wealth in unmarked bills stuffed in a duffle bag left at a dead drop in the middle of the night. Rather, the payoff will come in an indirect form. We will get better quality health care for less money, and more of us will get it, some 48 million to be precise. Oh, and we get to live longer too.

What are we going to do with this windfall? Buy stocks, and lots of them. At least that?s what the stock market thinks. Hence, last year?s ballistic move in equities. This year could be just as good.

If fact, we will be buying a lot of everything, which is why the auto industry is on fire, real estate is recovering, yet the bond market hasn?t crashed. This amount of money hitting the financial system over the coming decade could well be the appetizer to an investment ?golden age? during the 2020?s.

This is fabulous news for asset owners of all stripes, and pretty good for everyone else as well. Companies with rising share prices are much more likely to hire and expand capital investment than those with falling ones, raising standards of living.

The way this happens is what makes Obamacare so interesting, unlike the purely government sponsored plans now in operation in Europe and Asia. It does this with a heavy reliance on the private sector to unleash free market capitalism on the health care industry for the first time in its history.

At last, they will be thrown into the merciless pit of dog eat dog, cutthroat competition where the rest of us have already been living for quite some time. They will be the losers, and we will be the winners.

I have been studying health care for about 40 years now. I was once destined to become a medical researcher at the Center for Disease in Atlanta. But the Defense Department found out I was pretty good with numbers, and I found myself in a bleak part of Northern Nevada now known as Area 51.

When improving relations with the Soviet Union wound things down there and all the aliens went home, there was nowhere else for me to go but the stock market. Suffice it to say, I still know which end of a test tube to hold up.

Health care is the last 19th century industry that operates in this country (except possibly for coal mining). It is fragmented into local monopolies spread amongst the country?s 3,141 counties.

I haven?t had health insurance myself for seven years. After paying on a Blue Cross of California policy for 20 years, they suddenly cancelled my policy claiming an alleged pre existing condition. My real pre existing condition was that I was a 55-year-old white male.

Since I was paying out of pocket for every trip to the doctor, I became an expert on what things cost. The first thing that I learned is that no one in a doctor?s office knows what anything costs. They deliberately don?t know. That way they can feign innocence when you get hit with a whopping big bill.

It was only with the greatest persistence that I was able to chase down the actual dollar cost of tests and procedures. Needless to say, my health care providers considered me a nut case and a pain in the ass. Some refused me care.

This is the land of the $100 plastic hypodermic needle, the $300 paper gown, and the $1,000 saline drip (it?s salt water). MRI Scans can cost $6,000, or $1,500 at the hospital down the street. In fact, I?ve had friends show up for procedures at hospitals with a $3 gown they bought on Ebay, but were still forced to use the identical $300 version.

This is why the wealthiest guy in the county is often the one who runs the local hospital, or sells specialized prescribed treatments and procedures. From 1995 to 2012, dermatologists saw a 50% increase in annual incomes to an average $471,000 while most of America saw a steady decline in real take home pay. Oncologists and gastroenterologists did as well. This is especially true in rural parts of the country where there is a chronic shortage of doctors. Competition is anathema to these people.

What broke the health care system in this country is that there was a total absence of cost control, but an unlimited ability to get paid. If you?re having a heart attack, you don?t shop around for the hospital offering the best deal on surgery that week, as we might for a new set of tires or a new computer. Being the savvy consumers that we have become, if we don?t like the prices down at the mall we just go online. That?s tough to do with health care.

With insurers or the government picking up the tab whatever the cost, there was no incentive to do so anyway. Doctors excessively ordered tests to protect themselves from lawsuits, thanks to a tort system run amuck. Drug companies kept inventing new diseases (do any of you male readers suffer from ?low T??). Indulgent lifestyles assured that ever rising numbers of us got sick, driving prices skyward.

By creating national exchanges selling plain vanilla policies and setting rigorous standards on what they will pay for (?death panels? to opponents), American health care costs are now falling for the first time in history. 2013 saw the first year on year fall on record. This is only the beginning of that $1.6 trillion plunge in costs.

No one really knows what the marginal cost of an MRI scan is. But if you count the capital cost of buying a new $1.4 million machine, deduct the fee the specialist to read the scan, the $60,000 annual salary of the technician to run it, along with maintenance and depreciation, and I bet you get a number a hell of a lot less than $6,000. We are soon going to find out what the marginal cost really is.

This is why opposition to Obamacare has been so violent and vehement four years after it became law. Those who have been feeding off of the gravy train for so long will do anything to protect it. $1.6 trillion buys a lot of lobbyists in Washington DC. Most opposing Obamacare in the media are being paid to do so. Ask them exact details about exactly why it is so bad and they either mumble some lame ideological explanation or go mute.

States that support Obamacare and set up their own exchanges, like California, New York, and Kentucky, are seeing dramatic reductions in the cost of health care costs and insurance, up to 50% in some cases. Those that oppose it, such as Texas, are not.

The great irony in all of this is that the states opposing Obamacare need it the most. The 13 states of the old southern Confederacy suffer the worst health in the country. Take three states out of the national averages, Georgia, Mississippi, and Alabama, and the average male life span jumps from 78 to 82. I?m told they eat pure lard down there, not exactly a health food.

So Obamacare is basically a giant federal program that shifts money away from the two coasts toward the South and Midwest, or out of blue states into red ones. This is the same pattern for all large government programs. Why they are against Obamacare one can only imagine, except possibly the name.

I have been pointing out to the administration for years that they have greatly underestimated the long-term impacts of Obamacare on the economy, most of which are positive. This has led them to unintentionally undersell the program. The impact of the world?s large economy is so enormous that it was impossible to foresee all of the unintended consequences. The only way to find out was to do it.

I?ll give you a couple of examples. Take the ?Obama lied? issue, where the president promised voters they could keep their existing doctors and insurance. By setting minimal coverage and care standards the government put out of business the ?junk insurance? industry, which provides questionable policies with deductibles of $8,000 or more, low lifetime maximums, and boot you off your coverage as soon as you sneeze. They had a bad habit of taking in your premium income and disappearing as soon as you made a major claim, with denials at some companies running as high as 50%.

Banning these rip-offs from the industry is all well and good. But nobody knew there were so many such polices, over 5 million. It turns out that no research had been done on this ugly little backwater, as it was purely a private sector enterprise. Then the cancellation letters all went out at once, to the shock and surprise of everyone.

There is the fact that so few have signed up for the free and subsidized coverage. When you are living paycheck to paycheck, about 20% of the country, even $100 a month is too much to spend. Many just don?t like doctors or hospitals and will only sign up after they are seriously ill, probably at the prompting of a social worker.

I can tell you from my journalist days that 40% of the population doesn?t read newspapers at all, either the online or hard copy kind. Unless something appears on ESPN or the Golf Channel, they have no clue that it exists. There are those who still can?t operate a computer, as unbelievable as that may seem in the 21st century.

Then there is the website fiasco, the most easily preventable error in the entire rollout. I would bet big money that Health and Services Director, Kathleen Sebelius, has never built her own website. For her, I highly recommend Building a web Site for Dummies (click here for Amazon), which helped me get Mad Hedge Fund Trader off the ground seven years ago.

I was outraged when I heard that the lead contract for the construction of the website was given to a Canadian firm. I raised my hand and said ?Hey, we out here in Silicon Valley know how to build websites too.? They should have just given the whole thing to Google (GOOG). But that would have raised conflict of interest questions, as founders Larry Page and Sergei Brin were two of Obama?s largest donors.

Corporations will get, thankfully, out of the health care business completely, offloading coverage to Obamacare as fast as they can. Small companies are already doing this in large numbers because workers can get better coverage for less money. This will level the playing field with foreign competitors for the first time in more than half a century, whose own governments cover the health care costs of their employees for free.

Those in the hedge fund, banking, and oil industry luxuriating in $30,000 a year formerly tax free Cadillac insurance plans now have to pay ordinary income tax on benefits worth more than $10,000 a year. With most of the tax subsidy gone, there is little reason for employers to continue with these perks.

What is the bottom line for the shareholders in all of this? A substantial reduction in costs that drops straight to the bottom line, creating surging profits and stock prices.

All of the above is a major reason why health care has been a major plank in my trading portfolio for the past six months, and may remain so for the next decade. Followers of my Trade Alert Service cashed in on my long in the Health Care Sector Select SPDR ETF (XLV).

Those who took my advice to buy hepatitis drug manufacturer Gilead Sciences (GILD) joyfully watched it run away to the upside. Expect this to be a recurring theme in my equity coverage. (XLS), (XPH), and (XBI) are on the menu and looking tasty.

Every country in the world that has implemented national heath care has been successful. We are the smartest people in the world, so there is no reason we can?t make it work as well, if not better. Only political obstacles stand in the way.

It could well be that the stock markets are the first to see these momentous changes, far ahead of we mere mortals. Such is the wisdom of markets. So far, your investment portfolio agrees.

It will be at least a decade before we can judge the results of Obamacare, it is so vast and complex an undertaking. Up for grabs are individual markets for over 10,000 different treatments and services. It is far too early to call it a failure or a success. In any case, the earliest it can be repealed is 2025, after Hillary Clinton completes her second term as president. So get used to it.

What about my own insurance? I am going to wait until the last possible moment to sign up for Obamacare, when they are about to come for me with handcuffs and a taser. I bet many other Americans plan on doing the same.

By then, the website should be working and the costs brought in line with reality. Then I?ll buy the cheapest possible policy, the popular ?Bronze? plan.

After all, who needs health insurance if they are going to live forever?

They Said This Would Be So Easy

They Said This Would Be So Easy

Global Market Comments

January 17, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER SURGES AHEAD WITH A 5.78% 2014 PROFIT),

(SPY), (TLT), (XLK), (XLF), (XLE), (AAPL), (SFTBY), (FXY),

(AT&T IS DILAING A WRONG NUMBER),

(T), (VZ), (NFLX), (AMZN)

SPDR S&P 500 (SPY)

iShares 20+ Year Treasury Bond (TLT)

Technology Select Sector SPDR (XLK)

Financial Select Sector SPDR (XLF)

Energy Select Sector SPDR (XLE)

Apple Inc. (AAPL)

SoftBank Corp. (SFTBY)

CurrencyShares Japanese Yen Trust (FXY)

AT&T, Inc. (T)

Verizon Communications Inc. (VZ)

Netflix, Inc. (NFLX)

Amazon.com Inc. (AMZN)

The red hot performance of the Mad Hedge Fund Trader?s Trade Alert Service has maintained its blistering pace from last year, picking up another 5.73% profit in the first two trading weeks of 2014. The S&P 500 was down during the same period. Since the beginning of 2013, I am up 73.23%.

2013 closed with a total return for followers of 67.45%. Including both open and closed trades, all nine of the Trade Alerts issued so far this year were profitable, a success rate of 100%.

The three-year return is now an eye popping 128.3%, compared to a far more modest increase for the Dow Average during the same period of only 35%. That brings my averaged annualized return up to 41.6%.

This has been the profit since my groundbreaking trade mentoring service was launched in 2010. It all is a matter of the harder I work, the luckier I get.

The hot streak continues. It seems like I can do no wrong, but am avoiding walking under ladders, breaking mirrors, and trading on Friday the 13th.

I held on to every risk on position during the two-week December correction, fully expecting the pause to become the springboard for a new run to all time highs by year-end. That is exactly what happened in the wake of the Federal Reserve?s decision to taper its quantitative easing program by only $10 billion a month, mere sofa change given the size of our bond market.

The rally then came to a dead stop, once the New Year?s celebrations were over. The disappointing December nonfarm payroll of 74,000 didn?t help. But I held on to every ?RISK ON? position. That turned out to be the perfect thing to do.

In the rapid surge that followed this week, I took profits in the Financials Select Sector SPDR ETF (XLF), thanks to the leadership of the big banks. Ditto for my long position in the S&P 500 (SPY).

I also did well with my bets on the Technology Select Sector ETF (XLK). I benefited from a huge run in Apple (AAPL), its deal with China Mobile (CHL) assuring that my call options expired at their maximum value.

My assumption that Obamacare would herald a new golden age for the health care industry proved dead on, with my long in Gilead Sciences (GILD), racing to new highs. My short in the Japanese yen (FXY) provided yet another paycheck, like the ever faithful rich uncle.

Progress in the Geneva peace talks with Iran crush oil and robbed me of some of my profits in my Energy Sector Select SPDR ETF (XLE), but I still closed out positive. I even made a small amount of money in my Treasury bond short, despite a ferocious five point rally against me.

I am now 70% in cash, awaiting better entry points in the market on which I can pounce. I am still lugging a long in Softbank (SFTBY) shares at cost, awaiting the Alibaba IPO. I also slapped on a short position I AT&T (T) yesterday, a favorite hedge fund target, capitalizing on an ever weakening cash flow position in the company.

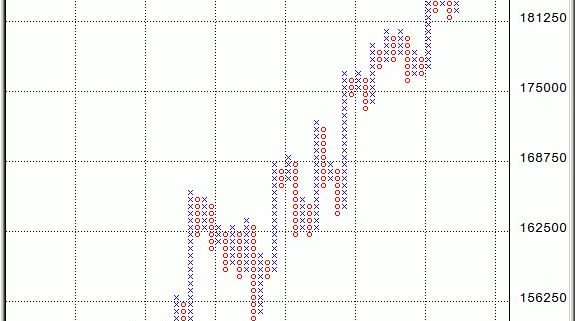

My esteemed colleague, Mad Day Trader Jim Parker, has also been coining it. Since April, his own performance numbers have just come back from the auditors, revealing that he is up a staggering 374%. That is just for an eight month year!

The coming winter promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014.

The Trade Alerts should be coming hot and heavy. Please join me on the gravy train. You will never get a better chance than this to make money for your personal account.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars.? Upgrade to?Mad Hedge Fund Trader PRO?and you will also receive Jim Parker?s?Mad Day Trader?service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the blue ?SUBSCRIBE NOW? button.

A High Sierra Pass in 1962

A High Sierra Pass in 1962

AT&T (T), or Telephone as we used to call it on the floor on the New York Stock Exchange when we hand traded its shares, enjoyed a nice little 50-cent pop yesterday, to $34, only the second day it managed to rise this year.

The move comes after a federal appeals court in Washington DC ruled that the FCC exceeded its authority when it told Verizon Communication (VZ) that it could not charge different prices to different content providers based on their bandwidth and numbers of users.

This is a reversal of the FCC's "net neutrality" rule and should allow both Verizon and AT&T to increase revenues and help protect their profits from customers who are costing them more money to service. ?Big users of broadband, like Netflix (NFLX) and Amazon (AMZN), saw their shares suffer accordingly.

You would think it would be off to the races for (T). But it won?t, as not all is well with Ma Bell. One of my first jobs at Morgan Stanley some 32 years ago was to break this company up into the seven ?baby bells? at the direction of the Antitrust Division of the Justice Department (I carried the shareholder ballots from one floor of our building to another). The company traded off its local telephone exchanges for the right to go into the computer business. I have been following it ever since.

For a start, (T) is suffering from some major internal cash flow problems. Revenues have been stagnant for years. Its hard-wired infrastructure has been corroding away for years. The capital spending needed to fix this will be a drag on any future earnings, and is unlikely to generate any real payoff. Do you know anyone under the age of 30 who owns a landline? It?s a wireless world, baby. Did I mention that their service sucks beyond belief?

Every pension fund manager in the country already owns this stock for its generous 5.30% dividend yield. One has to ask how long the company can maintain this in the face of a stagnant business in a highly competitive industry. Now that we are in a world of rising long-term interest rates, this yield will provide much less support than it has in the past.

The hedge fund community has been aware of these difficulties for a while, and has been pounding every rally. This is why (T) completely missed out on last year?s ferocious, record setting bull market, posting a zero return for 2013, versus a 26% increase in the main indexes.

AT&T is the oldest stock to inhabit the Dow 30, being a successor to a company founded by Alexander Graham Bell, the inventor of the telephone. It has long been a pillar of the investment establishment (it took a brief vacation from the index after the breakup). Its history mirrors that of American capitalism.

With 100 million customers and a market capitalization of $179 billion, it certainly occupies a big footprint. Time to put this beast out of its misery and retire it to the dustbin of history.

Looks like AT&T is Dialing a Wrong Number

Looks like AT&T is Dialing a Wrong Number

?There are two giant entities at work in our country, and they both have an amazing influence on our daily lives. . . one has given us radar, sonar, stereo, teletype, the transistor, hearing aids, artificial larynxes, talking movies, and the telephone. The other has given us the Civil War, the Spanish-American War, the First World War, the Second World War, the Korean War, the Vietnam War, double-digit inflation, double-digit unemployment, the Great Depression, the gasoline crisis, and the Watergate fiasco. Guess which one is now trying to tell the other one how to run its business?? said a sign that hung at AT&T headquarters in New York before its breakup in 1982.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Global Market Comments

January 16, 2014

Fiat Lux

Featured Trade:

(CASHING IN ON APPLE), (AAPL)

(BECOME MY FACEBOOK FRIEND),

(OIL ISN?T WHAT IT USED TO BE),

(USO), (DIG), (DUG)

United States Oil (USO)

ProShares Ultra Oil & Gas (DIG)

ProShares UltraShort Oil & Gas (DUG)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.