In recent weeks, I couldn?t help but notice the green and white vans of Solar City (SCTY) visiting my neighbors. My trader?s radar went up, so I thought there might be an opportunity here.

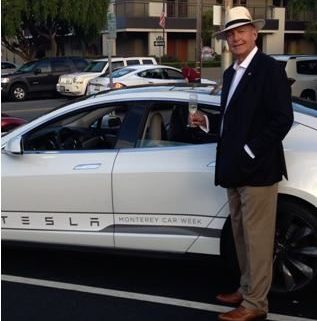

With my second Tesla (TSLA) about to be delivered, the Model X SUV, it was time for me to review my electricity bill.

My first Tesla, an S-1, boosted my monthly power consumption from 600 kWh to 1,800 kWh per month, about what a small industrial facility might use. Yet, my bill from PG&E increased from only $350 to $450 a month. This is because they effectively give away power for free from 12:00 AM to 7:00 AM to qualified EV users, charging me only 4.7 cents per kWh.

On my suggestion, Tesla then upgraded their software so vehicles could be programmed to recharge only at these hours. That means it is costing me $4.00 for a full 80 kWh charge that can take me 255 miles, or 1.6 cents a mile. That doesn?t include the enormous savings on maintenance (there is none).

Well then! The IRS currently allows a mileage deduction of 56 cents per mile for business purposes, so that?s an opportunity to exploit right there.

Given that the average US car now gets 25 miles per gallon of gasoline (and that is being generous), that means my equivalent cost for running my S-1 works out to paying a scant 40 cents a gallon.

This compares to the $3.60 at the local service station ($3.45 at Costco), which is at a one year low, or a savings of 89%. That is a little more than I paid for gas when I first started driving a beat up VW Bug at the Santa Anita Race Track parking lot back in 1967.

That sounds like a deal to me.

However, the second Tesla is likely to boost my monthly power consumption from 1,800 kWh to 3,000. When PG&E sees bills that big, they assume someone is operating an illegal marijuana grow house and send the DEA to kick your door down at 5:00 AM on a Monday morning.

So I was on the phone to Solar City the next morning. What I heard was nothing less than amazing.

For a start, they called up a Google Earth mapping program that focused on a picture of my roof from a low earth orbit satellite (Google has invested $280 million in Solar City). Then a second program autofit their existing solar panels to my roof and spit out a mass of numbers.

This complete stranger told me things about my roof that I never knew, like it was 4,000 square feet of flat concrete tiles on 14 planes. Welcome to the 21st century.

I nervously looked down and made sure my fly was fully zipped up.

He went on to tell me that he could fit a 15 kW DC system on my roof that would generate 106% of my power needs, generating 19,365 kWh a year. That would make me completely self sufficient in electricity, even though I will be charging two hulking Tesla 1,000 pound lithium ion batteries every day.

They will install a ?net? two-way electric meter on my house. When the sun shines, it will run backwards as I can sell power to PG&E (PCG) at high prices.

At night, when I recharge my cars, I would then buy cheap power from Solar City. No storage devices are required. The PG&E grid is effectively the storage system. That would turn me into a day trader of electricity, selling high by day and buying low by night. I love it!

How did their satellite know I was a hedge fund trader? What else does it know?

Now comes the best part. The cost of the installation and panels was $66,000. Solar City would do it for free. Yes, free, as in gratis, with no money down. They would lease me the panels for 20 years, with an annual price increase of 6.2%. That would cut my monthly electricity bill from $450 to $200. It does this by eliminating the tier 3, 4 and 5 prices I am currently paying PG&E.

If I sell my house, I can either buy out my contract at the discounted, fully depreciated value, or pass it on to the new owners. It is well known that solar panels significantly increase the value of existing homes.

Installation can be done in a day. But it can only take place on unbreakable concrete tile roofs. Those made of clay tiles, metal, tar and gravel, wood shakes, or slate don?t work for various reasons. You need a FICO score of 680 or better to qualify. There is a 60-day waiting list to get this done.

It didn?t take me long to figure out the game here. By purchasing the panels and leasing them to me, they keep the 30% government subsidy for capital investments in alternative energy, which works out to $19,890 for my house alone. Solar city also gets to depreciate these panels on an accelerated schedule, mostly in the first five years.

This explains why Solar City has grown larger than the next 15 competitors combined. Solar City?s largest customer is the US Army, which has already installed panels on 1 million structures.

There is one cautionary note to add here. The government subsidies that help float the company expire in 2018, making the entire proposition financially less attractive. That is, unless they get renewed. Think President Hillary.

The only things that would save them are dramatically higher conventional energy costs. However, right now energy costs are heading the opposite direction, thanks to fracking.

As with everything else Elon Musk touches, an investment in Solar City has been wildly successful. Since the company went public at the end of 2012, the shares have risen by an awesome 670%. Needless to say, with no earnings, and no dividend, the $6.5 billion market cap company may appear hopelessly expensive.

Like with Elon?s other company, Tesla, your aren?t betting on the value of the business today, but where it will be in five years, when it has a far larger share of the market.

Given Musk?s track record so far, that is a bet that I am willing to take.

My Home from Outer Space

My Home from Outer Space

It?s Been a Long and Winding Road Driving from This?

It?s Been a Long and Winding Road Driving from This?