As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 20, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH WITH 40% GAIN),

(SPY), (TBT), (TSLA), (BAC), (GILD), (DAL), (AAPL), (VIX),

(OCTOBER 22 GLOBAL STRATEGY WEBINAR)

SPDR S&P 500 ETF (SPY)

ProShares UltraShort 20+ Year Treasury (TBT)

Tesla Motors, Inc. (TSLA)

Bank of America Corporation (BAC)

Gilead Sciences Inc. (GILD)

Delta Air Lines, Inc. (DAL)

Apple Inc. (AAPL)

VOLATILITY S&P 500 (^VIX)

It was Thursday night, and the family was glued to the TV set. The San Francisco Giants were playing the St. Louis Cardinals for the National League Pennant.

It was the bottom of the 9th inning, the score was tied 3-3, and the Giants were up. Two men were already on base.

Then right fielder Travis Ishikawa blasted a home run out of the park, winning the game by 6-3. The fans went wild.

My kids rushed to the windows at my mountain top home and watched the barrage of fireworks in the distance.

It looks like I am going to the World Series for the third time in five years.

I have been smashing homers out of the park in my own way this year.

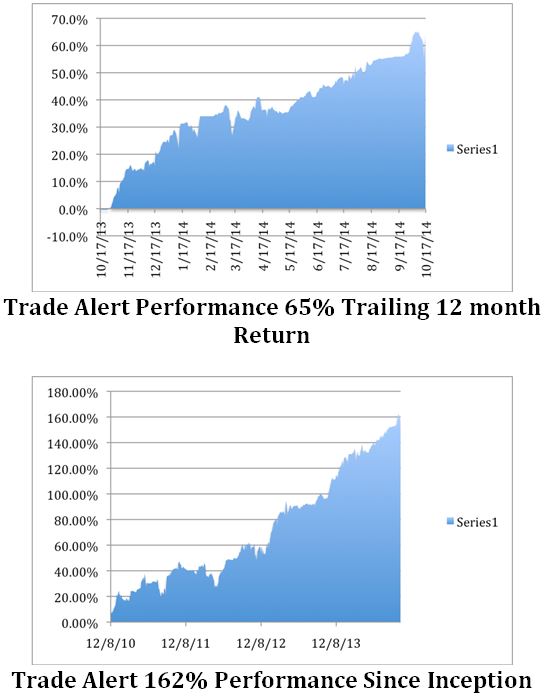

After weathering the worst market turmoil in three years, I managed to boost the performance of my Trade Alert Service this week to 40%, a new all time high.

So far in October, my followers are up a breathtaking 5.39%, a month when most professional traders are getting carried out on stretchers and sent to the Ebola ward.

This is compared to the miserable performance of the Dow Average, which is down -2% during the same period. That was on the heels of blockbuster 5.01% gain in September.

The nearly four year return is now at an amazing 162.4%, compared to a far more modest increase for the Dow Average during the same period of only 33%.

That brings my averaged annualized return up to 42%. Not bad in this zero interest rate world. It appears better to reach for capital gains and trading profits than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

What saved my bacon this month was my decision to pile on a hefty 40% short position at the September market top. I warned readers that the Alibaba IPO would suck the life out of the knocked the market and it would take a while to recover. Once the deal was priced, it was all over but the crying.

Wall Street gets so greedy, and takes so much money out for itself, there is nothing left for the rest of us poor traders and investors. They literally kill the goose that lays the golden egg. Share prices have nowhere left to go but downward.

Add to that Apple?s iPhone 6 launch on September 8 and the market had nothing left to look for. The end result has been the worst trading conditions in three years. However, my double short positions in the S&P 500 (SPY) and the Russell 2000 (IWM) provided the lifeboat I needed.

This gave me the extra profit I needed to weather the losses I took on my long side positions. One long stock position I did have, in Tesla (TSLA), I stopped out of with a tolerable loss, strategically cutting my highest beta momentum position.

A second long in Bank of America (BAC) I held on to, knowing full well that an impending positive earnings report would provide a parachute there. That is the power of research, to enable you to stick to your guns when the going gets rough.

I rolled another long position down and out for another loss, switching my (SPY) October $180-$185 vertical bull call spread into a November $168-$173 strike. As long as the (SPY) stays above $173, I should make back everything I lost n the first trade.

Finally, after spending two months touring dreary economic prospects on the Continent, I doubled up my short positions in the Euro (FXE), (EUO).

This extra protection kicked in this week when the market meltdown ensured in earnest and volatility (VIX) soared from $17 to $30.

I then spent Wednesday and Thursday covering short positions, and piling in new longs in Gilead Sciences (GILD), Delta Airlines (DAL), and Apple (AAPL). We may get a one day wonder from Apple, which reports quarterly earnings after the close today.

The market melt up that ensued on Friday delivered the biggest up day in the history of the Trade Alert Service, gaining 6.2%. All in all, it was a chorus of masterful trading, if I do say so myself.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past seven years. No one got wiped out. No one got a margin call. I quickly cut the highest risk positions, enabling me to ride out the storm with the rest. It all worked.

The only position I have currently bedeviling me is a premature short in the Treasury bond market in the form of the ProShares Ultra Short 20+ Treasury ETF (TBT).

Occasionally, the world does go mad. From the Tuesday high to the Wednesday low, yields on the ten-year Treasury bond plunged an unbelievable 44 basis points, from 2.30% to 1.86%, and then back to 2.20%.

All of the short positions in the market have been cleaned out (except ours). All of the margin calls are done. Fortunately, the hit there for us has been manageable. Our position in the (TBT) is relatively unleveraged and small.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

Our business is booming, so I am plowing profits back in to enhance our added value for you. The latest, our updated website, has a new look and is more user friendly.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product, Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes Global Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

It Has Been a Week of Soaring Homers

It Has Been a Week of Soaring Homers

?The dirty little secret in Washington is that the biggest doves wear uniforms. They have seen wars and they have seen consequences. They have also been sent into conflict and then seen political support evaporate. We need to be a lot more careful when deploying our military forces.? said former Secretary of Defense, Robert Gates.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.