As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 7, 2014

Fiat Lux

Featured Trade:

(WHY I?M COVERING MY STOCK SHORTS),

(SPY), (SPX), (HYG), (TBT), (TLT),

(AN AFTERNOON SURPISE IN SWITZERLAND)

SPDR S&P 500 (SPY)

S&P 500 Index (SPX)

iShares iBoxx $ High Yield Corporate Bd (HYG)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares 20+ Year Treasury Bond (TLT)

I?ll take the home run, thank you very much. Ten handles in the (SPY) on the downside in ten days totally works for me. We have milked this trade for all it?s worth, so it?s hasta la vista baby! Thank you Vladimir Putin!

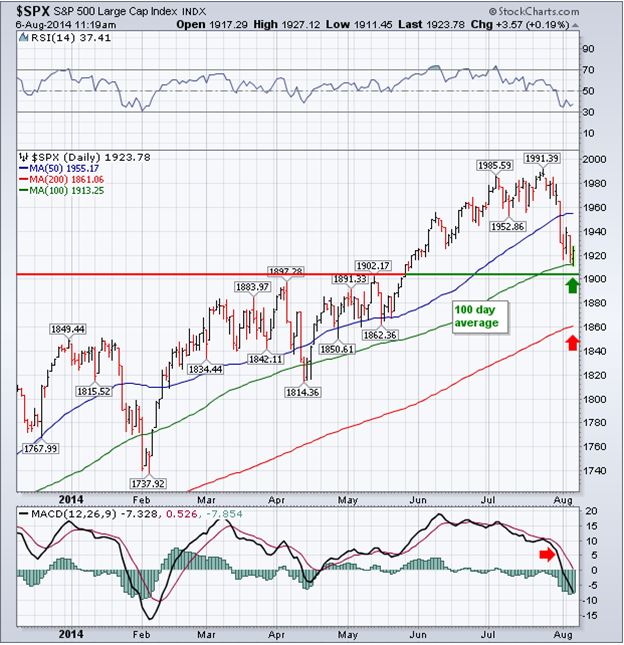

This is not a bad place to de-risk on the short side in stocks. Take a look at the charts below, and you will see a convergence of 100 day and 200 day support levels across several asset classes.

Check out the rock solid support level in the (SPY) at $191, and all of a sudden, buying back shorts here at $191.50 looks like a stroke of brilliance.

It is also interesting to see the suddenly despised junk bond ETF (HYG) hold at the 200 day moving average. Stocks and junk bond price movements are very highly correlated. It makes sense that after showing the most bubbleicious price action, high yield corporate debt led the change on the downside.

By the way, this could also mean that Treasury bonds are about to take a big dump off this morning?s 2.43% yield for the ten year, which is why I?m hanging on to all my short positions there.

We could still see more pain in risk assets. My favorite downside target in the (SPY) is the 200 day moving average at $186. That would give us a top to bottom correction of 6.5% in this cycle, in line with the pullback we saw earlier this year.

That?s where you want to load the boat one more time. When the BSD?s come back from their summer vacations in the Hamptons, Cannes or Portofino, they are going to quickly realize that stocks have been falling, while earnings have been rising.

That means they are going to be cheaper than they have been at any time in 2014. In a world where there is little else to buy, that is a big deal.

We have just entered a period when the seasonals strongly favor investment in equities. That sets up a yearend rally in the indexes that will not be as big as the melt up we saw in 2013, but will be just as welcome. My 2014 (SPY) target of $210, or $2,100 in the (SPX), may not be so Mad after all.

Yes, I know that geopolitics is still a factor. But it looks like both sides in the Gaza conflict have depleted their stockpiles of stupidity for the time being, so things are about to go quiet there.

Vladimir Putin is also likely to back down in the Ukraine because of that throbbing he is increasingly feeling in his pocketbook. The growing leverage and rising costs in the Russian oil industry mean that the recent $11, or 10%, drop in the price of crude cuts Russia?s revenues by 25%. The recession this will eventually bring could be bad enough to lose a future election.

In the end, that is what this is really all about.

I am already starting to draw up short lists to buy on the next turnaround. I?ll shoot out the Trade Alerts when I think the time is right.

Jim Parker! Get your ass back from Rome, per favore! The gelato can?t be that good!

Thank You Mr. Putin

Thank You Mr. Putin

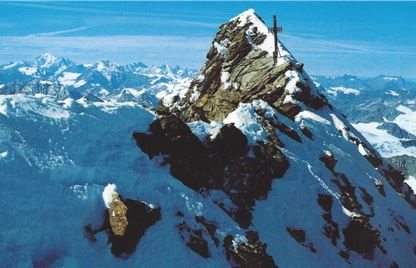

Exhausted, and running on fumes, I returned to Zermatt from my assault on Monte Rose, at 15,203 feet, the highest mountain in Switzerland.

You know, the one where I hung by a rope on a cliff face with one hand, while sending out a Trade Alert on my iPhone 5s to short the S&P 500 with the other?

The desk clerk looked particularly grim. He said the city government had been looking for me, and that I better get down to their offices right away.

I thought, what could they possibly want?

It has been 25 years since I had been a director of the Swiss Bank Corporation, and certainly the statute of limitations had long since run out on anything that transpired there. Yes, they later got taken over by the Union Bank of Switzerland, which then fell on hard times (poor Marcel!).

As for all those Nazi gold bars, I had nothing to do with it! That was another department; although I did think the Third Reich?s stamped gold eagles did look kind of cool. Besides, that too, was resolved in a court settlement a decade ago.

There was that relationship with the teenaged girl at the Youth Hostel. But that was in 1968, and she was older than me.

So what could the authorities in Zermatt possibly want?

Then my mind set to racing. If I caught the 8:00 AM cable car at the Kleine Matterhorn, I could be over the Italian border by 10:00 AM. I would thus be treading the path of refugees for time immemorial, although going in the opposite direction.

Ten minutes later, I was at their offices on Bahnhoffstrasse, still wearing my backpack, mud splattered, and my hair standing straight up. ?My goodness, where have you been? We?ve been looking all over for you!? cried the official.

I answered that I had been climbing the Monte Rose, and then asked ?Why??

?The mayor wants to give you the keys to the city. It seems you have been visiting Zermatt longer than almost anyone. But you have to get over to the Zermatterhoff Hotel. The ceremony starts in five minutes!

Five minutes! I stumbled, out of breath, into the elegant reception room at Zermatt?s premier five star hotel. Not only was the mayor there dressed in all of his finery, so were the entire city council and a number of guests.

Gold leaf rimmed the cornices and angels adorned the ceiling. I was handed a glass of Switzerland?s finest white wine (where do they hide this stuff?).

Then began the festivities...in the local Swiss German dialect. I agreed with everything and laughed at all the jokes. Then came the moment of truth.

The mayor had heard that I was visiting Zermatt for my 46th year. Since the tourist records for the city did not go back that far, he was going to give me a test to see if I had really been coming there for that long.

I said, ?Fire away.?

Question number one: ?Where is the Matterhorn from?? That was easy. During my fracking days in West Texas I had undergone a crash course in Geology.

I had long been a student of the local Swiss rocks, taking several beautiful specimens home every year (mica embedded shiest, black basalt, and low grade jade!), and correctly answered that the Matterhorn came from Africa. (The European Continental Plate is subducting under the African plate, forcing the Matterhorn to grow an inch a year).

?Right!? he responded.

Question number two: ?Who was the first man to climb the Matterhorn?? ?The Englishman, Sir Edward Whymper, in 1865,? I replied. (It?s also the name of a downtown bar). Correct again, cheered the mayor.

Question number three: ?Who was the most famous American to climb the Matterhorn?? Piece of cake: President Theodore Roosevelt, in 1888.

With that, the entire room burst into applause and bravos.

Then, a young woman wearing traditional folk dress approached with a red satin pillow bearing a gold pin. The mayor pinned it on my sweaty shirt. On it was inscribed the words ?40 Danks?, which translates into ?40 Thanks.? He went on to say that if I came back in four years, they would give me my 50-year pin.

I asked if they had a 60-year pin. He replied that no one had been awarded one yet, but if I came back in 14 years, they would have one specially made for me.

This is an invitation I am willing to accept. With that came a refill of that fabulous wine.

No one mentioned my ramshackle appearance. Climbers are afforded a special status here. Maybe, they think we are all insane, and give a wide breadth, for safety?s sake. Everyone else there was wearing a suit and tie.

After that, I went back to my hotel and collapsed. It?s all again proof that if you live long enough, you get to see everything.

Matterhorn Summit

Matterhorn Summit

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

August 6, 2014

Fiat Lux

Featured Trade:

(WHAT COULD DERAIL THE COMING GOLDEN AGE?)

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.